Crown Resorts Limited (ASX: CWN), with core businesses and investments in the resorts sector, and Lendlease Group (ASX: LLC), engaged in direct and indirect property investments, have reached a confidential out-of-court settlement with Infrastructure New South Wales (INSW), concerning the Crown Sydney Hotel Resort at Barangaroo.

CWN made the statement regarding the settlement on 19 August 2019, representing a major win for the company in protecting the views of the Harbour Bridge as well as Opera House for the Crown Sydney casino, in addition to Lendleaseâs three new apartment towers project, which is yet to be constructed, at Barangaro.

The company had made an announcement on 14 December 2019, unveiling a favourable judgement in connection to the proceedings against INSW, which was formerly known as the Barangaroo Delivery Authority. Post receiving judgment, the authority proceeded with filing a summons seeking leave to appeal the judgement. However, on 19 August 2019, Infrastructure New South Wales agreed not to proceed with the appeal.

Crown expects to start welcoming its first guests at the Crown Sydney Hotel Resort in early 2021.

The three parties - Crown Resorts, Lendlease and INSW - have decided not to pursue any legal action related to the matter. The resolution of not initiating any further legal action by the parties enables the government of New South Wales to work with all parties, targeting to complete as well as deliver projects related to Barangaroo.

Now, let us have a look at some of the recent updates from these two ASX-listed players.

Updates - Crown Resorts Limited

NSW Inquiry

On 8 August 2019, Crown Resorts Limited announced that it had received a notice from the NSW Independent Liquor & Gaming Authority regarding an inquiry into Barangaroo restricted gaming facility licensee and its close associates, under the regulations of Casino Control Act 1992. The inquiry is being conducted in relation to the proposed sale of shares in the company through a subsidiary to Lawrence Ho's Melco Resorts & Entertainment Limited, which is a Hong Kong-based casino operator, from James Packer's CPH Crown Holdings Pty Limited. The sale, which is yet to be closed, announced in a market update on 31 May 2019.

It was further mentioned in the release that the NSW Independent Liquor & Gaming Authority has issued notices to relevant company parties and other parties, which are compulsorily seeking documents and information that will be assisting the authority in its investigations. The authority would assign Honourable PA Bergin SC the task of holding the inquiry. Adding to that, it was also stated that Mr Scott Aspinall and Ms Naomi Sharp SC would be appointed as counsel to assist the inquiry.

Substantial Holding Updates

The company recently announced that Schroder Investment Management Australia Limited has made a change to its substantial holding to a voting power of 6.14% in comparison to the previous voting power of 5.04%. The change in substantial holding was made on 5th August 2019. Additionally, the company, in the month of July 2019, announced that Perpetual Limited and its related bodies corporate have ceased to become a substantial holder in the company from 19 July 2019.

A Look at First Half Results

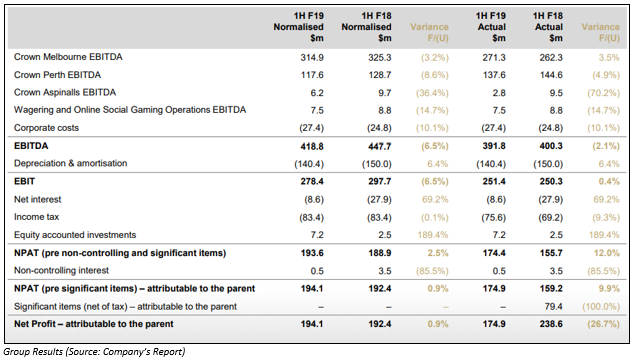

Crown Resorts, in February 2019, had updated the market regarding its operational and financial performance during the six-month period ended 31 December 2019. The company had updated regarding its proposed One Queensbridge project, which is a 50/50 JV between CWN and the Schiavello Group. Additionally, in the first half, the company bought back around $ 131.4 million of shares, which demonstrates around one-third of the buy-back capacity of $ 400 million of shares. The company delivered normalised net profit after tax attributable to the parent amounting to $ 194.1 million, reflecting a rise of 0.9% on pcp. It posted normalised EBITDA of $ 418.8 million in 1H FY19 as compared to $ 447.7 million in 1H FY18.

Stock Information

On 19 August 2019, the stock of Crown Resorts Limited last traded at a price of $ 11.370 per share, up 0.798% from its previous closing price, with a market capitalisation of $ 7.64 billion and approximately 677.16 million outstanding shares. As per ASX, Crown Resorts Limited produced returns of -11.39%, -13.03% and -6.85% in the last one month, three months and six months, respectively. It has an annual dividend yield of 5.32%, while its EPS stands at $ 0.721.

Updates - Lendlease Group

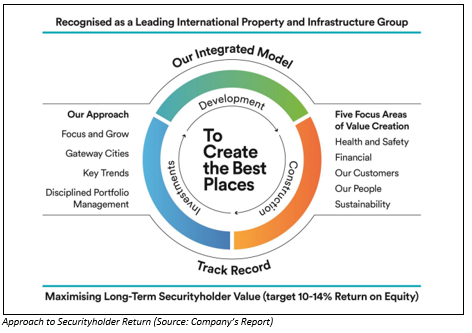

In a market release dated 19 August 2019, Lendlease Group announced its full year results for the fiscal year 2019 ended 30 June 2019. The following picture provides an overview of approach of the company to maximise long-term securityholder value:

A Look at Results

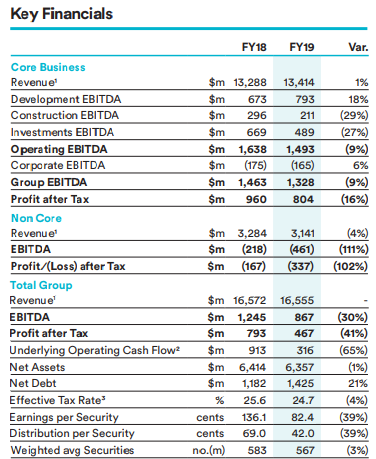

The company registered revenue of $ 16.56 billion for FY19. Its profit after tax for the period stood at $ 467 million, while earnings per stapled security and return on equity was 82.4 cents and 7.4%, respectively. The company stated that it has a development pipeline amounted to $ 100 billion. In FY19, the company secured four urbanisation projects in the area of San Francisco, Milan, Chicago and Sydney, amounting to around $ 27 billion. It reported development return on invested capital of 11.6%, which stood at the mid-point of 10 â 13% targeted ambit and posted construction EBITDA margin of 2.2%. The company reported cash conversion of 36% for the financial year 2019, while five-year cash conversion stood at 85%.

Source: Companyâs Report

Results of Engineering and Services Business

The non-core business, Engineering and Services, posted EBITDA loss amounting to $ 461 million for FY19, which includes pre-tax provision from underperforming projects amounting to $ 500 million that have been accounted for in 1H FY19. The above stated pre-tax provision mainly comprised of Gateway Upgrade North, which is operational since March 2019 and Kingsford Smith Drive, which have been completed more than 85% and anticipated to wrap up in CY20.

When it comes to the investments segment of the company, it reported EBITDA amounting to $ 345 million, which represents lower revaluations as compared to the previous year 2018. It posted co-investment amounting to $ 1.7 billion, which primarily represents higher income from Australian office portfolio and asset value appreciation fueled by solid income growth. Adding to that, the segment reported an investment of $ 1.4 billion in retirement living.

Outlook

The company stated that it is focused on leveraging the groupâs competitive advantage through the integrated model as well as with urbanisation and investment platforms. It is focusing on unwavering commitment to health and safety and disciplined approach to origination and managing individual project and property cycle risk. The company is also focusing on diversification across the segment, sector and geography to provide resilience. It is anticipating strong future earnings.

Stock Information

On 19 August 2019, the stock of Lendlease Group last traded at a price of $ 15.010 per share, up 10.857% from its previous closing price, with a market capitalisation of $ 7.64 billion and approximately 564.13 million outstanding shares. As per ASX, Lendlease Group produced returns of -4.71%, -3.97% and -0.95% in the last one month, three months and six months, respectively. It has an annual dividend yield of 3.47%, while its EPS stands at $ 0.664.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.