Retirement Plan:

Retirement, a term which forces an individual to think about his/her financial security in future. Besides, planning for the retirement needs to start in the early stage of a personâs career to have enough time in hand and take complete advantage of the available sources. For this, one should consider his/her liabilities and risk-taking abilities over a period of time.

Hence, in this article we would be discussing the three stocks with high dividend yield, that are expected to create value for its shareholders in the coming future.

Wesfarmers Limited

Wesfarmers Limited (ASX: WES) is an Australian company with diversified business which includes retail operations, general merchandise and department stores; along with fuel, liquor & convenience outlets; home improvement and outdoor living products and building materials; office retailing and technology products. Additionally, the company is involved in mining, gas processing & distribution, safety product distribution and so forth.

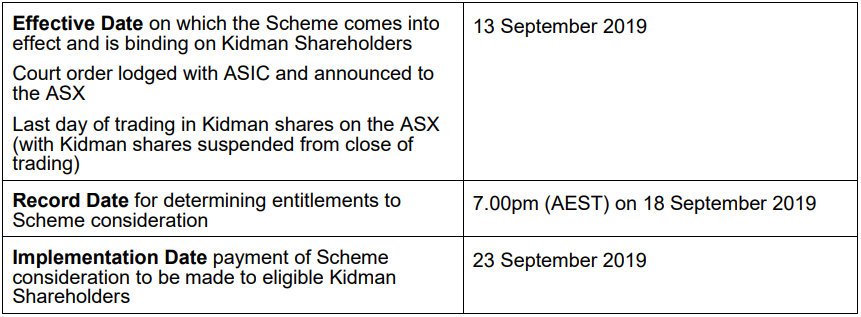

The company recently, on 13 September 2019, shared the information released by Kidman Resources Limited (ASX: KDR) that KDR has submitted a copy to the Australian Securities and Investments Commission (ASIC) with regards to the orders of the Federal Court of Australia, approving the scheme of arrangement.

According to the agreement, Wesfarmers Lithium Pty Ltd, a 100% subsidiary of WES, would obtain all of the issued ordinary shares in KDR and the shareholders of Kidman would be entitled to receive a cash of $1.90 for every Kidman share, held by them as on the record date.

KDR shared the timetable and next steps which are as given in the table below:

Timetable for implementation of the Scheme (Source: Companyâs Report)

Timetable for implementation of the Scheme (Source: Companyâs Report)

FY19 Results Highlights: In the full-year report, dated 26 August this year, WES mentioned the NPAT (net profit after tax) at $5,510 million for the period, including post-tax significant items of $3,171 million. NPAT from continuing operations witnessed a growth of 13.5% to $1,940 million on yoy.

The successful re-positioning of portfolio, for sustainable growth has strengthened balance sheet with net financial debt reducing to $2,116 million from $3,580 million in FY18, while distributing a special dividend to shareholders. The management declared a fully franked, final ordinary dividend of 78 cents per share, to be paid on October 9, 2019, bringing the total dividends to shareholders this year of $2.78 per share. The period witnessed successful divestments of Bengalla, Kmart Tyre & Auto (KTAS) & stake in Quadrant Energy.

Outlook: Benefited from a diversified portfolio, the group remains to be well positioned to gain out of different economic conditions; that would help the WES to continue to deliver long-term growth in shareholder value. Going forward, it would maintain its focus on developing a deeper & broader digital offer, developing great talent & teams, and driving entrepreneurial initiative.

Stock Performance: On 16 September 2019, by the end of the trading session, the stock of WES was at a market price of A$39.300, with a price to earnings multiple of 8.090x. WESâ market capitalisation stands at A$44.67 billion and has an annual dividend yield of 4.52%. The stock has gained a positive return of ~11.91% in the last 1-year period.

Commonwealth Bank of Australia

Commonwealth Bank of Australia (ASX: CBA) is known as one of Australiaâs leading providers in the space of financial services, catering the needs of +17.4 million customers, with a focus on retail and commercial banking. The bank recently, on 12 September 2019, notified that it has issued US$2.5 billion worth of subordinated notes, pursuant to CBAâs U.S. $50,000,000,000 Senior and Subordinated Medium-Term Notes Program (U.S. MTN Program). The bank, recently, announced a fully franked ordinary dividend of AUD 2.31000000, to be paid on September 26, 2019.

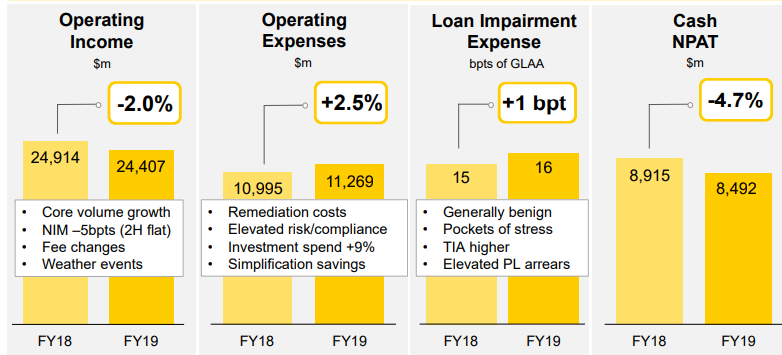

FY19 Results Highlights: In its annual report, closed 30 June 2019, the operating income for the bank was noted at $24,407 million in FY19, down 2% on yoy, primarily due to a decline of 1.2% in NIM (net interest margin), customer fee removals and reductions, along with an adverse impact of weather events. Further, the 2H19 period, saw a strong growth in home loan to 1.3x system, posting a volume growth of 4% for the year, supported by owner-occupied loans. Business lending posted a growth of 4% as well, backed by business services and transport. Transaction deposits posted a robust growth during the year, with balances witnessing a rise of 9%.

Overall, growth in group deposits for FY19 stood at 2%. Operating expenses to total operating income or cost-to-income ratio for the period came in at 46.2%. The liquidity coverage ratio (LCR) for the bank came in at 132%, which was well above the regulatory minimum of 100%.

FY19 Key outcomes (Source: Companyâs Report)

The leverage ratio at 5.6% was well above the Basel III minimum of 3% and APRAâs proposed minimum of 3.5%. By the end of the period, pro-forma CET1 (Common Equity Tier 1) at 11.8% was above APRAâs âunquestionably strongâ benchmark of 10.5%.

Stock Performance: CBA stockâs market price was at A$81.69, by the end of the trading session on ASX. It had price to earnings multiple of 16.92x with an annual dividend yield of 5.25%. CBA has a market capitalisation of A$145.41 billion. The stock has generated ~15.40% return in the last 12 months timeframe.

Rural Funds Group

Rural Funds Group (ASX: RFF) is engaged in the leasing of agricultural properties and equipment. The group acts as a lessor of agricultural property with revenue derived from leasing macadamia orchards, almond orchards, poultry property and infrastructure, vineyards, cattle properties, cotton properties, agricultural plant and equipment, cattle and water rights. Key lessees and counterparts include leading agricultural producers and processors like Olam Orchards Australia, RFM Poultry, Baiada and Turosi, Select Harvests, JBS Australia, Treasury Wine Estates among others.

Recently, on 13 September 2019, Rural Funds Management Limited (RFM), as a responsible entity of RFF, informed the market that it has issued legal proceedings against Bonitas Research LLC and its principal, Matthew Wiechert, for the losses and damages, it suffered as a result of allegation made by the latter party. The group announced an unfranked ordinary dividend of AUD 0.02711800, payable on October 31, 2019.

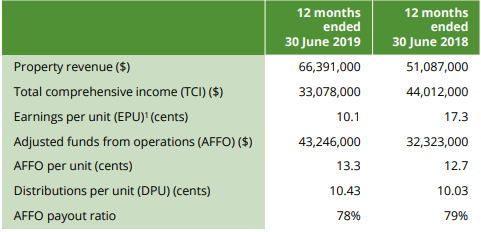

FY19 Results Highlights: On 27 August this year, RFF released a full-year report closed 30 June 2019, wherein property revenue witnessed a growth of 30%, led by JBS transactions, acquisitions, development capital expenditure, etc. The total comprehensive income (TCI) and earnings per unit (EPU) came in lower on the back of non-cash revaluation decrements on interest rate swaps worth $18 million. Adjusted funds from operations (AFFO) per unit for the year posted a growth of 4.7% which was in-line with the estimates.

Further, the management expects AFFO per unit for FY20 to come in at 14 cents, representing a rise of 5.3% as compared with FY19. RFF also expects DPU for FY2020 to come in at 10.85 cents, in-line with annual growth target of 4.0%, representing an estimated payout ratio of 77%. The company anticipated AFFO yield for FY2020 to come in at 7% with forecast payout ratio of 78%.

Income and earnings metrics for F19 (Source: Companyâs Report)

Adjusted total assets stood at $222.2 million, driven by acquisitions made during the year, capex and revaluations of almond orchards, vineyards and water entitlement. Gearing as at the end of the period stood at 31%, within the target range of 30-35%, with sufficient capacity to settle the remaining acquisitions and committed capital expenditure. Besides, adjusted NAV per unit witnessed a growth of 7%, led by independent revaluations of almond orchards, vineyards and water entitlement.

Stock Performance: RFFâs stock last traded at A$2.00 and is available at a price to earnings of 19.940x with an annual dividend yield of 5.16%. It has a market capitalisation of A$683.25 million. The stock has given a negative return of ~5.56% in the last one-year period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.