EBITDA or Earnings Before Interest, Tax, Depreciation and Amortisation, is a business operating metric widely used by both the companies and investors to track a business performance.

EBITDA Multiple

EBITDA multiple is mostly used by companies to value an acquisition. However, it is increasingly becoming an important financial ratio to value similar companies. EBITDA multiple compares the companyâs enterprise value to its annual EBITDA.

It provides value of the company and allows to compare the same metric for similar companies. Enterprise value represents the companyâs market capitalisation plus net debt.

EBITDA might serve as a proxy for net cash flows, but net cash flows and EBITDA have different characteristics, such as the capex that impacts the companyâs net cash flows. However, the capex is not factored in EBITDA as it is not charged in P&L.

In addition, growing companies require investments in higher levels of receivables, inventories, and other working capital assets to underpin higher revenue levels. The investments in these assets impact future cash flows. However, these are not reflected in EBITDA.

Moreover, the company specific factors impact the selection of the EBITDA multiple, and an optimal multiple of EBITDA requires a thorough analysis of a company and its industry.

Lately, there has been a lot of buzz around dairy stocks with expectations soaring to higher levels among market participants, prior to the full-year disclosure.

We are talking about Synlait Milk Limited (ASX: SM1) and The a2 Milk Company Limited (ASX: A2M). Both the companiesâ share price was under pressure after they disclosed full-year results.

Whereas, Clover Corporation Limited (ASX: CLV) appeared to be benefitted from its Omega 3 oils capability, along with decent growth in revenue and profits.

Synlait Milk Limited (ASX: SM1)

The company was founded to ensure global consumers were able to access New Zealandâs dairy products. The company with around 200 milk suppliers creates its products and supplies them to global customers.

Chasing Growth

On 25 October 2019, the company announced the conditional purchase of Dairyworks for $112 million, subject to Overseas Investment Office approval. The transaction is valued at an approximate 7.5x EBITDA multiple based on the last twelve months earnings.

The proposed transaction is complementary to the recent acquisition of cheese manufacturer â Tablot Forest. It would also allow the company to progress towards the delivery of Everyday Dairy strategy.

Full-Year Numbers

In the year-ended 31 July 2019, the company reached revenues of over NZD 1 billion for the first time, delivering revenue of NZD 1.02 billion compared to revenue of NZD 879 million in the previous year. The net profit after tax for the period was NZD 82.2 million compared to NZD 74.6 million in the previous year.

Stock Performance

On 28 October 2019 (AEST 01:14 PM), the stock of SM1 was trading at $8.98, down by 1.002% relative to the previous close. On a YTD basis, the stock has delivered a return of +5.15%. In the past three months, the return of the stock has been -5.07%.

The a2 Milk Company Limited (ASX: A2M)

The company has a well-established market in Australia, and its brands are loved by Australians in supermarkets and pharmacies. In addition, the company has a presence in China, US, Vietnam, Singapore and Korea.

Motivating Employees

This week, the company launched two new employee share plans, allowing certain employees to acquire shares of the company. These plans were designed for employees other than the employees who are eligible under Long Term Incentive Plan (LTI).

It was mentioned that the plan would allow the companyâs dedicated employees to take part in the success of the company while recognising the importance of the employees in the organisation. In addition, the company is taking steps to undertake employee share offers for its employees in China.

Gift Offer â Under this program, the part-time and full-time employees (Eligible Employees) in Australia, New Zealand and the United States of America are eligible, excluding the employees covered under the LTI Plan. The company issued ordinary shares worth approximately $500 to eligible employees as a gift.

Share Match Program â Under this program, the company invited eligible employees to acquire shares worth up to $2k using their own funds. If the employees held these shares until September 2021, the company would issue one matching share for each share acquired under the program.

Full-Year Numbers

In the year-ended 30 June 2019, the company delivered revenue growth of 41% to NZD 1.3 billion from NZD 922.35 million in the previous corresponding period. The net profit after tax for the period was NZD 287.7 million compared to NZD 195.7 million in the previous year.

Strategic Focus (Source: A2Mâs Investor Strategy Day Presentation)

Stock Performance

On 28 October 2019 (AEST 01:16 PM), the stock of A2M was trading at $12.020, up by 1.264% relative to the previous close. On a YTD basis, the stock has delivered a return of +14.18%. In the past three months, the return of the stock has been -28.96%.

Clover Corporation Limited (ASX: CLV)

The company is engaged in refining and sale of natural oils and production of encapsulated powders. It is also undertaking research and product development of functional food and infant nutrition ingredients.

Omega 3 Oils

Cloverâs unique range of microencapsulated Omega 3 oils allows the customers to incorporate DHA into their products with no adverse impacts on smell and taste. Increasingly, the legislative changes across jurisdictions have been amplifying the use of DHA in infant formula.

In China, the regulators had introduced DRAFT legislation, setting the constituents for infant formula, including minimum 15mg/100kcal of DHA, among others. If introduced, the legislation would change minimum DHA levels for products being sold in China.

In Europe, the company is actively working with customers to prepare them for the introduction of new DHA standard in February 2020, necessitating 20mg/100 Kcal of DHA.

In order to keep innovating, organisations need sufficient investments in R&D. In this regard, the company added resources to its R&D business to complement the increasing demand for tailored solutions. Further, the business has several products in pilot trials that would be available commercially across 2020.

Full-Year Numbers

In the year-ended 31 July 2019, the company recorded sales revenue of $76.7 million, an increase of 21.8% from $63 million in the previous year. The net profit after tax for the period was $10.1 million, an increase of 33.1% from $7.6 million in the previous year. It achieved sales revenue growth in all territories, benefitting from new products, new markets and new customers.

Stock Performance

On 28 October 2019 (AEST 01:18 PM), the stock of CLV was trading at $3.050, up by 4.096% from its previous closing price. On a YTD basis, the stock has delivered a return of +118.66%. In the past three months, the return of the stock has been +25.21%.

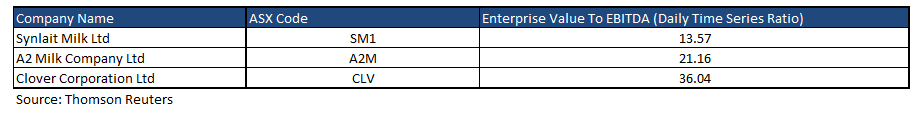

EV/EBITDA Multiple for the three companies discussed in this article is as depicted below, as on 25 October 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.