Medical device industry is diverse, highly regulated and has various small companies than the bigger players. The medical device industry has been extensively regulated around the world and offers unique growth opportunities as well as challenges. The big data implementation in the health care industry is acquiring complete global medical device market and anticipating encouraging opportunities in the near future.

Medical device market is poised for growth, and according to some research and media sources, the global market for the medical device industry is expected to reach USD 532.2 billion by 2024 from USD 380.0 billion in 2016 at a compound annual growth rate (CAGR) of 4.3% during the predicted interval. The major share of the market is occupied by medical devices manufacturing industries in the United States where surgical devices have captured the biggest share of the market.

The global medical equipment’s market outlook seems decent and has opportunities in both private as well as public hospitals. Over the survey period, it is being anticipated that the surgical device sector should remain the largest for the upcoming years.

The companies in the medical device space look at their business models and discover the technique for integration of Internet of Medical Things (IoMT) to serve as a partner for health care service providers, patients and payers.

Factors driving the medical device market are as follows -

- Growing interest in medical technology industries for the investment in the research and development of advanced medical devices;

- Growing demand for innovative remedies to beat the unmet needs in health care.

Let us delve deep and discuss the outlook for three ASX listed medical devices- PNV, COH, NAN

PolyNovo Limited (ASX:PNV)

An Australian based medical technology company PolyNovo Limited (ASX:PNV) is involved in the development of a dermal regeneration solution known as NovoSorb BTM. The company produces this solution by employing its patented technology- NovoSorb biodegradable polymer technology. PolyNovo’s developmental program provides solutions for Breast Sling, Hernia, and Orthopaedic applications. PolyNovo’s dermal regeneration solution NovoSorb BTM is registered for use in many countries including Australia, the US, South Africa, Israel, Malaysia, New Zealand and more.

According to one recent announcement on ASX, PolyNovo informed the market that December 2019 had been its first two-million-dollar month and provided information to its shareholders for the direction of sale that are as mentioned below:

- PolyNovo revealed that the unaudited revenue from the sale of NovoSorb BTM for the month of December 2019 was more than $2 million as compared with $890k December 2018, up by 134%.

- In the first half of FY2020, unaudited revenue from NovoSorb BTM were reported to be $8.57 as compared to $3.75 million for the first half of the fiscal year 2019, which increased by 129%.

The company mentioned that the audited financial results would be released to the market on Wednesday, 26 February 2020.

Moreover, the company anticipates providing a further announcement about the EU/UK prospects post CE authorisation shortly.

Outlook-

In the company’s full- year results for the period closed 30 June 2019, on the outlook front, PolyNovo mentioned that the new manufacturing machines had been ordered and are expected to be delivered circa February 2020. The company foresee filing for US FDA 510(k) for the end of the financial year 2020.

Beta-Cell has effectively conducted swine studies and demonstrated that within a NovoSorb BTM dermal implant Islet cells live and function properly. Moreover, the study is now under development using stem cell derived islet cells verses cadaver donor cells. It is anticipated to start a human clinical trial in 2020.

The CE Burn trial has been completed and PolyNovo has planned to publish the results by the end of Feb/March 2020.

Stock Performance

On 10 January 2020, the PNV stock closed the day’s trading at $2.010, down by 0.495% from its last close. The company’s market capitalisation stood at approximately $1.34 billion, with nearly 661.09 million shares outstanding. The 52 weeks high and low price of the stock was noted at $2.660 and $0.580, respectively. The stock has delivered a positive return of 210.83% in the last year.

An ASX listed medical device company Cochlear Limited (ASX:COH) is headquartered in Sydney, and engaged in providing implantable hearing solutions for providing a lifetime of hearing outcomes. Implantable hearing solutions of Cochlear has two main parts - external sound processor, and the implant surgeons place them below the skin and connect to an electrode array they put in the inner ear.

Cochlear’s offers Cochlear implants as well as acoustics, 88% of the revenue come from Cochlear implants and the remaining 12% come from acoustics that includes bone conduction implants and acoustic implants.

Financial outlook FY2020

COH released its full year results for the duration ended 30 June last year. It provided an outlook for the upcoming period, and the highlights are as follows:

- Cochlear anticipates reporting net profit approximately in the range of $290-300 million in FY2020, up by 9-13% on underlying net profit for the fiscal year 2019;

- The new products launched late in the financial year 2019 would help the company to achieve strong growth in cochlear implant units.

Key guidance considerations for the fiscal year 2020-

- In FY2020 Cochlear is targeting to maintain the net profit margin and anticipating a weighted average AUD/USD exchange rate of 70 cents for the fiscal year 2020.

- From the continued development of the manufacturing facility in China and investment in IT platforms, the capital expenditure is expected to rise to approximately $180 million in FY2020 and it is expected to drop to around $100 million in the financial year 2021.

- Cochlear is planning to expand the Acoustics product portfolio and anticipating the release of its new osseointegrated steady-state implant (OSIA) product later in the FY2020.

Stock Performance

On 10 January 2020, the COH stock closed the day’s trading at $232.690, up by 1.341% compared to its last close. The company’s market capitalisation stood at approximately $13.28 billion, with approximately 57.83 million shares outstanding. The 52 weeks high and low price of the stock was noted at $238.540 and $164.000, respectively. The stock has delivered a positive return of 25.29% in the last one year.

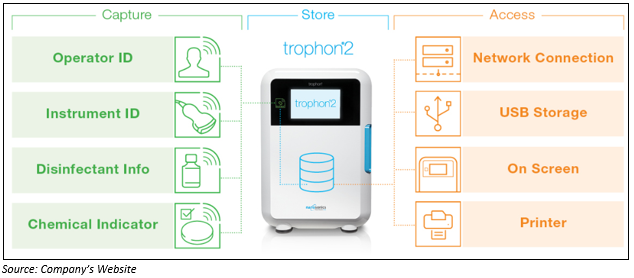

NSW headquartered, health care sector player Nanosonics Limited (ASX:NAN) is an innovator in delivering high-level disinfection for ultrasound probes and into the development of unique automated high-level disinfection device.

The unique, automated trophon® EPR high-level disinfection device of Nanosonics is a comprehensive solution for diminishing the spread of health care acquired diseases by decreasing the infection between the patients.

The proprietary technology of the company is being successfully introduced across the globe, transforming the way infection prevention practices are understood, and applied within the healthcare environment. This technology safely and effectively addresses the issues concerned with traditional ultrasound probe disinfection practices and is becoming the new standard of care.

Features of Nanosonics Trophon 2 device-

FY20 outlook

In its full-year report for the period closed 30 June last year, NAN highlighted a few pointers on its outlook front, that are as mentioned below:

- Nanosonics would continue to grow the installed base in North America with expectations that adoption in the fiscal year 2020 would be similar to the fiscal year 2019.

- The company is planning to launch its first new product by the end of the fiscal year 2020.

- The rising sales infrastructure across Europe to drive escalating growth in trophon adoption as fundamentals of adoption have strengthened across France, the UK and Germany.

- Upgradation or replacements of trophon® EPR units to trophon2.

- It is anticipated that the company’s active ongoing investment in growth would result in the fiscal year 2020 operating expenses of nearly $67 million, including ~$15 million, in the research and developments.

Stock Performance

On 10 January 2020, the NAN stock closed the day’s trading at $6.740, up by 2.744% compared to its last close. The company’s market capitalisation stood at approximately $1.97 billion, with approximately 300.48 million shares outstanding. The 52 weeks high and low price of the stock was noted at $7.600 and $2.835, respectively. The stock has delivered a positive return of 123.13 per cent in the last one year.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.