The term “Blue Chip” was coined from poker, a game where the blue chip has the highest value. These stocks are considered long term, high valued investment vehicles. Blue chip stocks are prominent and well-established companies that have many attributes that are profitable for long-term investors.

Blue chip stocks are considered safe havens for investors during an economic slump due to their stable and secure earnings. As these stocks do not move much, they provide regular dividends to their shareholders. The stocks provide increased and uninterrupted dividends over time and in the long run, shareholders can gain from dividend income and create portfolio income.

Usually, to distribute their profits, companies pay dividends to their shareholders. They have an option of either re-investing the surplus that they create during a period, known as retained earnings or distribute a part of their profits to their shareholders. Generally, how much dividend a company is going to pay is decided by the board of directors of the company.

Generally, companies with a large market cap are the best dividend payors as they have more predictable profits. These companies seek to maximize shareholders wealth apart from normal growth. High growth companies and start-ups do not usually pay dividends because of their future growth opportunities and low disposable profits.

Let’s look at five blue chip stocks we have cherry-picked for you.

CSL Limited (ASX:CSL)

CSL Limited is a global biotech firm that manufactures and delivers innovative medicines that protect public health, save lives and help people with life-threatening medical conditions. The company engages in manufacturing, marketing, and developing of biopharmaceuticals and diagnostic products, cell culture media and human plasma fractions.

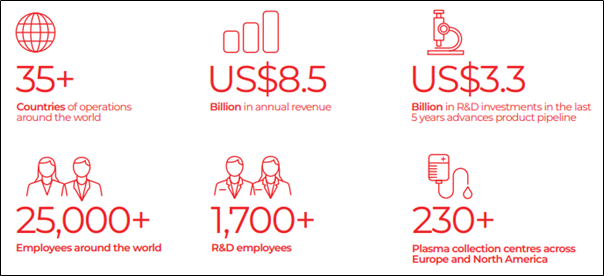

CSL at A Glance (Source: Company’s Report)

CSL Provides Update on its R&D Pipeline

CSL Limited is gradually expanding its Research & Development (R&D) capabilities and pipeline. The company aims to create a highly distinguished product portfolio mix and focus on the wide array of patients’ unmet needs.

- The company is building its leadership in plasma therapies by identifying emerging new medicines - To aid plasma business’s growth, CSL has forged targeted innovation partnerships near its R&D locations

- CSL released details on progress for a novel treatment of asthma, which has advanced to Phase 1 trials.

Stock Performance

The stock of CSL was trading at $290.660 per share on 09 January 2020, up by 1.683% (at AEDT 12:59 PM). The company’s market capitalisation is $129.74 billion. The total outstanding shares of the company are 453.87 million, and its 52-week low and high price is $184.000 and $291.460, respectively. The company has given a total return of 18.86% and 29.17% in the time period of three months and six months, respectively.

Telstra Corporation Limited (ASX:TLS)

Telstra Corporation Limited is a technology and telecommunication company that offers a wide range of telecommunication and information services including mobiles, pay television and internet.

Highlights of AGM

FY19 was a crucial year for Telstra as it commenced T22 strategy to transform the company for the future. The company has made substantial progress and Telstra today is a different, much simpler and more customer-focused organisation than compared to a year ago. The following points validate the positive impact of the strategy:

- The company reduced more than 1,800 Consumer and Small Business plans to just 20 in market plans;

- It eliminated excess data charges in Australia on new mobile plans;

- Since 2016, the number of calls coming into contact centres had fallen by more than 15 million per year and goal is to reduce them by another 16 million by 2022, all driven by better customer experience;

- The company achieved around $1.2 billion of annual cost reduction since FY16, with a target to reduce the cost by a further $630 million this year.

The shareholders of the company will receive a total dividend of 16 cents per share, combined with the total interim dividend paid in February 2019 and returning $1.9b to shareholders.

Stock Performance

The stock of TLS was trading at $3.795 per share on 09 January 2020, up by 1.471% (at AEDT 12:59 PM). The company’s market capitalisation is $44.48 billion. The total outstanding shares of the company are 11.89 billion, and its 52-week low and high is $2.800 and $3.978, respectively. The company has given a total return of 8.09% and -2.07% in the time period of three months and six months, respectively.

Transurban Group (ASX:TCL)

Transurban Group is an operator, owner and developer of intelligent transport systems and electronic toll roads. Recently, the company announced that Hills M2 Motorway, a 100% owned subsidiary of TCL, had raised A$403 million through non-recourse debt via a new debt facility of 12 months term. The company’s financial vehicle, Transurban Finance Company Pty Limited, has successfully refinanced its existing A$1,650 million corporate syndicated bank debt facility. The new facility comprises two tranches of A$825 million with tenors of 3 and 5 years respectively.

Stock Performance

The stock of TCL was trading at $15.350 per share on 09 January 2020, up by 1.12% (at AEDT 1:12 PM). The company’s market capitalisation is $41.49 billion. The total outstanding shares of the company are 2.73 billion, and its 52-week low and high is $11.530 and $16.060, respectively. The company has given a total return of 1.47% and 0.40% in the time period of three months and six months, respectively.

Woodside Petroleum Limited (ASX:WPL)

Woodside Petroleum Limited is an ASX-listed company is focused on exploration & production, transportation and distribution of oil and gas. The company also focuses on the implementation and operation of the North West Shelf Gas Project.

Woodside Signs Agreement with Uniper

On 24 December 2019, Woodside Energy Trading Singapore Pte Ltd and Uniper Global Commodities initialled a long-term sale and purchase agreement (SPA) under which Woodside will deliver LNG to Uniper from its worldwide portfolio starting in 2021 for a period of 13 years. A total quantity of 0.5 million tonnes per annum will be initially supplied under the SPA;

- From 2025, the supply will be increased to approximately 1 million tonnes per annum;

- The supply from 2025 will be confirmed once the final investment decision on the Scarborough development is made

Stock Performance

The stock of WPL was trading at $35.850 per share on 09 January 2020, down by 0.802% (at AEDT 1:13 PM). The company’s market capitalisation is $34.05 billion. The total outstanding shares of the company are 942.29 million, and its 52-week low and high is $30.580 and $37.700, respectively. The company' has given a total return of 15.17% and 0.17% in the time period of three months and six months, respectively.

Westpac Banking Corporation Limited (ASX:WBC)

Westpac Banking Corporation is one of the four major banking organisations in Australia and is engaged in the provision of financial services including deposit-taking, lending, payment services, superannuation and funds management, among others.

WBC Completes Institutional Placement of $2 Billion

On 05 November 2019, Westpac announced the successful completion of institutional placement worth $2 billion. Under the placement, about 79 million fully paid ordinary shares will be distributed at $25.32 for each share.

Stock Performance

The stock of WBC was trading at $24.580 per share on 09 January 2020, up by 0.163% (at AEDT 1:16 PM). The company’s market capitalisation is $88.63 billion. The total outstanding shares of the company are 3.61 billion, and its 52-week low and high is $23.860 and $30.050, respectively. The company has given a total return of -14.44% and -12.42% in the time period of three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.