What the company expects from an IPO? - As per conventional belief, a fall in stock price on the first day of trading after a company releases its IPO, may be considered as a threat to the investors. A stock trading in line or below the issue price is in fact a positive indication that the company floating the IPO has maximised its value capture in the IPO. As per reports by few financial analysts, it has been observed that first-day decline in prices is not an indication of the future performance of the company.

As an initial step to the IPO process, the company has to appoint an investment bank as a managing underwriter. The manager and the company then meet the institutional investors to discuss the companyâs results and develop an IPO price range and IPO offer document before the offering is made public. The shares are primarily sold to institutional investors who pay the price fixed in the IPO. Subsequently, the stock begins to trade wherein the opening price of the share is determined by the balance of supply and demand. To maximise the value received from the IPO, the company should maximize the IPO price at which all the shares in the offer can be sold. As a result, the company receives no benefit from the increase in stock price immediately after the share starts trading in the secondary market.

Now let us have a look at some recently listed stocks on ASX.

Quickfee Limited

Quickfee Limited (ASX: QFE) is a company operating in the financial sector.

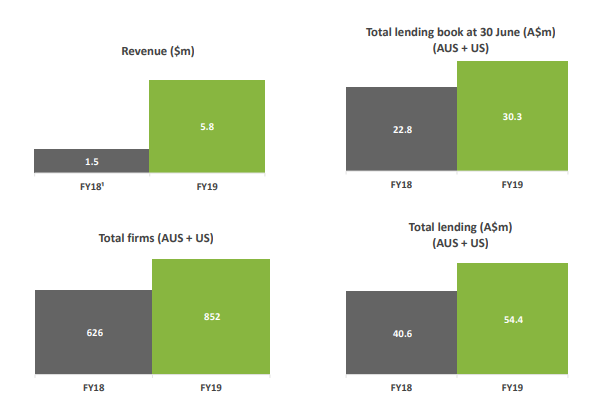

FY19 Financial Results: During the year, the company achieved significant growth in lending to clients of professional firms with Australia reporting a record lending of $42 million, up 15% on prior corresponding period. Lending in US was reported at US$8 million, up 70% on prior corresponding period. The number of firms using the companyâs platform also increased significantly. The period reported 109 new additions in Australia and 117 additions in the US. The period was marked by the highest pre-tax profit in Australia at $851,000. Revenue for the year amounted to $5.8 million, as compared to $1.5 million in prior corresponding period. Interest income revenue from Australia amounted to $3.7 million and that from the US amounted to US$577,000. Other sources of revenue included loan application fee and payment portal hosting fee.

FY19 Key Metrics (Source: Company Presentation)

During the year, the company significantly strengthened its balance sheet following funds amounting to $13.5 million, raised through an IPO. A growth in loan book was represented by increase in receivables and borrowing. Given the above factors, the company seems well funded to pursue its aggressive growth strategy.

Stock Performance: The stock of the company is currently trading at a market price of $0.365, up 2.817% on 02 September 2019 (AEST â 2:13 PM). Over a period of 1 month, the stock generated negative returns of 1.39%.

Pointsbet Holdings Limited

Pointsbet Holdings Limited (ASX: PBH) offers innovative sports and racing betting products and services.

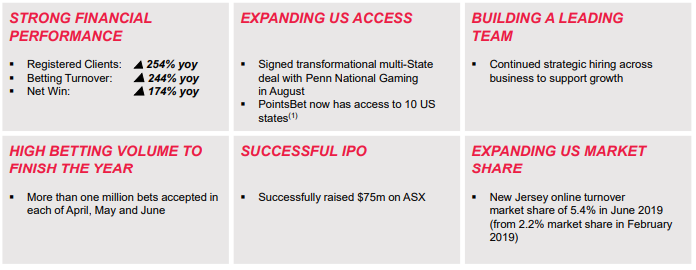

Financial Highlights: During the period ended 30 June 2019, the company reported strong financial performance with registered clients growing 254% YoY. Betting turnover for the period witnessed a growth of 244% YoY. The company expanded into the US through a transformational multi-state deal with Penn National Gaming in August. During the months of April, May and June, more than one million bets were accepted in each of the months.

FY19 Highlights (Source: Company Presentation)

Revenue during the year amounted to $25.6 million, up 173% on prior corresponding year revenue of $9.4 million. EBITDA loss for the year was reported at $32.7 million, with the highest EBITDA loss reported in the US at $19.5 million. During the year, the company generated a loss amounting to $34.4 million.

Business Update: The company reported that it has been witnessing a very strong growth in Net Win in Australia. In FY19, net win went up by 181%, from A$10.3 million in FY18 to A$28.9 million in FY19. YTD group net win for FY20 has been reported at $9.1 million with a net win margin of 7.6%. This represents a year on year growth of 237% on prior yearâs net win amount of $2.7 million.

Stock Performance: Over a period of 1 month, the stock of the company generated negative returns of 3.69%. Currently, the stock is trading at a market price of $2.800, down 2.439% on 02 September 2019 (AEST â 2.32 PM).

Victory Offices Limited

Victory Offices Limited (ASX: VOL) is engaged in providing flexible office solutions.

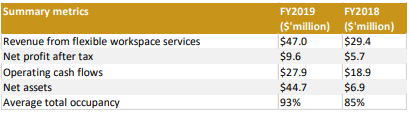

FY19 Performance: During the year, the company reported operating revenue amounting to $47.0 million, up 60% on prior corresponding period. Net profit after tax amounted to $9.6 million, up 67% on prior corresponding period. Operating cash flows during the period increased to $27.9 million, as compared to $18.9 million in prior corresponding period. EBITDA margin for the period was reported at 71%. The period was marked by a strong average total occupancy of 93%. During the year, the company opened eight locations with eight other locations due to be opened in FY20. The companyâs customer base increased substantially from 915 customers in FY18 to 2,264 customers in FY19.

FY19 Highlights (Source: Company Presentation)

Outlook: As per the trading update, the company reported a positive start to FY20 with a target of eight new locations to be opened in FY20 with three already secured. In addition, the company aims to pursue new locations and is well positioned to capitalise on the increasing trend of flexible workspaces within the Australia market.

Stock Performance: The stock of the company generated returns of 4.55% over a period of 1 month. Currently, the stock is trading at a market price of $2.280, down 0.87% on 02 September 2019 (AEST â 2:49 PM).

PKS Holdings Limited

PKS Holdings Limited (ASX: PKS) is involved in software programming.

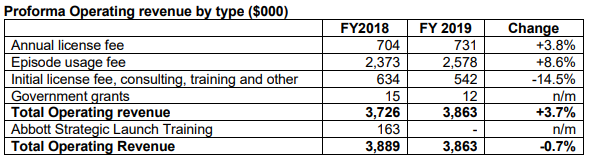

FY19 Financial Highlights: During the year, the companyâs total operating revenue amounting to $3.73 million. The operating revenue majorly comprised of annual license fee amounting to $0.70 million, episode usage fee amounting to $2.37 million, receipt of fee for initial license, consulting and training amounting to $0.63 million. Annual recurring revenue was reported at $3.3 million, up 7.5% on prior corresponding period. Other income generated during the period amounted to $542,000, which comprises a mix of initial license fees, consulting software development services and training. EBITDA for the period was reported at $2.1 million, representing an EBITDA margin of 54.0%. As at 30 June 2019, the companyâs cash balance as at 30 June 2019 stood at $4.1 million.

Operating Revenue (Source: Company Reports)

During the year, the company added 9 new customers worldwide. The company is now executing its strategic growth plan for PKS following its IPO. In Australia, the company has set up a business development resource and is pursuing new direct customer opportunities. The company also entered into an agreement with Abbott Laboratories for a Go to Market Launch in the USA and ANZ. In addition, the company is also negotiating the renewal of the Channel Partnership Agreement with Abbott Laboratories.

Stock Performance: The stock of the company generated negative returns of 5.13% over a period of 1 month. Currently, the stock is trading at a market price of $0.170, down 8.108% on 02 September 2019 (AEST â 3:09 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.