The United States Energy Information Administration (or EIA) did not sound very optimistic over the crude oil future in its September energy outlook, which could possess strong headwinds for the ASX-listed oil and gas stocks ahead.

EIA Short-term Oil Outlook

- EIA forecasted that U.S. crude oil production to average around 12.2 million barrels per day in 2019, up by 4.27 per cent from the previous anticipated average production of 11.7 million barrels per day.

- As per the forecast, the U.S. crude generation will further inch up by 1.0 million barrels per day in 2020 to average around 13.2 million barrels a day.

- While EIA predicts higher production, the organisation also estimates the global liquid fuels consumption to drop by 0.9 Mbpd in 2019, down from y-o-y growth of 1.3 Mbpd in 2018.

EIA projects a slower rate of growth in U.S. crude oil production post-2019 due to the anticipated fall in crude oil price. The Brent crude oil price, which acts as a reference price for other liquid fuels, is forecasted by EIA to average $60 a barrel in Q4 of 2019 and $62 in 2020.

The September forecast of EIA remained in line with the warning signalled by the International Energy Agency to OPEC over the possibility of surmounting supply in late 2019 into 2020.

Factors-Dragging Down the Oil Market

- Global economic indicators declined substantially in August 2019, which further contributed to the oil market decline and higher volatility.

- The Manufacturing Purchasing Managersâ indices showed a contraction across various economies in August 2019.

- The Purchasing Manager Index in the United States witnessed mixed signals as the IHS Markit PMI expanded slightly; while the U.S. Institute for Supply Managementâs PMI contracted for the first time since 2016.

The U.S-China trade tussle contributed significantly towards the oil spill after China imposed 5 per cent tariff on its oil imports from the United States.

Over the subdued global economic conditions and escalated U.S-China trade war, EIA downgraded its 2019 crude oil target by $2 a barrel in its September 2019 forecast to $63 a barrel.

On the demand front, the EIA reduced the global oil demand by 0.1 million barrels a day in 2019 to 0.9 million barrels a day.

EIA has been downgrading its oil price forecast from July 2019, when the organisation initially predicted an average Brent price of $67 a barrel for the second half of the year 2019 to the present forecast of $60 per barrel.

Also Read: EIA Downgrades Crude Oil Price Forecast For 2019 Amid Weak Demand Estimation

EIA Short-term Natural Gas Outlook

The natural gas spot price declined amid rising production in the United States, and despite higher exports and domestic consumption in the energy sector, the Henry Hub Ng spot price averaged $0.15 lower at $2.22 per million British thermal units (MMBtu) in August 2019.

- Due to the oversupplied natural gas market in the United States, EIA anticipates the natural gas prices to average at $2.55 per MMBtu in 2020, down by $0.20 per MMBtu from its August forecasted price of $2.75 per MMBtu.

The inching up production of natural gas in the United States would also contribute significantly over the price reduction. The production of dry natural gas is anticipated by EIA to average at 91.4 billion cubic feet per day in 2019, up by 0.4 billion a day from its previous forecast.

The EIA anticipates the natural gas supply to decline slightly during the first quarter of 2020 amid lower price in the market.

Would Prince Abdulaziz bin Salman Deep the Curb Policy?

The newly appointed Saudi energy minister- Prince Abdulaziz bin Salman mentioned to the media about no radical changes to the OPEC and Russiaâs stance to curb 1.2 per cent of the global oil demand.

It would be worth monitoring if the Prince takes any strong action to reduce the production from the pre-decided level further. The stance of Saudi should be monitored by the market participants as any action from the Saudi oil minister could influence the oil prices and its forecast.

Another global event worth monitoring to gauge the crude price behaviour ahead is the development in the U.S-China trade spat, which holds an immense potential to shake the global market.

Also Read: S&P/ASX 200 Energy Recovers as New Saudi Oil Minister Sticks to the Production Curb

Over the surmounting supply forecast and high risk in the oil market, the investors are also exploring investment opportunities in the alternative energy sector, which is gaining higher interest from both investors and global economies.

To Know More, Do Read: ASX-Listed Alternative Energy Stocks Under Investorsâ Lens as Oil Risk Surmounts

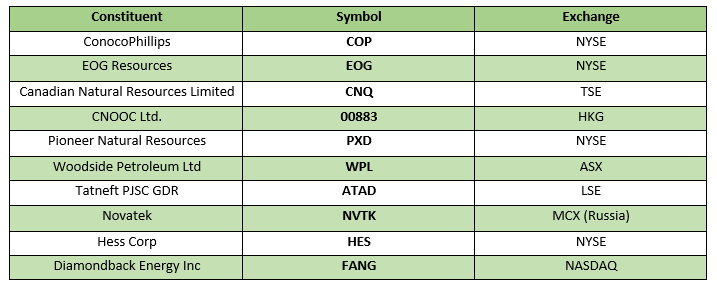

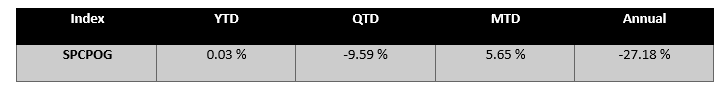

S&P Commodity Producers Oil & Gas Exploration & Production Index S&P Commodity Producers Oil & Gas Exploration & Production Index, which tracks global oil & gas explorer share price movement is moving downside for quite some time with negative returns and the recent outlook on the crude oil could further exert pressure on the index. S&P Commodity Producers Oil & Gas Exploration & Production Index CompositionS&P Commodity Producers Oil & Gas Exploration & Production Index Composition

ASX-listed Oil & Gas Explorers

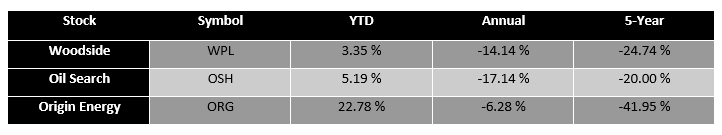

The ongoing plunge in crude oil prices is exerting pressure on the share prices of the ASX-listed oil and gas explorers, which in turn, impacting the stock returns. The returns from some of the prominent ASX-listed oil explorers are as below:

The crude oil prices went high in the international market during the first quarter of the year 2019 into the mid-second quarter, which in turn, benefitted these explorers over the short-run. Due to their strong performance in the second quarter, the YTD returns are still positive; however, the recent drag-down in crude oil prices is diminishing the YTD returns of these upstream energy players.

Also Read: Originâs Australian Pacific LNG Copious Shell-Off Fanned Dividend Expectations Among Investors

However, despite the fall in natural gas prices at the Henry Hub, the ASX-listed natural gas producers are wrapping the opportunity of domestic shortage amid high LNG exports.

To Know More, Do Read: Australia Set to Surpass Qatar Over LNG Exports; Domestic Natural Gas Conditions To Derail the Projections?

The natural gas producers are doing better than the oil explorers on ASX thanks to the natural gas shortage in the domestic market.

To wrap up, the ASX-listed oil explorers are facing hard times now, and the future oil forecast could bring more headwinds for the ASX-listed oil & gas explorers. However, the natural gas explorers are currently protected from return erosion amid a domestic shortage of natural gas.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.