Gold prices are again rising in the international market after a slight correction. Gold Spot, which corrected from the level of US$1,557.09 (Dayâs high on 04 September 2019) to the level of US$1,500.98 (Dayâs low on 10 September 2019 reached a high of US$1,535.18 (as on 25 September 2019). However, the gold prices again corrected in the international market yesterday and plunged to the current levels of US$1,508.80 (as on 26 September 2019 11:54 PM AEST). Despite the correction, the short-term gold rally is intact propelled by global uncertainties, and gold is in a strong uptrend. The rise in gold prices is again capturing investorsâ attention globally to park their investment against the backdrop of falling risky assets in the international market amid surmounting geopolitical tensions.

What is Providing Cushion to the Gold Prices?

The gold prices are currently supported by the surmounting geopolitical tensions, leading to high demand for gold in the market to hedge against the systematic risk. The squabbling between the global leaders at the United Nations General Assembly propelled the gold prices higher. At the U.N. General Assembly, the United States President criticised Chinaâs trade policies and mentioned that he would not accept a bad deal during the negotiation. The comments from the United States President sparked fear among the market participants over further intensification of the U.S-China trade tussle. The market experts assessed that the U.S-China trade deal is yet very far away from reaching a peaceful conclusion, which in turn, supported the gold prices.How Strong Are the Long Side Fundamentals?

Gold marked a strong demand during the first half of the year 2019 from central banks, and gold-backed ETFs are marking higher fund inflows to increase their respective gold holdings. To Know More, Do Read: Global Gold-Backed ETFs Pushes Gold; ASX-listed Gold Stocks Under Pressure Over Bearish Signs The recent survey conducted by the World Gold Council observed that around 11 per cent of the developing economies central banks are still eyeing gold to safeguard themselves against the global currency plunge. Apart from that, the free fall in bond yields and interest rate is also supporting the gold prices. To Know More, Do Read: Central Banks and Gold backed ETFs led Gold Shine; Whatâs next for the Safe-Haven?Potential Risk for the Gold Rally

- The spike in gold prices has already dampened the sentiments of jewellery makers amid reduced demand across high jewellery consumption geographies such as India and China, which in turn, could further reduce the gold demand over the coming months.

- The surge in gold prices has prompted the global gold miners to consider the moneyness of their options of developing gold in exchange of higher prices, which in turn, could lead to an ample supply if the gold prices continue to climb over the long-run.

- The surmounting pressure from other nations on the United States and Iran to ink a nuclear pact could ease the geopolitical tensions, which in turn, could increase the premiums of risky assets substantially (considering high volatility).

Gold on Charts

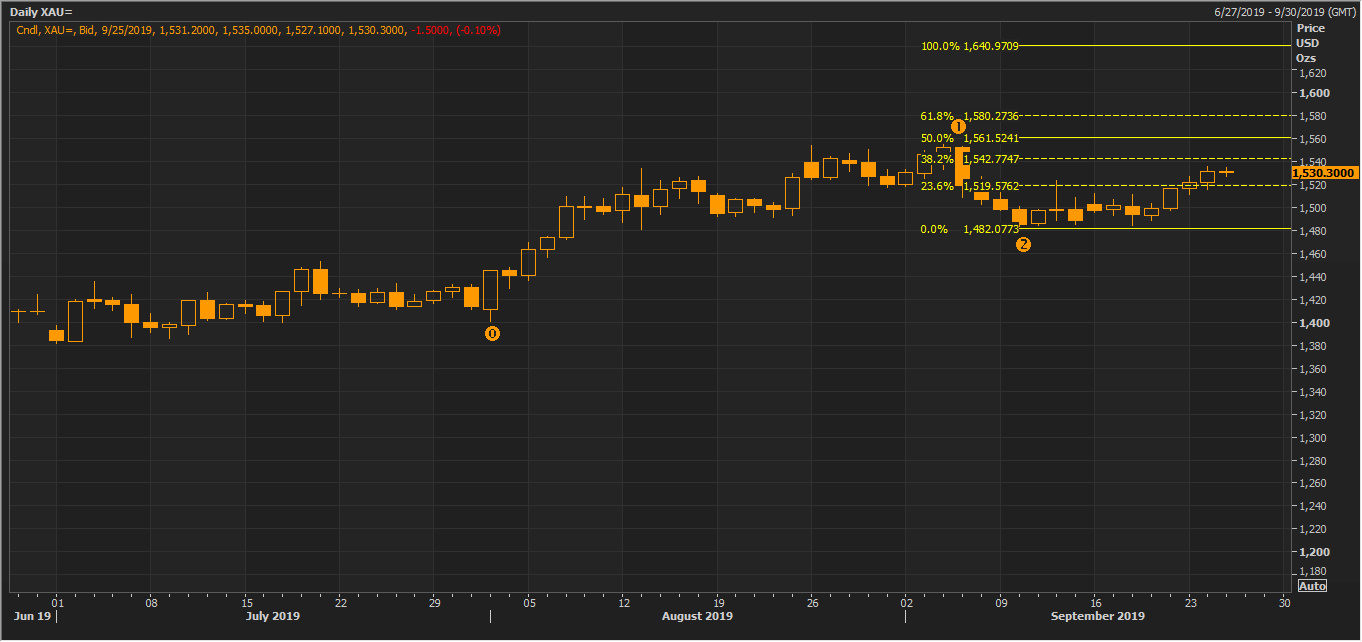

Gold Spot Daily Chart (Source: Thomson Reuters)

On the daily chart, gold prices corrected slightly and took the support of the upward sloping trendline to rise again in the market. The prices are currently above the support zone (encircled area), and investors should keep a close eye around this zone as it is the primary support area for gold.

The major resistance for gold is intact around the level of US$1,558, and the level should be monitored to reckon the price direction ahead. Break and sustain above the level of US$1,558 could further propel the ongoing rally in gold; however, failure to do so could instigate a short-term correction.

Gold Spot Daily Chart (Source: Thomson Reuters)

On the daily chart, gold prices corrected slightly and took the support of the upward sloping trendline to rise again in the market. The prices are currently above the support zone (encircled area), and investors should keep a close eye around this zone as it is the primary support area for gold.

The major resistance for gold is intact around the level of US$1,558, and the level should be monitored to reckon the price direction ahead. Break and sustain above the level of US$1,558 could further propel the ongoing rally in gold; however, failure to do so could instigate a short-term correction.

Gold Spot Daily Chart (Source: Thomson Reuters)

The volatility in the gold prices is normal, as depicted by the distance between the upper and lower line of the 14-day simple Bollinger Band. The prices are comfortably trading within twice the standard deviation from the 14-day simple average.

The status of a safe asset along with normal volatility is providing gold demand with a cushion, which could support the prices in the near-term. The prices are currently trading above the 14-day simple average and are expected to take a hurdle around the upper line of the Bollinger Band, which is at US$1,551.

Gold Spot Daily Chart (Source: Thomson Reuters)

The volatility in the gold prices is normal, as depicted by the distance between the upper and lower line of the 14-day simple Bollinger Band. The prices are comfortably trading within twice the standard deviation from the 14-day simple average.

The status of a safe asset along with normal volatility is providing gold demand with a cushion, which could support the prices in the near-term. The prices are currently trading above the 14-day simple average and are expected to take a hurdle around the upper line of the Bollinger Band, which is at US$1,551.

Gold Spot Daily Chart (Source: Thomson Reuters)

If the gold prices continue to rally further, the projected levels (small hurdles) for gold are as below:

38.2 per cent (US$1,542.77), 50.0 per cent (US$1,561.52), 61.8 per cent (US$1,580.27), 100.0 per cent (US$1,640.97). However, the projected levels would not hold true if the prices breach the low of the candle marked as (2) on the chart shown above.

Gold Spot Daily Chart (Source: Thomson Reuters)

If the gold prices continue to rally further, the projected levels (small hurdles) for gold are as below:

38.2 per cent (US$1,542.77), 50.0 per cent (US$1,561.52), 61.8 per cent (US$1,580.27), 100.0 per cent (US$1,640.97). However, the projected levels would not hold true if the prices breach the low of the candle marked as (2) on the chart shown above.

ASX-Listed Gold Miners

The surge in demand for gold supported the share prices of the ASX-listed gold miners, and they remained among the top-performing mining stocks on ASX. The ASX-listed gold miners have rallied proportionally to the rise in gold prices due to their positive correlation with gold prices, and some miners have even outperformed returns from gold over the short- and long-term. However, amid a halt in the gold rally, the ASX-listed gold miners are now struggling to cross their previous highs. To Know More, Do Read: A Glimpse Over ASX-Listed Top Performing Mining Stock While the gold prices are high, the ASX-listed gold miners are taking advantage and showcasing their growth potential on various platforms to gain investorsâ interest. To Know More, Do Read: ASX Gold Miners-NCM, NST and RRL Showcasing at the Denver Gold Forum Newcrest Mining Limited (ASX: NCM) The share prices of the company have been in a decent rally from the level of A$18.570 (low in September 2019) to the level of A$38.870 (high in August 2019), which in turn, underpinned a growth of over 109 per cent. However, since the gold prices are taking a strong hurdle around the level of US$1,558, the share prices of the company are struggling to cross its August 2019 high of A$38.870. Northern Star Resources Limited (ASX: NST) The stock demonstrated the same trajectory of an uprise followed by a halt in the rally as exibited by many of the ASX-listed gold companies. NST rose from the level of A$2.960 (low in December 2018) to the level of A$14.050 (high in July 2019), which in turn, underpinned a growth of over 374 per cent. The shares marked a continuous upside for eight months; however, the rally is now on a halt amid capped gold prices. In a nutshell, the gold prices rose substantially from December 2019 to August 2019, which in turn, provided cushion to the global and ASX-listed gold miners; however, the gold rally is now facing a hurdle around the level of US$1,558, keeping a lid on the gain in share prices of the ASX-listed gold miners.Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice