Summary

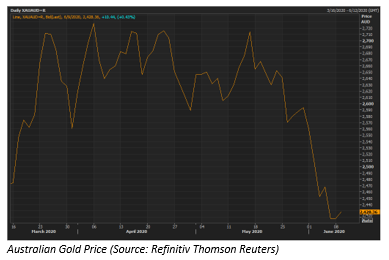

- With AU currency gaining strength, the Australian gold price has been dwindling, proving a point of concern for gold investors.

- However, gold prospects remain bright as the world economy is still hovering around a negative economic growth, showing bullish market for gold investors

- Backed by bullish gold market along with new resources being discovered by many operators, small-cap gold companies listed on ASX are experiencing a price rally.

Australian gold price experienced a sharp decline in the month of May, as the AU currency gained strength. The US gold price is also hovering around the US$1700 mark.

As gold shares an inverse relation with stock market performance, the decline reflects increasing confidence of investors on the Australian Securities Exchange (ASX). However, with the economy still to pick up pace, gold market is expected to stay bullish in the future, brightening up the prospects of many ASX-listed small-cap gold stocks.

Also Read: Gush for Gold; How You Should Plan to Play The Consolidation?

Let’s discuss how few small-cap gold companies had been performing during the COVID-19 restriction period.

Resolute Mining Limited (ASX: RSG)

Resolute Mining has been in the business for over 30 years, operating as an exploration and development company for gold mines in Australia and Africa. Apart from ASX, the Company is listed on the London Stock Exchange (LSE) under the ticker RSG.

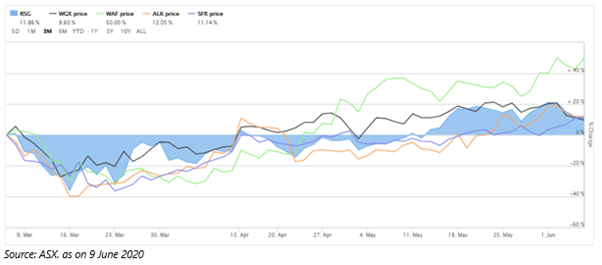

The Company’s share price has increased by approximately 11.86% since March 2020, driven by several factors such as positive earnings and future outlook coupled with completion of its second tranche of ~$195 million equity raising. The Company also posted a positive 2019 review with 394,920oz of gold sold at an average price of US$1,344/oz ($1,933/oz) and incurred All-In Sustaining Cost (AISC) of US$1,090/oz ($1,577/oz).

The Company currently has 4.7Moz of ore reserves and 13.3Moz of mineral reserves. It owns three gold mines- Syama Gold Mine in Mali (Syama), Mako Gold Mine in Senegal, and Bibiani Gold Mine in Ghana, which is under a strategic review. In March 2020, the Company sold its Ravenswood Gold Mine for upfront proceeds of $100 million including $50 million in cash and $50 million in promissory notes, in addition to retaining additional upside exposure to the mine via 2 further notes valued at a maximum of $200 million.

From existing processing infrastructure, Syama Gold Mine can produce more than 300k ounces of gold per annum while the Mako Gold Mine in Senegal produces high-quality 140,000 ounces of gold annually.

Resolute’s guidance for fiscal year 2020 is 430,000 ounces of gold production at an AISC of US$980 per ounce. The guidance for the Syama Gold Mine in Mali is 260koz at an AISC of US$960/oz and 160koz for the Mako Gold Mine in Senegal at an AISC of US$800/oz.

Also Read: Resolute Mining Signs a New USD 300 million Debt Refinancing

Westgold Resources Limited (ASX: WGX)

Westgold Resources operates in the Western Australian region with three production facilities- the Murchison Gold Operations, Fortnum Gold Project, and Cue Gold Operations.

The Company’s share price has increased by ~9.60% since March 2020. Some of the factors that can be attributed to the gain include recommencing of underground sub-level mining operations at Big Bell and a new capital raising program of $45 million by placing 20 million shares at a cost of $2.25 per share.

The Big Bell underground mine is located at Westgold’s Cue Gold Operations. Executive Chairman of the Company, Peter Cook, is very optimistic about the Big Bell operations, as it used to be one of the largest single mine gold producers in the Australian gold sector.

Mr. Cook is bullish on future prospects, on the back of three operating process plants, more than 9Moz of resource base and the advantage to underwrite more than 300k ounces of production per annum in the longer run owing to the Company’s unique position of being an owner operator.

West African Resources Limited (ASX: WAF)

West African Resources’ share price has been experiencing ups and downs over the past few months. Though listed on ASX, the West African Resources Limited is engaged in the exploration and development of mineral projects in West Africa. The Company has ventured into gold production through its high-grade gold discovery in Burkina Faso, West Africa.

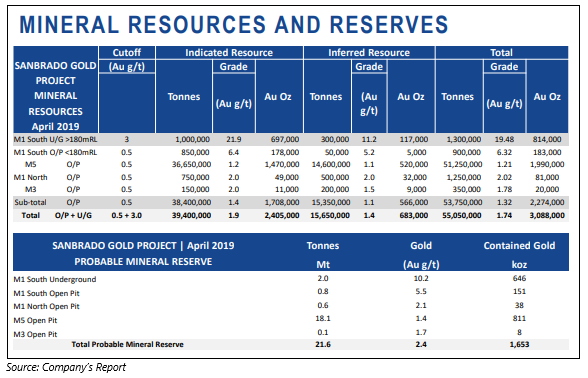

At the Sanbrado Project, WAF poured first gold in March 2020, and at an AISC below US$600/oz, the Company is expecting production of more than 300koz gold in the first year and an average of 217koz a year in the initial five-year period. With an initial mine life of 10 years covering underground mining of 6.5 years, the Company expects a capital payback at US$1300/oz gold from the project.

Also Read: West African Resources Limited: Sanbrado Gold Project is Processing its First Gold

Alkane Resources Limited (ASX: ALK)

Alkane Resources operates as a gold production company with projects located primarily at the Central West region of New South Wales. Its project, Tomingley Gold Operations (TGO) has been operating since early 2014. The Tomingley open pit production from 2014 to 2019 had been 369,000oz at an AISC of $1,192/oz.

The Company’s share price has increased by 12.5% in last three months, showing resilience during the COVID-19 hit stock market. The Company, in May investor presentation, highlighted unlocking the value of its wholly-owned subsidiary, Australian Strategic Materials via a demerger and listing during the current year.

Production guidance for Tomingley Gold Project is 30,000 – 35,000oz Au for FY20. At the project, the Company has announced initial Roswell and San Antonio Resources, with Roswell Inferred Resource at 7.02Mt @1.97g/t Au (445,000oz) and San Antonio Inferred Resource at 7.92Mt @1.78g/t Au (453,000oz).

The Company boasts of strong cash position of $81.9 million, bullion and listed investments with zero debt, as on 31 March 2020.

Sandfire Resources (ASX:SFR)

Sandfire, focused on building a diversified portfolio of high-quality base metal assets, operates DeGrussa Copper-Gold Mine, which is located near Perth in Western Australia. The high-margin gold project produces high-quality copper-in-concentrate with significant gold credits. Since 2014, the Company has been experiencing a steady growth in gold production with highest production hit 44,455oz in FY 19.

The Company’s share price has increased by more than 11% since March 2020 driven by strong cash position and business prospects. As on 31 March 2020, the Company had $242 million cash with no debt. FY2020 guidance is 70-72kt Cu and 38-40koz Au at C1 ~US$0.90/lb. The Company expects a cumulative production of 305,000oz and yearly production of 28,722oz of contained gold by Q3’ FY20.

Also Read: Sandfire Provided March 2020 Quarterly Report; Cash on Hand Reported to $242.0 million

Disclaimer: All the currencies mentioned are in AUD unless specified