Given the COVID-19 pandemic, several businesses are making decisions and undertaking measures to keep them well-positioned and their employees safe in the current unprecedented times, while exploring ways to navigate the road ahead.

The coronavirus storm has impacted a number of businesses, while there are several businesses that have also benefitted. Considering all this, for a long-term, investors need to rebalance and restructure their portfolios.

In this backdrop, we have screened some stocks that have recently released some significant market updates.

Let us now have a look at these ASX-listed stocks.

EML Payments Limited (ASX: EML)

EML Payments Limited (ASX: EML), an IT sector player listed on ASX in 2006, operates as an issuer of pre-paid financial cards. During April 2020, the Company announced the closure of acquisition of Prepaid Financial Services (Ireland) Limited.

Key Deal Highlights-

- The acquired entity is a provider of white label payments and banking-as a-service technology;

- The deal is expected to make EML one of the leading global prepaid fintech enablers;

- Upfront enterprise valuation amounting to GBP 131.5 million (renegotiated) reduced by GBP 94.5m from GBP 226 million (previous terms).

Do Read: Agreement with NSW Health.

At the end of session on 4th May 2020, the stock of EML settled at $2.660 per share, up by 0.377%. The stock of EML moved up by 20.45% during the span of one month.

Sonic Healthcare Limited (ASX: SHL)

Medical diagnostics company engaged in providing laboratory and radiology services, SHL recently secured a contract from the Government of Australia. Under the contract, the Company will deliver pathology services, enabling providers to collect samples and conduct test for COVID-19 quickly. The services will be targeted towards residential aged care facilities.

Also, the Company entered a partnership with the Government of Australia and the Minderoo Foundation in order to boost COVID-19 testing capacity throughout the country.

Do Read: How SHL is performing amid COVID-19 pandemic?

At the end of session on 4th May 2020, the stock of SHL traded flat at $26.300 per share. The stock of SHL moved up by 6.91% during the span of one month.

Altium Limited (ASX: ALU)

During this uncertain environment caused by COVID-19 pandemic, the Company is well placed operationally and commercially. The operating model of ALU is expected to be relatively strong and highly adaptable to the new global conditions, as the Company is engaged in the development and sales of computer software for the design of electronic products.

Though the Company has suspended its earnings guidance for FY20, it is committed to long-established aspirational market leadership target for the financial year 2020, set at US$200 million.

At the end of session on 4th May 2020, the stock of ALU settled at $33.720 per share, up by 2.089%. The stock of ALU moved up by 15.17% during the span of one month.

Objective Corporation Limited (ASX: OCL)

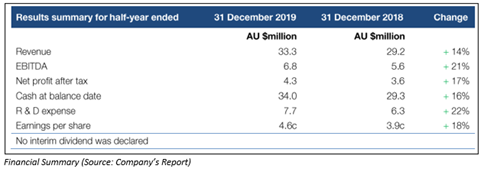

Objective Corporation Limited (ASX: OCL) is a software development company, which holds specialisation in enterprise content management. During 1H FY20, the Company reported revenue amounting to $33.3 million, reflecting a rise of 14%. There was also a rise of 17% in its bottom line (NPAT) to $4.3 million.

During the half-year period, the Company continued its successful transition to subscription-based contract. Annually recurrent contracts revenue proportion reached to 75%, which proved as new milestone for OCL. It closed the period with a cash balance of $34.0 million, indicating an increase of 16% over 1H FY19.

At the end of session on 4th May 2020, the stock of OCL settled at $5.830 per share, down by 4.739%. The stock of OCL moved up by 12.50% during the span of one month.

Afterpay Limited (ASX: APT)

Afterpay Limited (ASX: APT) is a technology software and services company. Recently, the Company announced that Tencent Holdings Limited and Tencent Mobility Limited became a substantial holder in APT on 30th April 2020 with a voting power of 5.00%. It added that Tencent is an internet value-added services provider, which is listed on Hong Kong Stock Exchange.

During the March 2020 quarter, the Company reported solid performance with underlying sales at $7.3b (14th April 2020) (YTD), reflecting a rise of 105% against pcp.

At the end of session on 4th May 2020, the stock of APT settled at $36.100 per share, up by 23.8%. The stock of APT moved up by 41.14% during the span of one month.

AP Eagers Limited (ASX: APE)

AP Eagers Limited (ASX: APE) is mainly involved in the sale of new and used motor vehicles. Recently, the Company notified the market with responses towards COVID-19 pandemic and stated that its Dealerships business is operational with health and safety of employees and customers as its priority.

In order to reduce cost base, the Company decreased its workforce by 1,200 roles, reflecting a decline in employee costs by around $6 million per month. The Company has a strong balance sheet comprising of cash and undrawn corporate debt facilities amounting to $270 million with a spread of maturities out to December 2023.

At the end of session on 4th May 2020, the stock of APE settled at $4.310 per share, down by 7.312%. The stock of APE moved up by 33.62% during the span of one month.

Woolworths Group Limited (ASX:WOW)

Woolworths Group Limited (ASX:WOW) is in food, general merchandise and specialty retailing via chain store operations. During Q3 FY20 ended 5 April 2020, sales from continuing operations went up by 10.7% to $16.5 billion and online sales stood at $817 million, up 34%. For the same period, the Company reported Australian and New Zealand food sales growth of 11.3% and 13.7%, respectively. The financial position of the group is strong, with access to funding and liquidity.

During Q4 FY20, the Company expects numerous costs to continue including costs concerning the temporary employment of around 22,000 new team members.

Do Read: Plans of Woolworths for the deliveries of Food and Groceries amid pandemic.

At the end of session on 4th May 2020, the stock of WOW settled at $35.250 per share, up by 2.322%. The stock of WOW provided return of -4.33% during the span of one month.

Nearmap Ltd (ASX: NEA)

Catering to business, enterprise and government customers, Nearmap Ltd (ASX: NEA), involved in the provisioning of geospatial map technology, recently announced that it has not experienced any material impact on its business from COVID-19. Also, NEA is undertaking numerous cost management initiatives to maintain solid balance sheet, preserve cash and maximise flexibility for the future, while focusing on the health and well-being of its employees.

Meanwhile, the Company would continue making investments in growth initiatives.

At the end of session on 4th May 2020, the stock of NEA settled at $1.415 per share, down by 4.392%. The stock of NEA moved up by 24.89% during the span of one month.