With the anticipation of slower growth and weak inflationary pressures in the near-term, the Bank of America Merrill Lynch (BofAML) has reduced its year-end forecast for the yield on Australia's 10-year note to 1.9 per cent from 2.25 per cent.

Additionally, BofAML has also reduced its outlook for the Aussie to US73¢ by the end of 2019 from the earlier forecast of US81¢ made in last November.

At around 9:00 AM AEST today, Australia's 10-year yield was at 1.53 per cent.

The yield on Australiaâs 10-year note has dropped 130 basis points in the last year and 36 basis points in the last month. However, the yield on the US 10-year note declined 67 basis points in the last year and 25 basis points in the previous month.

Recently, the US government debt yields declined to their lowest level since 2017, amid ongoing trade tensions between the United States and China over trade tariffs.

The trade dispute between the two largest economies of the world aggravated when US President Donald Trump decided to raise the tariff on Chinese goods to 25 per cent word $200 billion. In answer to Mr Trumpâs threat, China retaliated by announcing a plan for imposing tariffs on US goods worth $US60 billion from June 1. The conflict between the two economies raised concerns about global economic growth and pushed the yield on 10-year US Treasury bonds to a low level of 2.3 per cent.

BofAML specified that the ongoing trade dispute has raised a possibility of extended and larger tariffs and less optimistic backdrop for the rest of the year. Their interest rates team has already cut many of its yield forecasts considering RBA policy adjustments and disappointing inflation figures, mentioned BofAML.

BofAML has revised the forecast for yield on Australia's 10-year note over the indication by the Reserve Bank of Australia (RBA) of an interest rate cut in June. The RBA signalled rate cut in June this week following the rise in an unemployment rate in April 2019 to 5.2 per cent.

The Australian Prudential Regulation Authority (APRA) has also proposed a plan to ease regulatory conditions for mortgage borrowing recently. The APRA has suggested the removal of 7 per cent home loan buffers to banks.

According to BofAML, a rate cut in June will increase housing cash flow and decrease the cost of money, while the removal of home loan buffers will improve the supply of credit.

BofAML also emphasised that in the wake of recent election results and a weaker Australian dollar, the Australian fiscal policy is set to boost incomes via tax relief.

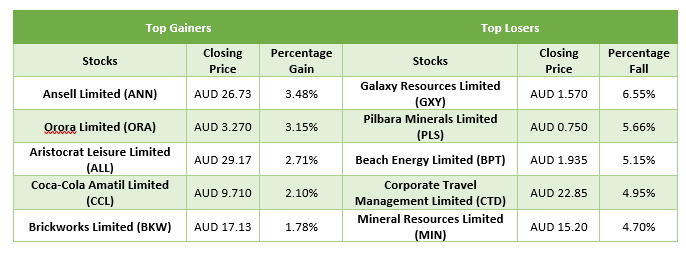

Owing to the trade dispute and growth worries, the S&P/ASX 200 closed lower today at 6456 points, down by 0.6 per cent relative to the last close. ANN, ORA, ALL, CCL and BKW were the star performers while GXY, PLS, BPT, CTD and MIN were under pressure on the ASX 200.

The below table shows the closing price of these top gaining and top losing stocks on the ASX on 24th May 2019 and the relative percentage gain or loss in comparison to the previous closing price.

However, the Australian shares closed the week higher, celebrating the federal election results. The S&P/ASX 200 Index rose 1.4 per cent this week while the broader All Ordinaries closed 1.3 per cent higher.

However, the Australian shares closed the week higher, celebrating the federal election results. The S&P/ASX 200 Index rose 1.4 per cent this week while the broader All Ordinaries closed 1.3 per cent higher.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.