On 13 August 2019, Orocobre Limited, CYBG PLC, Cochlear Limited and Genworth Mortgage Insurance Australia Limited, four stocks listed on the ASX and serving different categories of the clients, witnessed significant decline in their share price.

Let us have a look at the developments of these stocks.

Orocobre Limited

High-grade, high-value lithium chemicals supplier, Orocobre Limited (ASX:ORE) reported a 6.41% fall in its share price on 13 August 2019. The company, on 24 July 2019, had reported a weak performance of ORE in terms of production, sales revenue and gross cash margins at its Olaroz Lithium facility in northern Argentina during the quarter ended 30 June 2019.

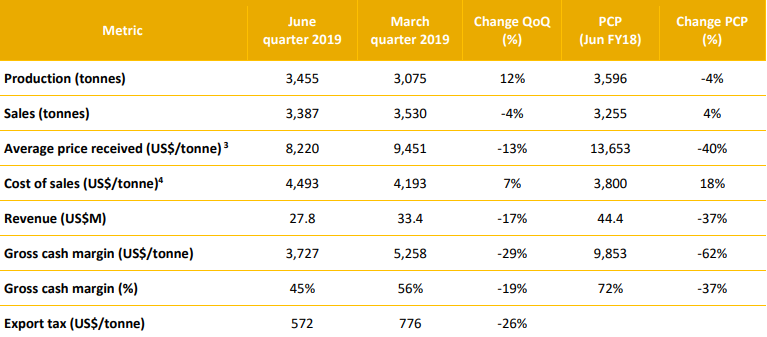

At the Olaroz Lithium facility, the company reported a 4% year-on-year decline in production to 3,455 tonnes and a 37% year-on-year fall in revenue to USD 27.8 million for the June quarter. Also, gross cash margins squeezed by 62% to USD 3,727 per tonne during Q4 FY19 when compared with USD 9,853 per tonne during the same period a year ago. Cash costs went up by 7% quarter-on-quarter to USD 4,493 per tonne for the concerned quarter.

Olaroz Lithium Facility Highlights (Source: Companyâs Report)

Olaroz Lithium Facility Highlights (Source: Companyâs Report)

For lithium growth projects, the company unveiled that construction work at the Naraha lithium hydroxide plant in Japan is likely to begin in early H2 CY19, while commissioning is expected to begin during the first half of 2021. The production of battery grade lithium hydroxide from this plant will be used by the Japanese battery industry. Also, progress is being made with respect to the construction of secondary liming plant, ponds, roads and other key items, concerning the second stage expansion of the Olaroz lithium facility. Moreover, Orocobre reported a 10% increase on a quarterly basis in overall sales volume for Borax Argentina to 11,758 tonnes for the June quarter. It had available cash of USD 248.0 million after expenditure as at 30 June 2019.

In a market update on 6 August 2019, the company announced the start of construction at the Naraha lithium hydroxide plant in Japan. The development strengthens the companyâs position as a global producer of lithium chemicals operating at the bottom quartile of the lithium cost curve, commented Orocobre Managing Director and CEO Mr. MartÃn Pérez de Solay during the groundbreaking ceremony.

Stock Information: With a market cap of A$ 688.21 million and approximately 261.68 million outstanding shares, the stock of ORE was trading at A$ 2.580 on 14 August 2019 (AEST 02:38 PM), down 1.901% from its previous closing price. Its EPS stands at $ 0.092, while PE ratio is 28.65x.

CYBG PLC

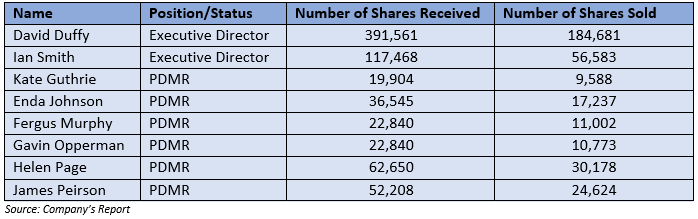

Banking products and services provider, CYBG PLC (ASX:CYB) witnessed a fall of 6.20% in its share price on 13 August 2019. The company unveiled that on 12 August 2019 some Directors and PDMRs received ordinary shares in the company. Of the total shares, some were divested by these Directors and PDMRs in order to cover their respective tax liabilities and sale costs.

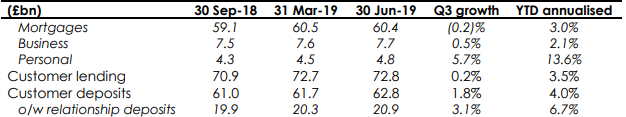

For the third quarter ended 30 June 2019, the company reported a 0.2% mortgage book reduction to GBP 60.4 billion, on the back of rise in redemptions during the period and subdued new business volumes, which is as per the companyâs optimisation strategy. There was a 0.5% increase in business lending during the quarter to GBP 7.7 billion; however, the company has a strong pipeline of new lending for the fourth quarter.

In the June quarter, personal lending grew by 5.7% to GBP 4.8 billion, while customer deposit increased by 1.8% to GBP 62.8 billion. Further, the company posted a 3bps decline in NIM to 168bps (annualised for three quarters), which was lower than the first half of FY19, as a result of re-financing due to a large volume of mortgage redemptions in the third quarter. CYBG expects FY19 NIM to be at the lower end of the guidance range anticipated to be 165-170bps.

Result Highlights (Source: Companyâs Report)

Stock Information: With a market cap of A$ 3.68 billion and approximately 1.43 billion outstanding shares, the stock of CYB was trading at A$ 2.520 on 14 August 2019 (AEST 03:03 PM), down 1.946% from its previous closing price. Its EPS stands at negative $ 0.182, while annual dividend yield is 2.16%.

Cochlear Limited

Stock of Cochlear Limited (ASX:COH), the Cochlear implant systems manufacturer, fell 3.36% on 13 August 2019. The company is scheduled to announce its full year results for the financial year 2019 on 16 August 2019.

Source: Companyâs Report

According to the companyâs guidance for FY19, it expects revenue to be driven by its services business, in addition to strong performance of the Nucleus 7 Sound Processor. However, the company anticipates registering a lower growth rate for cochlear implants across the developed markets. Moreover, for FY2019, the company is expecting net profit to be in the range of $ 265 million to $ 275 million, representing an increase of 8-12% when compared with the same period a year ago.

On the other hand, the company has recently got the approval from FDA, a federal agency of the United States Department of Health and Human Services, for the Nucleus Profile Plus Series cochlear implant. Available in the United States and Germany, the company plans to launch it in other European countries over the coming months.

Stock Information: With a market cap of A$ 11.74 billion and approximately 57.72 million outstanding shares, the stock of COH was trading at A$ 203.140 on 14 August 2019 (AEST 03:22 PM), down 0.113% from its previous closing price. Its EPS stands at $ 4.577, while annual dividend yield is 1.55%.

Genworth Mortgage Insurance Australia Limited

Stock of lenders mortgage insurance provider, Genworth Mortgage Insurance Australia Limited (ASX:GMA), saw a 4.39% fall on 13 August 2019. The companyâs majority shareholder Genworth Financial Inc. recently reached a deal with Brookfield Business Partners LP, under which the latter would acquire the Canadian unit of the former. The deal worth $ 2.4 billion.

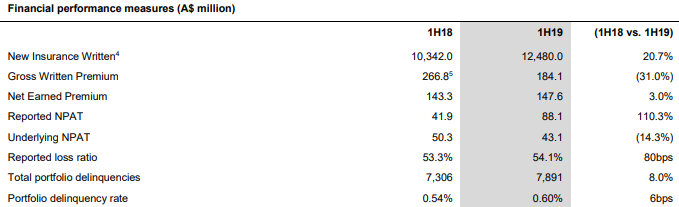

On the other hand, the company during the first half of 2019 registered more than double reported net profit after tax (NPAT) to $ 88.1 million compared to $ 41.9 million in 1H18. The companyâs underlying NPAT stood at $ 43.1 million in 1H19 versus $ 50.3 million in 1H18. For the first half of 2019, it reported a 20.7% rise in New Insurance Written (NIW) to $ 12.5 billion compared to $ 10.3 billion in the first half of 2018.

Source: Companyâs Report

Source: Companyâs Report

Additionally, the company started on-market share buy-back of $ 100 million on 21 February 2019. As at 30 June 2019, the company had acquired 25 million shares of aggregate value of $ 63.9 million as part of the capital management program. The company has declared fully franked interim ordinary dividend of 9 cents per share and an unfranked special dividend of 21.9 cents per share.

Stock Information: With a market cap of A$ 1.18 billion and approximately 412.51 million outstanding shares, the stock of GMA was trading at A$ 2.840 on 14 August 2019 (AEST 03:46 PM), down 0.351% from its previous closing price. Its EPS stands at $ 0.165, while annual dividend yield is 6.32%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.