The process of drug development is launching a new pharmaceutical compound to the market after the lead compound identification through drug discovery. The drug development process includes drug discovery and development, preclinical & clinical research, FDA review and post-marketing safety monitoring. The discovery and development of drug consists of designing a product for reversing or stop the effects of the disease.

After the identification of a pharmaceutical compound, the absorption, metabolism, distribution and excretion (ADME) information is collected. Development process also include identification of the mechanism of action (MOA), best dosage and route of administration (oral or topical injection) including the side effect or adverse drug reaction (ADR) of a pharmaceutical compound.

Before testing the drug in clinical trials (in Humans), the drug is tested for its toxicity in preclinical research through in-vitro and in-vivo studies. After the preclinical study the outcomes are reviewed, and the researcher decide whether to test the drug in humans or not.

After identifying that the new entity does not have any severe drug toxicity, it is further tested in humans under clinical studies or trials. The drug developers or sponsors have to submit an Investigational New Drug (IND) application to FDA before processing for the clinical trial. The IND application should include the toxicity study data in animals, including the manufacturing information.

There are some essential recommendations that a researcher or trial sponsors should consider when they are conducting early phase trials-

- Identification of factors which influence risk.

- Careful dosing selection.

- Better justification for and planning of integrated protocols.

- Selecting participant group carefully and developing other treatment precautions.

The pharmaceutical and biotech companies are engaged in developing their robust pipeline of pharmaceutical products. These companies are continuously conducting clinical trials for developing new therapies for the treatment of rare diseases or for unmet medical needs.

In this article, we are discussing an ASX listed health care stock (Opthea Limited) which is engaged in the drug development.

Let us zoom the lens on Opthea-

Opthea Limited (ASX:OPT)

Optheaâs stock was trading at 3.130 on 3 December 2019, down by 0.949% (at AEST 2:33PM). The stock has a market cap of $790.92 million with a 52 weeks high and low price of $4.150 and $0.550, respectively. OPT has outstanding shares of 250.29 million. The stock has delivered a good return of 454.39% on a year to date basis and 409.68% in last six months.

OPT-302 is the lead compound of Opthea, which blocks Vascular endothelial growth factor C (VEGFC) and Vascular endothelial growth factor-D (VEGF-D) and causes vessels to grow & leak. When used in combination with a Vascular endothelial growth factor-A (VEGF-A) inhibitor, OPT-302 has the potential to improve clinical outcomes in Diabetic Macular Edema (DME) patients.

OPT-302 Intellectual Property-

- Covering OPT-302 molecule

- Opthea has granted patents for OPT-302 molecule in Australia, the United States, South Africa, Singapore, Japan and Russia.

- Patents are accepted for grant in Malaysia, Europe and Mexico.

- Few patent applications are pending in a further ten jurisdictions which includes Brazil, India and China.

- Covering sVEGFR-3 molecules (incl. OPT-302)

- Opthea has granted patents in the United States, Australia, Canada, Europe and Japan.

- A separate US patent granted covering generic use of sVEGFR-3 capable of binding VEGF-C to inhibit blood vessels in mammal having disease characterised by expression of VEGFR-3 in blood vessels.

OPT-302 Phase 2b wet AMD Trial

Phase 2b wet AMD trial met the primary endpoint. The combination therapy of OPT-302 (2.0mg) demonstrated superiority in visual acuity over ranibizumab + sham group. Vision gain of +3.4 letters which is found to be statistically significant (p=0.0107).

The secondary outcomes from the study were helpful for the primary endpoint. More patients gained approximately 15 letters of vision, and fewer patients lost ? 15 letters of vision.

Retinal anatomical improvements-

- Reductions are observed in central subfield thickness (CST), sub-retinal and intra-retinal fluid.

- Greater decreases in total lesion area and choroidal neovascularisation (CNV) area.

Source: Companyâs Report

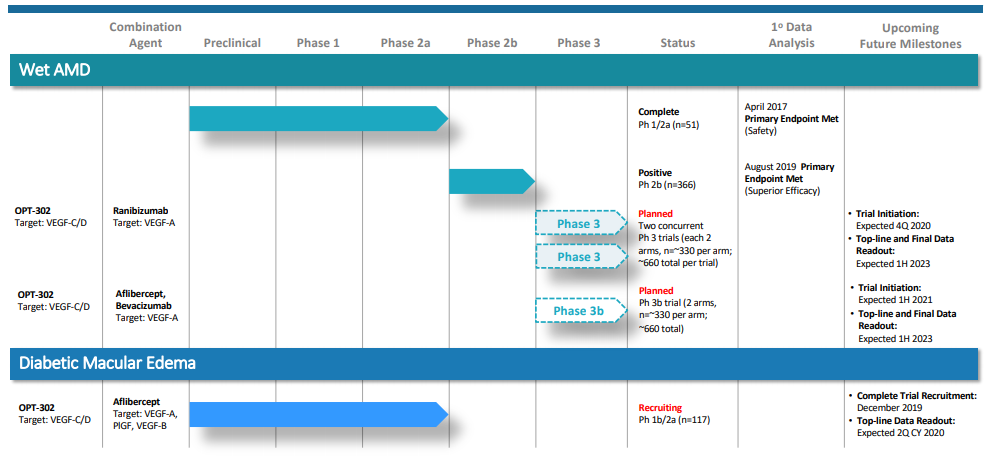

Planned: OPT-302 Pivotal Phase 3 Program

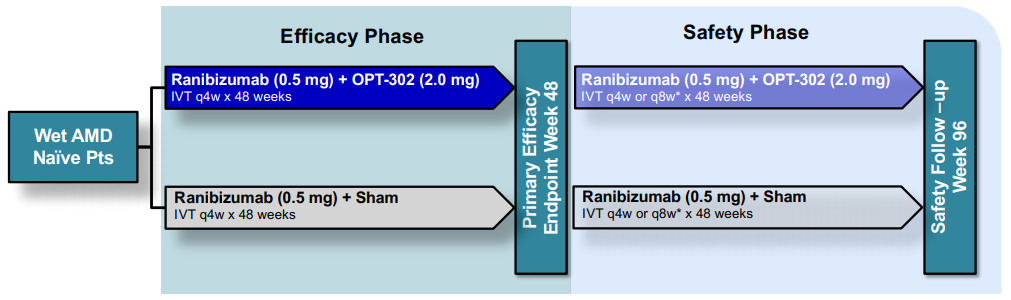

- This study is a multi-centre, double-masked, randomised (1:1), sham-controlled trial and have a regulatory quality of 90% power and 5% type I error rate.

- The sample size for this study is approximately 330 patients per arm, 660 per study (1,320 patients across the two studies).

- The trial is expected to commence in the fourth quarter of 2020 with the top line and full data readout expected in the first half of 2023.

OPT-302 Pivotal Phase 3 Program (Source: Companyâs equity raising presentation)

Opthea Raises $50 million in Institutional Placement

On 2 December 2019, Opthea unveiled that the company has undertaken a non-underwritten private placement from sophisticated and institutional investors to raise $50 million via a private placement in Australia and the United Kingdom.

The earnings from the companyâs Institutional placement would be applied for the funding of the additional endeavours to help the OPT-302 late-stage clinical development as a treatment for wet AMD or Age-related Macular Degeneration. Further, it would also include the production of enough amounts of clinical-grade OPT-302 for stage 3 clinical development and to start 2 simultaneous stage 3 crucial registrational trial works in people suffering from AMD.

This non-underwritten private placement had conducted at a fixed price of $2.65 per new share which represents a discount of 5.9 per cent to the 15-day VWAP, and a discount of 3 per cent to the closing price of $2.73, as on 29 November 2019. Under this institutional placement, a total of 18.9 million fully paid ordinary shares would be issued, which represents approximately 7.5 per cent of the current issued capital.

About Opthea

An ASX listed biopharmaceutical company Opthea Limited (ASX:OPT) which is into developing new biologics for the treatment of ophthalmic diseases is headquartered in Victoria. Opthea is expanding its new therapeutic product OPT-302 for retinal disease and is advancing the clinical development program in phase 2 wet age-related macular degeneration (AMD) and diabetic macular edema (DME) clinical trials of OPT-302.

The company is engaged in developing OPT-302 for use in combination with VEGF-A inhibitors and has reported the outcomes from sham-controlled, multi-centre, prospective, double-masked, superiority study in patient having wet AMD, and a total of 366 treatment-naïve patients were enrolled in this study.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.