The consumer discretionary sector of Australia includes those companies which are sensitive to the health of economic cycle. With the upside or downside of the economic cycle, these companies comparatively get highly impacted by such economic movement or disruption.

Most of the sectorâs operational activities are determined with demand-supply balances in the market, however, consumer discretionary sector is more inclined towards the economic movement. On ASX, this sector is being recognised as S&P/ASX 200 Consumer Discretionary Sector, which was closed at $2,622.70 with fall of $2.0 on 1st November 2019. In the below article, we would be looking at five consumer discretionary stocks, which are in limelight and in the eyes of investors.

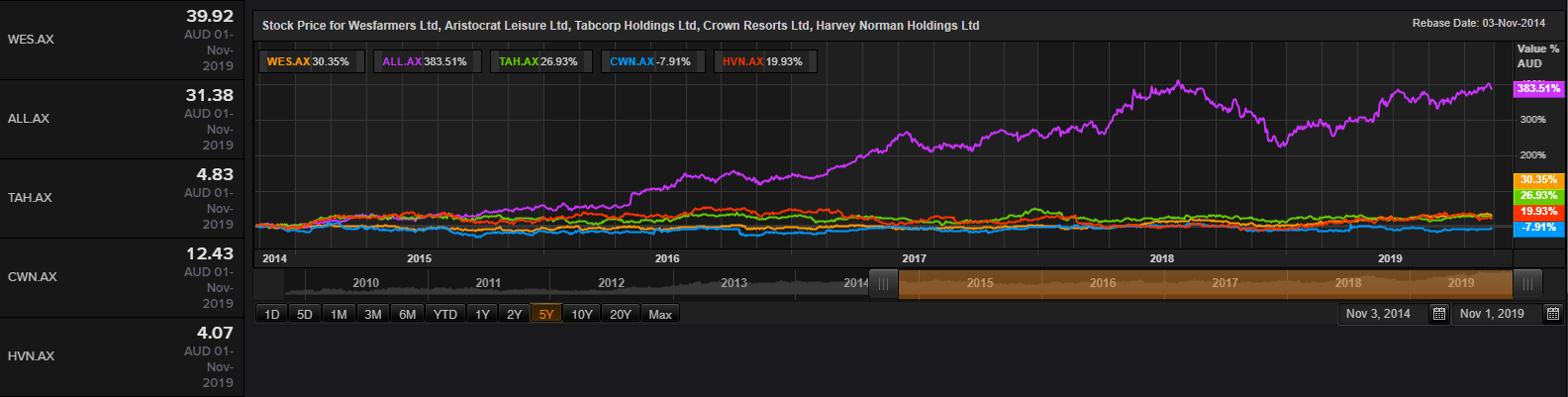

Comparative Chart (Source: Thomson Reuters)

Wesfarmers Limited (ASX: WES)

Wesfarmers Limited (ASX: WES) is primarily in the retailing of home improvement and outdoor living products as well as supply of building materials.

Launch of New Website

- The company through a release dated 15th October 2019 announced that it has rolled out a new sustainability website, which provides enhanced information as well as more frequent updates on areas. The website also includes issues, which are critical to the WESâs continued long-term performance.

- It added that the new website admires the expanded disclosures, which were on sustainability performance in the Annual Report 2019 included a substantial rise in climate-related financial disclosures.

- The company further stated that sustainability highlights in the past year has included (1) Climate change resilience, (2) Diversity and inclusion, (3) Community, (4) Ethical sourcing, and (5) Safety.

It was mentioned in the investor briefing and site tour presentation that WesCEF (Wesfarmers Chemicals, Energy & Fertilisers) strategic priorities revolves around:

- Leveraging the existing infrastructure and incrementally expand capacity as market conditions allow, and to seek the continuing operational efficiencies as well as automation opportunities.

- WesCEFâs priorities also include to apply innovation and technology to develop new products and services to meet the needs of its customers.

Notice of 2019 AGM

Wesfarmers would be conducting its Annual General Meeting 2019 on 14th November 2019, and few resolutions under consideration would be:

- To consider and receive the financial statements and the reports of the directors and auditors.

- For electing the Directors

- For adoption of the remuneration report.

To know more also read: https://kalkinemedia.com/au/news/wesfarmers-limited-asx-wes-is-set-to-shrug-off-coles

On the stockâs performance front, Wesfarmers Limited was last traded at a price of A$39.930 per share with a rise of 0.428% on the trading session of 1st November 2019. It experienced a rise of 11.09% in the time frame of six months.

Aristocrat Leisure Limited (ASX: ALL)

Aristocrat Leisure Limited (ASX: ALL) is engaged in the activities such as designing, development and distribution of gaming content, platforms and systems, which include electronic gaming machines, casino management systems as well as digital social games.

Key takeaways from Investor Presentation

- The company has innovative commitment in premium video hardware as well as showcasing age defying brands, like Crazy Rich Asians, Zorro, Big Bang Theory & Star Trek.

- It is expanding its portfolio with more denomination options.

A look at Half-Year 2019

- For the half-year ended 31st March 2019, the company reported normalised profit after tax and before amortisation of acquired intangibles amounted to $422.3 million, which demonstrated 16.8% in reported terms and 7.7% on constant currency basis.

- It added that these results have been fueled by continued strong growth in the Americas and Digital businesses of the group, in combination with a further lift in performance throughout the Australia and New Zealand region.

- It witnessed a rise of 20.8% and 29.8% on constant currency basis and reported basis, respectively against previous corresponding period (pcp) and reached to new reported record, which amounted to more than $2.1 billion.

- In the same period, the company declared an interim dividend of 22.0 cps, fully franked, with a rise of 16%.

Future Aspects

The company expects moderate growth in corporate costs, as it builds the appropriate infrastructure in order to grow a more complex and diverse business. It projected a decline of 100 â 150 bps in the groupâs effective tax rate as compared to FY18.

On the stockâs performance front, Aristocrat Leisure Limited was last traded at a price of A$31.390 per share with a decline of 0.727% on the trading session of 1st November 2019. It experienced a rise of 20.41% in the time frame of six months.

Tabcorp Holdings Limited (ASX: TAH)

World-class diversified gambling entertainment company, Tabcorp Holdings Limited (ASX: TAH) recently announced that David Attenborough has made a change to his holdings in the company by acquiring 617,283 performance rights on 24th October 2019.

Chairmanâs Address

- The Chairman of the company addressed the shareholders at 2019 Annual General Meeting and stated that 2019 has been a year where Tabcorp and Tatts operated as a combined business. The Chairman added that vision of the company revolves around to become a Trusted Gambling Entertainment Company.

- The company powerful brands, strong balance sheet and strong and resilient earnings as well as cash flows places the company in a strong position to compete and grow.

- It was stated that the strong revenue growth, underpinned by the excellent progress in delivering the integration synergies, resulted in a profit after significant items amounting to $362 million.

- When it comes to integration, it was added that the integration program, which was set out in December 2017 is on track, and scheduled to be wrapped up by FY21, as planned.

Outlook

- TAH stated that its Lotteries & Keno business is well placed to grow its share of the gambling entertainment market via continued game innovation as well as delivering a compelling customer experience throughout the retail and digital channels.

- It added that the team of Gaming Services is focused on extending contracts, winning more venue customers as well as expanding its offer throughout the eastern seaboard.

On the stockâs performance front, Tabcorp Holdings Limited was last traded at a price of A$4.825 per share with a rise of 0.521% on the trading session of 1st November 2019. It experienced a rise of 0.21% in the time frame of six months.

Crown Resorts Limited (ASX: CWN)

Crown Resorts Limited (ASX: CWN) well known as one of Australiaâs leading entertainment groups with its core businesses as well as investments in the integrated resorts sector. On 24th October 2019, the company announced that Geoffrey Dixon has stepped down as director of the company.

Significant Taxpayer

- Recently, the company has completed its 2019 Annual General Meeting, wherein, the Chairman of the company has addressed the shareholders and stated that in the past five years, the company made investment of more than $1.1 billion into its Melbourne and Perth properties in order to confirm that these properties remain globally competitive.

- In financial year 2019, the company spent more than $650 million as taxes to all the Government levels in Australia, reflecting almost two-thirds (2/3) of the companyâs pre-tax profits, and making the company a significant and continuous taxpayer.

- The Chairman of the company stated that Crown Sydneyâs construction work is continuing as schedule. It was added that the pre-opening activities have started. It would escalate via this financial year with a management team being formed as well as staff recruitment is well underway for the preparation of its opening in the 1H FY21.

On the stockâs performance front, Crown Resorts Limited was last traded at a price of A$12.420 per share with a decline of 0.321% on the trading session of 1st November 2019. It experienced a decline of 7.01% in the time frame of six months.

Harvey Norman Holdings Limited (ASX: HVN)

Harvey Norman Holdings Limited (ASX: HVN) is primarily in the sale of bedding, furniture, communications and consumer electrical products and computers in Singapore, New Zealand, Slovenia, Malaysia, Northern Ireland, Croatia and Ireland.

Issue of Securities

- On 18th October 2019, the company has issued 66,270,064 ordinary shares at the consideration of $2.50 per new share with respect to the terms of a pro-rata renounceable rights offer, which was announced to ASX on 30th August 2019.

- The company is intending to utilise the proceeds from pro-rata renounceable rights offer to decrease the amount of HVN consolidated entity debt.

Sale of Interest in The Byron At Byron Resort

- The company and certain of its controlled entities, controlled by Gerald Harvey, as owners of the property and business âThe Byron at Byron Bay Resortâ, have wrapped up sale agreements for the resort.

- It added that the purchasers under the Sale Contract were GAG Byron on Byron Property Co Pty Ltd and GAG Byron on Byron Business Company Pty Ltd.

On the stockâs performance front, Harvey Norman Holdings Limited was last traded at a price of A$4.070 per share with a decline of 0.489% on the trading session of 1st November 2019. It experienced a rise of 2.22% in the time frame of six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.