COVID-19 pandemic has hit hard almost every business with sectors such as aviation struggling to survive, and many leading market players implementing measures to reduce cost and ensure business continuity.

Number of companies have already withdrawn their guidance for the upcoming period, while many dividend-paying companies have either cancelled, reduced or postponed their dividend distribution, given the current unprecedented situation.

In this article, we are discussing few ASX-listed dividend-paying companies to gauge how the COVID-19 outbreak impacted their dividend distribution plans.

Australia and New Zealand Banking Group Limited (ASX: ANZ)

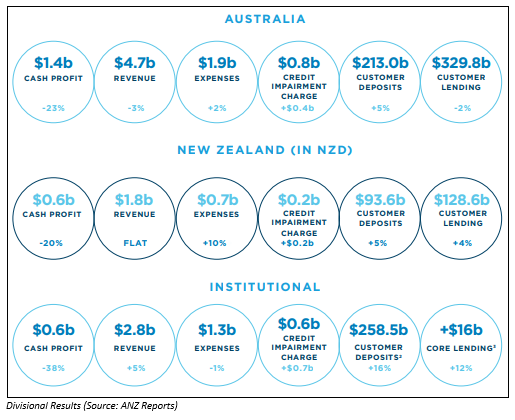

Headquartered in Melbourne, Australia and New Zealand Banking Group Limited (ASX: ANZ) is amongst the top four banks in Australia and the largest banking group in New Zealand. It also ranks amongst the top 50 banks in the world. ANZ has been a consistent dividend payer for its shareholders for the past few years.

However, for 1H FY2020 ended 31 March 2020, ANZ deferred dividend payment until clarity regarding the economic impact of COVID-19, with an update expected in August 2020. In evaluating options, the bank considered uncertainty regarding the economic outlook and guidance from APRA to consider deferring decisions on dividends until clarity on the outlook. Meanwhile, the bank plans to consider all factors over the coming months and continue to assess the evolving situation to finalise a decision on the interim dividend payment.

Moreover, for the first half, ANZ New Zealand, representing all of ANZ’s operations in New Zealand, decided not to pay any dividend on ordinary shares or redeem non-Common Equity Tier 1 capital instruments until the Reserve Bank of New Zealand considers that the economic outlook of New Zealand adequately recovered after COVID-19.

Stock Information: On 20 April 2020 (AEST 03:02 PM), ANZ stock was trading at A$15.450, up 0.065% from the previous close. The Company has an annual dividend yield of 10.36%.

Unibail-Rodamco-Westfield (ASX: URW)

Unibail-Rodamco-Westfield (ASX: URW), which got listed on ASX on 31 May 2018, is the owner as well as operator of commercial properties in Europe, United Kingdom and the United States.

Earlier on 23 March 2020, the Company provided a COVID-19 update, announcing a decision to have withdrawn its guidance. URW also stated that to meet the obligation towards its REIT dividend distribution, interim cash dividend payment of €5.40 per share would cover its distribution obligations for 2019. After making the dividend payment on 26 March, the Group had ample liquidity with €11.7 Bn in cash on hand and undrawn credit lines as at 28 April 2020.

In a recent market release of the Company dated 15 May 2020, URW updated that after the AGM on 15 May 2020, setting the amount of the dividend at €5.40 per stapled share for FY19, the new 2015 ORNANE Conversion Rate from that date will be 0.96.

As per the contract provisions, calculation of the new conversion rate was done based on the Unibail-Rodamco-Westfield volume-weighted average price of the stapled shares unveiled by Euronext for the 3 trading days prior the ex-dividend date of 24 March 2020.

Stock Information: On 20 April 2020 (AEST 03:04 PM), URW stock was trading downward by 3.667% to A$3.940.

Perenti Global Limited (ASX: PRN)

Perenti Global Limited (ASX: PRN) is a diversified global mining services group, engaged in the business of surface mining, underground mining as well as mining support services.

In its announcement dated 3 April 2020, the Company restated its decision to defer the payment of interim dividend and reinstated the DRP, highlighting its focus on capital and liquidity management during this uncertain period. DRP participants entitled to Perenti shares at a price of A$0.6553 per share for the HY20 interim dividend were due to receive their shares on 28 April 2020, in lieu of the cash payment to be made on 20 October 2020.

The Group has a strong liquidity position with cash reserves at A$315 million and A$115 million in undrawn revolving credit facilities, according to the Company announcement dated 15 April 2020. The Company had experienced no material financial impact from COVID19 related interruptions across its global operations.

Stock Information: On 20 April 2020 (AEST 03:25 PM), PRN stock was trading at A$1.095, up 3.302% from the previous close, with an annual dividend yield of 6.6%.

WPP AUNZ Ltd (ASX: WPP)

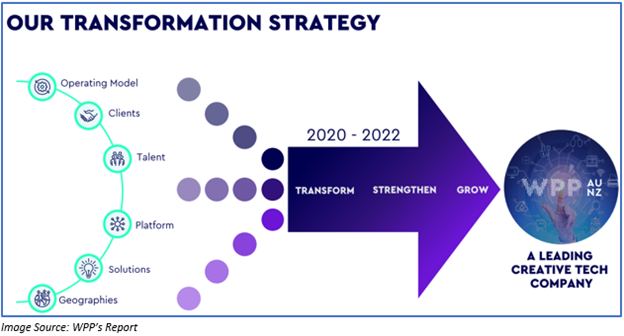

After WPP merged with STW Group, WPP AUNZ evolved as the leading creative transformation agency in Australia and became the home to many of the most admired agencies in the industry.

In the recent AGM, the Company announced cancellation of the ordinary and special dividend payments because of the uncertainty surrounding the COVID-19 crisis. The Company also requested its directors, leadership team, and employees to agree for pay cuts and reduced working hours. WPP also highlighted plans regarding further review changes and cost reduction measures to right-size the business for the present scenario and at the same time, ensuring that it comes out as a stronger and more effective business post COVID-19.

Trading Update:

- Net sales for Q1 FY2020 ended 31 March 2020 declined 6%, while in March 2020, net sales were down 10.8% on the previous year and net sales in April 2020 dropped 22% as compared to the previous corresponding period.

- Media and global integrated agencies were the first ones to get impacted by COVID-19 with cancellation as well as deferral of projects and productions.

Stock Information: On 20 April 2020 (AEST 03:35 PM), WPP stock was trading at A$0.225, with an annual dividend yield of 23.11%.

Sydney Airport (ASX: SYD)

Given the COVID-19 crisis, government restrictions and uncertainty surrounding the coronavirus, Sydney Airport (ASX: SYD) decided not to make interim distribution for the half year period ending June 2020. The decision was made by the Boards of Sydney Airport Limited and Sydney Airport Trust 1.

Financial Position: In a recent announcement made by the Company on 20 April 2020, SYD updated to have secured A$850 million of additional bank debt facilities, thereby boosting its balance sheet.

The Company has implemented strict operating expenditure reduction measures, which include a reduction in the director’s fee and fixed remuneration of CEO by 20%.

Traffic Update: In April 2020, the Company reported a 97.9% drop in domestic traffic growth and a 96.9% decline in international traffic as compared to the previous corresponding period. The total decline in overall traffic was 97.5% for the month.

Stock Information: On 20 April 2020 (AEST 03:50 PM), SYD stock was trading at A$5.675, up 1.339% from the previous close, with an annual dividend yield of 6.96%.