The slump in automobile sales is a prolonged global trend, and the expectation by researchers suggest that sales of cars and SUVs are likely to fall further in 2020. Some of the prominent research houses also indicate that global sales would translate into no revenue growth, and the trend is likely to continue until 2021.

According to a global rating agency, global auto sales have been tracking an expected drop of 3.1 million for the year. This would be the largest slump in automobile sales since the global financial crises.

Globally, the automakers are adjusting their manufacturing capacities in the wake of the emergence in electric vehicle and environmentally friendly technologies that also underpins the global narrative to reduce carbon emissions in a bid to fight against climate change.

Australian Car Sales

In Australia, the new car sales have been depicting a downward trend for 20th consecutive month, according to November 2019 sales numbers by the Federation Chamber of Automotive Industries (FCAI).

Australian car market recorded new car sales of 84,708 units during the month, indicating a 9.8 per cent fall over the same month last year.

On a YTD basis, the total new car sales in the country were noted at 978,628 units, equating to 8.2 per cent fall over the same period last year.

CEO of FCAI, Mr Tony Weber stated that it is the best time to buy a car in Australia due to very high competition, backed by over 60 brands and more than 350 models, which makes the Australian car market among the most competitive in the world.

In November 2019, the passenger vehicle segment posted a sales figure of 23,022 units. The SUV segment recorded sales of 39,541 units while sales in the Light Commercial Vehicle (LCV) segment were 19,605 units.

Chinese Automobile Sales

In China, the automobile market has observed a decline in demand. With China being the worldâs largest automobile market in the world, it could have ramifications to the global automobile market outlook.

Earlier this year, the policymakers in Beijing lowered the subsidy for electric vehicle (EV) sales that led to an additional slump in the EV market. And, the trade dispute has led to subdued investments by the companies.

According to the China Association of Automobile Makers (CAAM), the passenger vehicle sales slipped 5.4 per cent in November 2019 against the same month in the previous year. The declining sales is an alarming signal for automakers who sell in China.

Some of the prominent global automakers have either quit the market or running on lower capacity due to declining demand and deteriorating economics of the business.

Intriguingly, the affluent Chinese class continue to splash on premium cars with the German premium automobile trio (Audi, Mercedes-Benz & BMW) racked up double-digit growth in sales during the month.

Electric Vehicle Market

CAAM also noted that the New Energy Vehicle output was down 36.9 per cent over the year to November at 110k units. The declines in the output level have been continuing since July this year. However, the New Energy Vehicle output showed a rise of 15.8 per cent from the previous month.

Chinaâs New Energy Vehicle sales in November were recorded at 95k units, meaning a fall of 43.7 per cent over the year with a prolonged decline since July this year. Nonetheless, the sales were higher compared to the previous month, marking a gain of 26.7 per cent.

Australian Implications of Chinese Car Sales

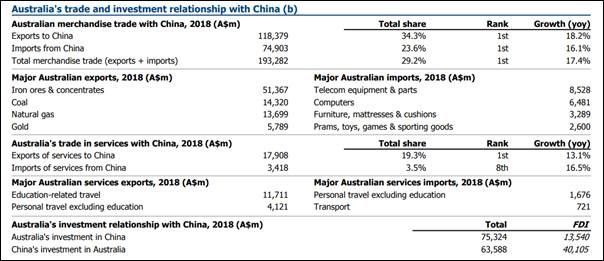

China is the largest trade partner for Australia, accounting for a substantial portion of exports. And both countries have a strong trade relationship. In 2018, the majority of the exports to China were iron ore & concentrates, coal, natural gas and gold, according to the Department of Foreign Affairs & Trade.

Source: Department of Foreign Affairs & Trade

Declining electric car sales could add pressure to the battery manufacturers in China, and in turn, the raw material suppliers to those battery manufacturers, which happens to be the lithium producers.

Recently, the China Automobile Power Battery Industry Innovation Alliance (CAPBIIA) has noted that the loading volume of power batteries was down 25.9 per cent in November 2019 (y-o-y terms). However, the volume was up 54.3 per cent over the previous month.

Further, the loading volume of ternary batteries was down 30 per cent over the year to November, and the loading volume of LFP batteries was down 24 per cent over the year to November.

At the outset, it is evident that electric car sales in China have been nosediving over the previous year. However, the segment has picked up in month over month terms, possibly adding some tailwind to China-focused lithium producers in Australia.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.