Financial market has been witnessing a lot of changes occurring in the economy of Australia. There are several reasons behind these changes, such as low interest rates, implementation of recommendations suggested by Royal Commission, initiation of new legislative policy, ongoing consolidation by larger international players, along with banks no longer providing any personal advice, lower or minimal growth in income, growth of employment at a very slow pace, and a pullback in construction of buildings.

As an impact of these economical, regulatory and structural changes, there are a lot of companies that have downgraded their earnings in guidance FY 2020.

A few of such companies operating in diverse sectors are mentioned below:

Apollo Tourism & Leisure Ltd (ASX:ATL) functions in the consumer discretionary space, and is a multinational company operational in Australia, New Zealand and the United States.

ATL is rental fleet operator, vertically integrated producer and a retailer and wholesaler of a wide range of RVs including campervans, motorhomes and caravans.

- In a recently provided update by the company on 29 January 2020, ATL mentioned that at present, it is too challenging to predict the effect of coronavirus and bushfires on future bookings.

- It further mentioned that ATL expects low margins and sales in H1 FY 2020. Statutory Net Profit After Tax is expected to be of $10.5 million for H1 FY 2020 as compared to $14.7 million in the previous corresponding period. Similarly, underlying Net Profit After Tax is also expected to be lower in H1 FY 2020 ($11.5 million) as compared to H1 FY 2019 ($15.0 million).

ATL stock last traded at $0.365, moving up by 1.389 percent compared to its previous closing price, as on 31 January 2020.

Treasury Wine Estates Limited (ASX:TWE) is a company from consumer staples sector. It is involved in sourcing and grape growing, along with wine production and its marketing, selling and distribution.

- On 28 January 2020, TWE declared that there is a decrease in its previously forecasted figure of 15 - 20 percent in its EBITS growth to 5 - 10 percent for FY 2020. The Company mentioned that this decrease accounts to the dip in sales volume from its operations in North American market, which has 40 percent contribution in the Company’s total sales.

On 31 January 2020, the stock of the Company last traded at $13.030, marginally up by 0.231 percent compared to its previous closing price.

Downer EDI Limited (ASX:DOW) provides integrated services to customers of Australia and New Zealand. It builds, designs, and sustains infrastructure, assets and facilities.

- Recently, in January 2020, the Company stated about its weak cash performance during FY 2020 period, wherein, it is expecting the cash conversion of around 40 - 50 percent of EBITDA.

On 30 January 2020, DOW last traded at $ 7.410, moving up by 3.636 percent compared to its previous closing price.

As mentioned above, the turmoil created by certain factors such as bushfire, coronavirus and others, can induce the companies to create opportunities for themselves by learning and experimenting the implementation of new strategies, which are in tandem with the prevailing environment.

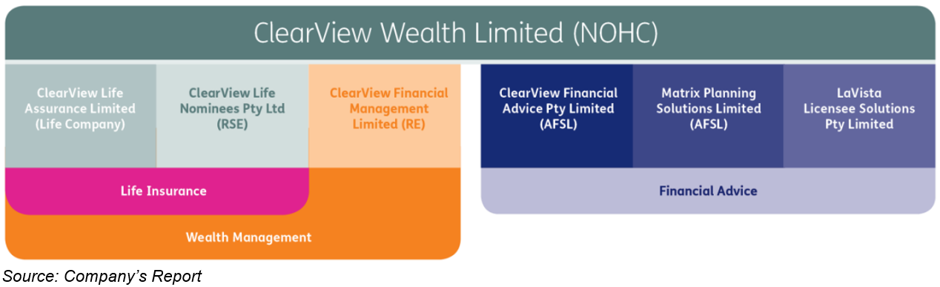

One such example is of ClearView Wealth Limited (ASX: CVW), an ASX-listed company which is into the business of financial services. CVW deals into three business segments, namely, Life insurance, Financial advice and Wealth management.

Let’s further deep dive to understand the company’s financial aspects.

CVW’s Financial Aspect:

Key financial highlights of the Company in its Annual report for FY 2019 for the period closed 30 June last year is as mentioned below:

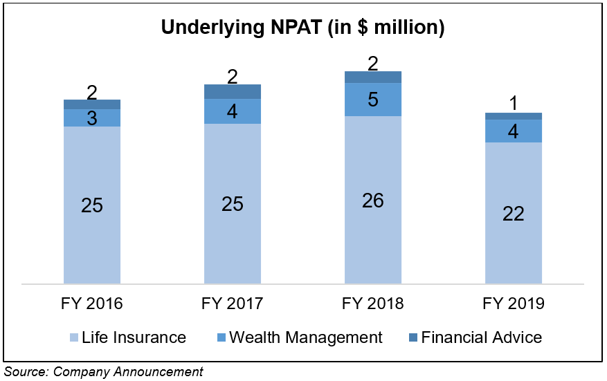

- Underlying NPAT was at $25.1 million in FY 2019, reflecting a decrease of 22 percent from FY18 $32.4;

- Also, the segmental NPAT, namely Life insurance, Wealth Insurance and Financial advice declined by 16, 30 and 44 percent, respectively as compared to the last year.

- While viewing underlying NPAT in the above-mentioned segments for the period of last four years, only wealth management has maintained a growth figure of 7 percent.

- Embedded Value was $672.7 million or $0.99 per share (including franking credits and ESP loans).

- Loss in claims and lapse were noted at - $5.2 million and - $5.6 million in FY 2019, respectively, as compared to - $5.5 million and - $2.1 million in FY 2018, respectively.

CVW comments on its above-mentioned financials in its FY2019 results: Regarding the decline in underlying NPAT, the Company’s results indicated poor lapse and claims experience.

CVW’s Business and Trading update ahead of HY20 results:

CVW is anticipating-

- Underlying NPAT for half-year HY 2020 period was noted $10.2 million, which was $11.9 million in the previous corresponding year.

- Life Insurance segment witnessed the fall in underlying NPAT with $8.7 million in HY2020 and $11.9 million in the same corresponding previous year.

- Wealth Management Underlying NPAT for the six months period has been noted at $1.7 million.

In the annual report 2019, the company has mentioned that its investment in technology, side by side with the continuous expansion of its IFA footprint would aid medium to long term development. On the business outlook front, it had stated that strategies related to business and focus was reset, placing CVW to derive benefit of structural changes in the market, in spite of substantial short-term period headwinds.

Buy-back of its shares:

CVW has been actively performing buy-back of its shares as an initiative towards capital management. The Company mentions that buy-back is in interests of shareholders and is a better use of capital.

Dividend distribution:

The year-end dividend for FY 2019 has been suspended, as mentioned by the Company. However, CVW has delivered the annual dividend in the past comprising of 0.03 in 2018, 0.0275 in 2017 and 0.025 in 2016.

ClearView’s Share performance:

The above-mentioned unrest has also impacted CVW’s share price traded on ASX.

- On 31 January 2020, CVW stock last traded at $ 0.425, moving down by 4.494 percent compared to its previous closing price.

- The company has outstanding shares of around 676.09 million and a market capitalisation of nearly $ 300.86 million. The 52 weeks low and high price of the stock was noted at $ 0.42 and $ 0.9, respectively.

- The stock has delivered a return of -33.58 percent and -50.00 percent in the last six months and one-year, respectively.

Despite, the above-mentioned situations, CVW has a positive business outlook and in its Annual Report mentioned the key focus areas for FY20, they are as follows –

- Updating desktop technology as well as main elements of core Life Insurance.

- Repricing and repositioning of Financial Advice segment with an aim to build a sustainable revenue model which has no cross subsidies over time.

- Finalising a strategic review of Wealth Management platforms.

- Further work on positioning, pricing and retention strategies in Wealth Management and Life Insurance segments.