Growth Stocks

Growth stocks are the stocks of those companies that generally do not pay a dividend to their shareholders and are expected to grow at a rate significantly above the market average. These companies re-invest earnings in order to speed up growth in the short term. Growth stocks are associated with high-quality, successful companies, which have high price to earnings (P/E) ratio and high price to book ratio (P/B).

The investment made in these stocks can be risky for investors due to the lack of dividends, as the only way for them to make money on their investment is through the sale of the shares. If the company is undergoing through tough times and is not performing well, investors will take a loss on the stock when it is the time to sell.

Value Stocks

The type of stocks that trade at a lower price to their intrinsic value is categorised under Value Stocks. These stocks are characterised by high dividend yield, low price to book ratio and low price to earnings ratio. Value stocks may need some time to come out from their undervalued position.

Growth Stocks versus Value Stocks

The difference between growth stocks and value stocks is often confusing for investors. They do not differ in the way they are bought or sold; however, the disparity lies mainly in the way they are perceived by the market. Growth stocks are expected to outperform the overall market due to their perceived potential, whereas value stocks are usually marred by temporary setbacks such as low growth and competition.

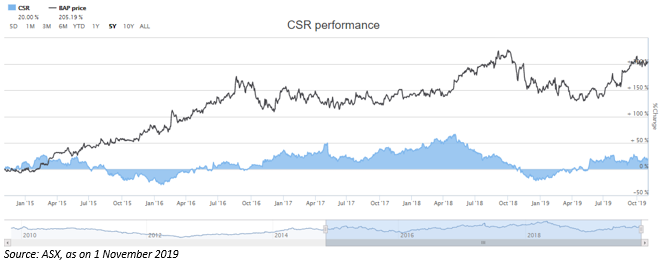

Let us discuss two stocks - Bapcor Limited from the consumer discretionary segment and CSR Limited from the materials segment. Bapcor, which has a PE ratio of 20.780x and annual dividend yield of 2.38 per cent, has been a consistent performer for the past five years, exhibiting characteristics of a growth stock. On the other hand, CSR Limited has a PE ratio of 26.710x and a healthy annual dividend yield of 6.28 per cent. In the past five years, the stock has delivered a modest return of 20 per cent. The healthy dividend yield and underperformance of the CSR stock in the last five years puts the stock in the category of value stocks.

Bapcor Limited (ASX: BAP)

Bapcor Limited is a provider of automotive aftermarket parts, equipment, accessories and services. The companyâs trade businesses include Burson Auto Parts, Precision Automotive Equipment and BNT, coupled with a wide range of car parts for thousands of vehicle brands and models. The company employs a staff of 4.5k people in over 950 locations in New Zealand, Thailand and Australia.

Bapcor to Acquire Truckline and Diesel Drive

On 1 November 2019, the company announced to have signed agreements to acquire both Truckline and Diesel Drive. Truckline is a provider of spare parts for heavy commercial trucks with 22 branches in Australia. It has a team of 150 members with revenue of ~ $100 million. Diesel Drive specialises in the sale of Japanese commercial truck spare parts.

The combined purchase price stands at approximately $48 million and will be funded through existing debt facilities. The businesses are expected to achieve a minimum 15 per cent return on investment and boost earnings per share. The transactions are expected to complete by December, subject to certain satisfactory conditions.

The entry into the heavy commercial trucks business complements the group, while the continued expansion in the Japanese commercial truck group reflects progress towards the target of 40 outlets. Bapcor is now uniquely positioned to provide aftermarket parts to all forms of road transport.

EBITDA Up by 9.8 Per Cent in FY2019

On 1 November 2019, the company released CEOâs presentation from 2019 AGM. Few takeaways from the presentation are as follows:

For the year ended 30 June 2019, the company reported record results.

- EBITDA from proforma continuing operations increased by 9.8 per cent to $164.6 million compared to the previous corresponding period.

- Revenue from continuing operations went up by 4.8 per cent year on year to $1,297 million.

- Net profit after tax from proforma continuing operations soared by 9.0 per cent to $94.3 million.

- Earnings per share (proforma continuing operations) increased by 8.0 per cent of 33.45 cents per share.

- Full year dividend stood at 17.0 cents per share for FY2019, up 9.7 per cent year on year

Operational Highlights

- FY2019 results were in line with guidance.

- Major segments such as Burson Trade, Bapcor New Zealand and Specialist Wholesale recorded solid growth.

- Retail segment experienced challenges during the second half due to a high proportion of immature loss-making stores and market conditions.

- The company added 59 new branches or store locations, boosting the number to over 950 locations.

- Intercompany sales growth reported at 35 per cent.

- Working capital management improved when compared with H1 in FY2019.

Year-to-Date Trading Update

- Trade segment same-store sales (SSS) in line with pre-FY2019 historical levels.

- NZ is facing economic headwinds but still growing.

- Specialist Wholesale continuing to perform reasonably.

- In all the segments, margins under pressure due to competitive market.

FY2020 Outlook

- Profit guidance reiterated for FY2020 of at least mid single-digit percentage increase in pro-forma NPAT.

- EBTIDA ~2 percentage points higher increase due to additional depreciation for investment in technology and systems.

Stock Performance

The stock of BAP closed at $7.040 on ASX on 1 November 2019, down by 1.538 per cent from its previous close. The company has approximately 284.54 million outstanding shares and a market cap of $2.03 billion. The 52 weeks low and high value of the stock is at $5.320 and $7.480, respectively. The stock has generated a positive return of 25.22 per cent in the last six months and a positive return of 22.22 per cent on a year to date basis.

CSR Limited (ASX: CSR)

CSR Limited is a leading building products company, which operates low-cost manufacturing facilities and a strong distribution network to serve customers across New Zealand and Australia.

Statutory NPAT Down 19 Per Cent in 1H FY2020 (ended 30 September 2019)

On 1 November 2019, the company declared financial results for the half year ended 30 September 2019. Few highlights from the results (continuing operations) are as follow:

- Revenue decreased by 4 per cent to $1,150.1 million compared to same period of the previous year (1H FY2019), reflecting slowdown in the residential construction.

- Statutory NPAT declined by 19 per cent to $68.8 million.

- CSR Group EBIT dipped by 16 per cent to $113.1 million, reflecting lower Building Products result and timing of Property transactions.

- Aluminium EBIT rose by 10 per cent to $25.4 million with improved cost position.

Outlook for FY2020 ending 31 March 2020

- The Building Products segment results are expected to be lower in the second half than the first half due to seasonality in volumes.

- In the companyâs property segment, ongoing development is continuing on several projects, thus any additional sales confirmed in the second half of the year are unlikely to result in material levels of earnings recorded in FY2020.

- As of 31 October 2019, 72 per cent of net aluminium exposure for the second half of the year is hedged at an average price of $2,763 per tonne.

- CSR expects to deliver NPAT for the year between $107 million and $133 million.

In another market update on 1 November 2019, the company announced that UBS Group AG and its related bodies corporate became a substantial holder in CSR with 24,989,780 ordinary shares, translating to a 5.08 per cent voting power.

Stock Performance

The stock of CSR closed the dayâs trading at $4.330 on ASX on 1 November 2019, up by 4.589 per cent from its previous close. The company has approximately 491.45 million outstanding shares and a market cap of $2.03 billion. The 52 weeks low and high value of the stock is at $2.620 and $4.465, respectively. The stock has generated a positive return of 15.97 per cent in the last six months and a positive return of 49.46 per cent on a year to date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.