The world has witnessed one of the worst crackdowns on the economic front in recent months due to the COVID-19 pandemic. People have been forced to remain under lockdown and abide by the ‘stay at home’ restrictions. However, constraints like these have only increased the burden over the businesses with closed and shuttered outlets.

Few essential businesses that remain operational have been functioning with several social distancing measures like limited capacity for people to shop, online payments to avoid contact through cash etc. A significant increase in the number of cashless transactions has turned the tables for companies offering buy now pay later services.

The BNPL players had a torrid time around mid-March when the companies in this space started facing the heat from the pandemic and were one of the worst performers in the Australian market. The significant decline in the share price of these companies was primarily driven by massive sell-offs amid fears of rising unrecoverable debts, and to an extent, due to market correction.

However, the fundamentals of the players have remained robust, and the outlook looks promising. Many BNPL businesses have registered record value of transactions as well as significant growth in their business since the onset of the COVID-19. In Australia, too, the BNPL businesses have remained resilient to the impact of the pandemic and have recorded significant growth.

One reason for such growth is the exceptional increase in online transactions. Additionally, as we shall see some relaxations in the restrictions, it is expected that the consumers shall run to shop online, making the outlook favourable for these companies.

Let us look at some of the BNPL stocks listed on ASX and their recent developments.

Afterpay Records 97% Increase in Sales

Afterpay Limited (ASX:APT) has experienced continued strong performance across its business with underlying sales at $7.3 billion on year to date basis which represents a growth of 105% compared to the prior corresponding period (pcp), being Afterpay’s third-largest underlying sales month on record, while underlying sales for Q3 FY20 increased 97% on Q3 FY19.

Notwithstanding increased contribution from newer markets that are initially higher loss early in the lifecycle, Gross Losses of APT for March is estimated to be approximately 1.0% (unaudited), in line with H1 FY20.

Moreover, active customers continued to grow strongly totalling 8.4 million globally at the end of Q3 FY20, representing 122% growth on the pcp and the same continued throughout early April.

In addition to this, APT witnessed continuous onboarding of new merchants in all markets at volumes that are in line with pre-COVID-19 levels. At the end of Q3 FY20, active merchants reached 48.4k globally, supported by strong merchant additions across all regions and representing 78% growth on pcp.

To add increasing value to its merchants throughout this period, APT has been proactively developing initiatives as well as identifying opportunities to support merchants who were experiencing difficulties.

For prioritising the health and wellbeing of its people, APT has taken the necessary health and safety measures with all employees working from home since mid of March.

APT’s dynamic business model and strong balance sheet translate that Company is well-positioned to respond and adapt through the current period of high uncertainty and remains confident that its customer-centric model shall be even more relevant in the post coronavirus setting, through encouraging budgeting and responsible spending.

The APT stock closed at $27.010 on 24 April 2020, a decline of 0.516% from its previous close. The Company has a market cap of $7.25 billion.

Zip Co Earns 96% Higher Revenue

Notwithstanding the economic impact of COVID-19, Zip Co Limited (ASX:Z1P) continues to perform strongly, with healthy customer growth, transaction volume, and a strong pipeline of new partners in the March quarter.

Against a backdrop of economic uncertainty that emerged during March 2020, the Company delivered a robust set of quarterly numbers by generating $45 million in revenue over the quarter, which was 96% higher than the same period in 2019, with ANZ transaction volume annualising at $2.1 billion.

During the quarter, Zip launched the “Shop Everywhere” feature, which allows Australian app users to pay with Zip at any online store and its functionality works by generating a single-use virtual card number at the checkout.

This feature, in addition to the current Zip digital wallet functionality, allows customers to pay for their everyday needs and smoothen their repayments over time interest-free, which is a well-received initiative in the current climate.

Zip believes it is uniquely placed to trade through the current economic environment with:

- Exposure to defensive, recession-proof sectors and online

- Exposure to credit-verified, older millennials

- Investment in credit-decision technology, and Unique, account-based concept

In response to the potential impact of COVID-19, Zip has already adjusted its application underwriting algorithms and is leveraging real-time portfolio management tools to actively monitor account behaviour and adjust limits accordingly.

The current economic conditions and delayed launch in the UK, has impacted the Company’s ability to reach its global customer target. However, Zip is comfortable that the annualised transaction volumes and looks forward to achieving or exceed the stated goal of:

- Annualised transaction volumes at EOFY 2020 of $2.2 billion

- A global target of 2.5 million customers at EOFY 2020

The Z1P stock closed at $1.920 on 24 April 2020, a decline of 1.031% from its previous close. The Company has a market cap of $757.36 million.

Pushpay Expects Smooth Navigation Through COVID-19

Another leading solutions provider to simplify engagement payments and administration, Pushpay Holdings Limited (ASX:PPH) had advised that its performance for the year ending 31 March 2020 is not expected to be adversely affected as a result of the impacts from COVID-19.

In times when several organisations are temporarily closing their physical premises in response to the spread of COVID-19, Pushpay is witnessing experiencing an increase in demand for its services through a transformation to digital pathways where Customers are utilising its mobile-first tech solutions.

Despite the increasing demand for digital platforms, the Company continues to be well-equipped to support customers to leverage digital technology and steer continued congregation participation using its mobile app.

Pushpay reiterates its guidance for the year ending 31 March 2020, of

- Operating revenue of between USD 121.0 million and USD 124.0 million

- Gross margin of more than 63%

- Total Processing Volume of between USD 4.8 billion and USD 5.0 billion

- EBITDAF of between USD 23.0 million and USD 25.0 million

However, the above-stated guidance excludes the acquisition of the ownership interests in Church Community Builder and the impacts associated with the same.

The PPH stock closed at $3.880 on 24 April 2020, a decline of 2.757% from its previous close. The Company has a market cap of $1.1 billion.

Sezzle Records Solid Growth

North American payment platform, Sezzle Inc. (ASX:SZL) recorded a trajectory of solid growth across all key operating metrics while maintaining a strong financial position despite global economic headwinds stemming from COVID-19.

In order to safeguard its employees, SZL had implemented requisite measures that also support its consumers and assist in active communication with its merchant partners.

SZL has been witnessed a shift amongst consumers and retailers in North America towards eCommerce for meeting their needs. This shift in the preferences of the shoppers as well as retailers to online shopping has positioned Sezzle as a key partner for merchants with extra flexible payment options for their customers.

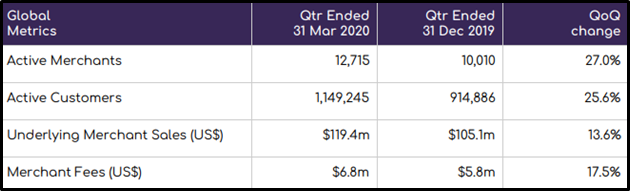

As reflected by the numbers, Sezzle’s active merchants increased by 2,705 QoQ, the single largest increase in this metric in the Company’s history, bringing its total number of active merchants to 12,715 at the end of Q1 FY20.

Underlying Merchant Sales (UMS) increased by 13.6% QoQ and improved by more than 321% YoY, while Merchant Fees totalled USD 6.8 million at the end of Q120.

Repeat usage, improved to 85.6% for Q120, representing an improvement of nearly two percentage points compared to 83.7% in Q419.

SZL believes that its continued strong financial position provides the Company with the runway to weather prolonged effects from the COVID-19 pandemic. The Company has offered several tools and resources to support its employees and contractors in this time of economic uncertainty.

The SZL stock closed at $1.450 on 24 April 2020, an increase of 3.943% from its previous close. The Company has a market cap of $249.9 million.