Different investors have different strategies to invest in market and make money out of it, one such strategy is to invest in growth stocks! One might think what growth stocks are- These are the shares of the company, which expand their profits at a pace faster than the average profits. The companies who are able to maintain this for a longer period of time are usually rewarded with the higher share price and witness greater returns.

One basic criterion most analysts focus for the growth stocks are the earnings, while the value stockholders focuses more on the price component of the P/E ratio. Besides the rising profits, one can also look for large market opportunities and a solid business model. Also, these stocks help to derive huge revenue and profit growth and prove themselves as the winning investments for the investors.

Here are some traits which might be beneficial for you to identify a growth stock easily:

- Market Capitalisation: This is one of the easiest ways to identify the growth stock- the size of the company in terms of its capital.

- Higher Profitability: The companies which build their profits over the years are more likely to be consistent with their earnings and are less likely to be risky. Also, the P/E multiple for these companies are usually positive. Hence, this will help you to clear out the companies which have not yet produced the positive income.

- Stable Balance Sheet: While there is no harm in taking debt, but the companies with huge debt liabilities are a little riskier to invest in. Companies with lower Debt/Equity ratio are better.

This is, however, not a full proof way to identify the growth stocks but will definitely remove some from your potential list and will help you identify some winners. While everything seems so wonderful for the growth stocks, the catch here is - what happens if the company fails to meet the expectations?

Below mentioned are some growth stocks which are under the investors radar-CGC, BAP

Costa Group Holdings Limited (ASX:CGC)

NSW Bushfires at Tumbarumba: Costa Group Holdings Limited (ASX:CGC) is Australia’s leading horticulture group, which supplies fresh produce to the major Australian food retailers. As on 23 January 2020, the market capitalisation of the company stood at $1.09 billion.

The company has recently taken on record that Vitalharvest Freehold Trust (ASX:VTH) is the owner of Australia’s largest citrus and berry portfolio, and leases these assets exclusively to CGC has been impacted by the bushfires. The company noted that the fire has damaged the packing shed, but it is understood that the plants have not been materially impacted.

In another release, the company updated the market on the resignation of Linda Kow, CFO or Chief Financial Officer, with effect from 1 May this year.

Costa Successfully Concludes Retail Shortfall Bookbuild: CGC notified on the conclusion of the retail shortfall bookbuild of its 100% underwritten one for four pro-rata fast-tracked renounceable entitlement offer, wherein it raised nearly $176 million.

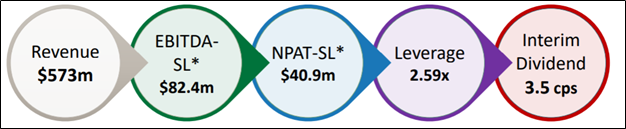

For the half-year period ended 30 June 2019, the company witnessed revenue growth of 11.8% on the prior period and stood at $573 million. This was majorly due to the growth led by new Colignan farm sales and increased table grape marketing volume, and international growth from China and Morocco. During the same time span, EBITDA-SL went down by 8.4% due to lower produce segment earnings and stood at $82.4 million.

Financial Performance (Source: Company’s Report)

Growth Opportunities: The company’s business model is strategically designed to attain competitive advantage and manage agricultural risk. The company anticipates CY20 EBITDA-SL to be around $150 million and NPAT-SL to be nearly, in accordance with CY18 NPAT-SL, which stood at $56.6 million. The extreme hot and dry conditions are negatively affecting fruit size and yields, and it is expected that it would have a material impact in the results.

Stock Performance: The stock of CGC is currently trading at $2.685, down by 1.287% (at AEDT 1:43 PM) and is trading very close to 52-weeks’ low level of $2.320 (as on 23 January 2020). As per ASX, the stock of CGC gave a return of 8.80% in the past one month. In terms of valuation, the stock is trading at a P/E multiple of 9.670x and is earning a dividend yield (annual ) of 3.13%.

Bapcor Limited (ASX: BAP)

Bapcor Limited (ASX: BAP) is engaged in sale and distribution of motor vehicle aftermarket parts and accessories, automotive equipment and services, and motor vehicle servicing. It is one of the largest automotive suppliers in Australasia with a network covering over 900 sites.

As on 23 January 2020, the market capitalisation of the company stood at $1.76 billion. The company has recently announced that Greg Fox, Chief Financial Officer and Company Secretary of Bapcor Limited will retire at the end of the 2020 financial year.

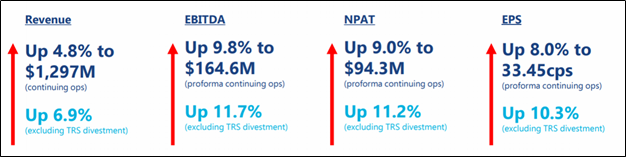

Record results in FY2019 on all key measures: During FY19, revenue of the company went up by 4.8% to stand at $1,297 million and EBITDA witnessed an increase of 9.8% to $164.6 million. In the same time span, NPAT of the company was noted at $94.3 million, up by 9.0% on the prior corresponding period. The decent financial performance of the company resulted in the EPS to increase by 8 percent to 33.45 cents per share.

FY19 Financial Performance (Source: Company’s Report)

Future Strategy and Expectations: The company expects no change in targets but anticipates significant growth in the upcoming periods. It also anticipates growth in organic sales to be around 2% to 3% p.a.

BAP is also aiming for the footprint expansion in Burson with approximately 10-12 stores p.a., Retail up to 10 -12 stores p.a. and 5 NZ stores p.a. The company expects increased selling price in all segments, predominately indicating fluctuation and devaluation in currency.

The company has reiterated FY2020 profit guidance and expects at least middle single digit percentage increase in pro-forma NPAT. It also anticipates an increase of 2% in EBITDA due to additional depreciation from investment in technology and systems.

Stock Performance: The stock is trading at $6.245, up by 0.726% on 23 January 2020. As per ASX, the stock of BAP gave a negative return of 1.88% on the YTD basis and a negative return of 4.43% in the past 30 days. In terms of valuation, the stock is currently trading at a P/E multiple of 18.020x and is earning dividend yield (annual) of 2.74%.