The COVID-19 disaster is placing immense pressure on the international availability of medical devices and ventilators, that are required to pump oxygen into the collapsing lungs of severely infected patients.

Recently, the Food and Drug Administration (FDA) also announced that it took action to help increase the supply of ventilators and respirators in the United Stated for protection of health care workers and patients. As the demand for ventilators and other medical devices is higher than usual from profoundly affected COVID-19 regions, there is a great opportunity in the medical device industry.

Also read- Is Coronavirus Gender Biased? Health Tips!

Australian medical device and diagnostic industry-

Australia has a prominent track record of health and medical research excellence. The medical device and diagnostic sector in Australia has grown at a rapid rate, with robust growth in digital health technologies and devices using advanced materials, imaging, robotics, IT, design and adaptive diagnostic technology platforms.

The Australian health and medical sector is supported by a robust regulatory and funding system that comprises of a competitive research and development (R&D) tax incentive scheme and a world-class healthcare system that generates a highly advantageous environment for innovation, investment and collaboration.

The medical devices and diagnostics industry in Australia has pioneered niche products such as continuous positive airway pressure devices for sleep apnoea, 3D customised titanium implants, transdermal insulin delivery devices, and diagnostic technologies for sleep disorders, neurophysiology and cardiology.

Related: A Look at Medical Device Stocks in Australia

Let us zoom lens for three ASX listed medical device stocks- RMD, UCM, FPH

ResMed Inc (ASX:RMD)

An ASX listed Medical device and software company, ResMed Inc is into developing high-quality medical devices to deliver a superior and improved life to individuals suffering from sleep apnoea, chronic obstructive pulmonary disease (COPD), and other chronic diseases. The outside hospital software platform of the Company helps health care practitioners and assistants to cater to patients.

COVID-19 and increased demand for ResMed’s Ventilator

As per the information provided on the Company’s website, ResMed stands with the world in during the challenging period of the COVID-19 pandemic, and is prepared to help in lessening its impact as well as assisting individuals to breathe while their immune system fights this deadly virus.

The Company informed that the requirement of its ventilators is higher than usual this time specially from highly affected COVID-19 countries; however, the Company highlighted that new patient diagnoses for sleep apnoea might reduce as hospitals emphasis on the treatment of COVID-19 patients.

Further, the Company revealed that over 7,500 employees are working in more than 140 countries for COVID-19 treatment.

It is noteworthy that ResMed is working with governments, hospitals, physicians, health authorities and patients across the globe to assess their requirement, and to provide the ventilation therapy, which is essential for the treatment of respiratory complications of coronavirus affected individual.

The Company is working with the aim to increasing the availability of ventilators and other respiratory support devices for the infected individuals who require them most.

Stock Performance-

The stock of RMD closed the day’s trade at $22.570 down by 1.096%, on 27 March 2020, with the market capitalisation at nearly $33.01 billion. With almost 1.45 billion shares outstanding, RMD stocks fifty-two weeks low and high price was observed at $13.560 and $26.660. The Company has generated a positive return of 2.50% on year to date basis and 12.96% in the previous six months.

An ASX listed innovative medical technology Company, Uscom Limited is into designing, development, as well as worldwide marketing of non-invasive cardiopulmonary medical devices. UCM has primarily three sets of medical devices in the field of pulmonary and cardiovascular intensive care; for Asthma and COPD - the Uscom SpiroSonic Suite, for heart failure and sepsis USCOM 1A and for hypertension- Uscom BP+.

USCOM updated the market with its investor presentation on ASX, on 26 March 2020, revealing the impact of the coronavirus and the 3rd quarter results.

COVID-19 impact-

The Company disclosed that it is playing a significant role in combating COVID-19 and its product USCOM 1A which is the only universally available Doppler Haemodynamic Monitor is used for cardiovascular support when COVID-19 patient is in ICU.

Moreover, USCOM 1A is advised by the Chinese National Health and Medical Commission of the People’s Republic of China for the treatment of acute coronavirus (COVID-19) infection in children and in adults.

It is notable that the Company accomplished mid-term sales for USCOM 1A as all markets recognise the need for improved ICU services.

Third Quarter Results-

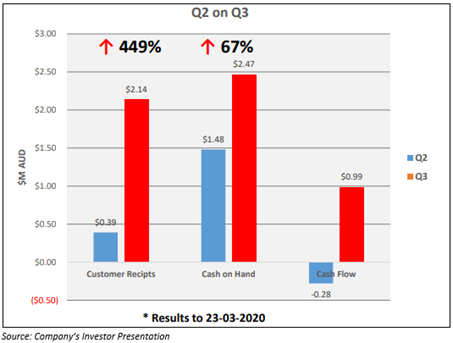

- USCOM has reported approximately ~$0.35 million profitable in the third quarter of the fiscal year 2020;

- The positive cash flow of the Company recorded at approximately $0.99 million;

- UCM has nearly $2.47 million cash on hand.

Also Read: USCOM now authorised to sell its Type II Medical Devices directly in China

Stock Performance-

The stock of UCM closed the day’s trade at $0.235 down by 9.615% on 27 March 2020, with the market capitalisation at nearly $38.91 million. With almost 149.66 million shares outstanding, UCM stocks fifty-two weeks low and high price was observed at $0.095 and $0.530, respectively. The Company has generated a positive return of 104.35% on year to date basis and 95.83% in the last six months.

Fisher & Paykel Healthcare Corporation Limited (ASX:FPH)

Fisher & Paykel Healthcare Corporation Limited is a health care sector company and listed on both NZX as well as in Australian Securities Exchange (ASX). The Company provides innovative products used in respiratory care and is a leader in the designing, production and marketing of these products to support clinicians and medical practitioners for enhancing patient care and outcomes.

Fisher & Paykel confirms status as Essential Service-

Subsequent to the announcement by PM of New Zealand that the coronavirus (COVID-19) alert status can rise to Level 4 within 48 hours’ time, the Company advises that it has been nominated as an essential service by the Government of New Zealand and will continue businesses in its Auckland facilities.

As an essential service, FPH is constantly focused on meeting the requirement for its respiratory products that are directly involved in the treatment of coronavirus infected persons across the world.

Moreover, Lewis Gradon- Managing Director and CEO of Fisher & Paykel stated that this is a speedily changing condition and F&P is monitoring developments closely and will proactively share more updates.

Stock Performance-

The stock of FPH closed the day’s trade at $27.270 down by 0.908% on 27 March 2020, with the market cap of nearly $15.81 billion. With almost 574.56 million shares outstanding the fifty-two weeks high and low price of stock reported to be $29.890 and $14.000, respectively. The Company has delivered a positive return of 30.04% on a year to date basis and 73.36% in the last six months.