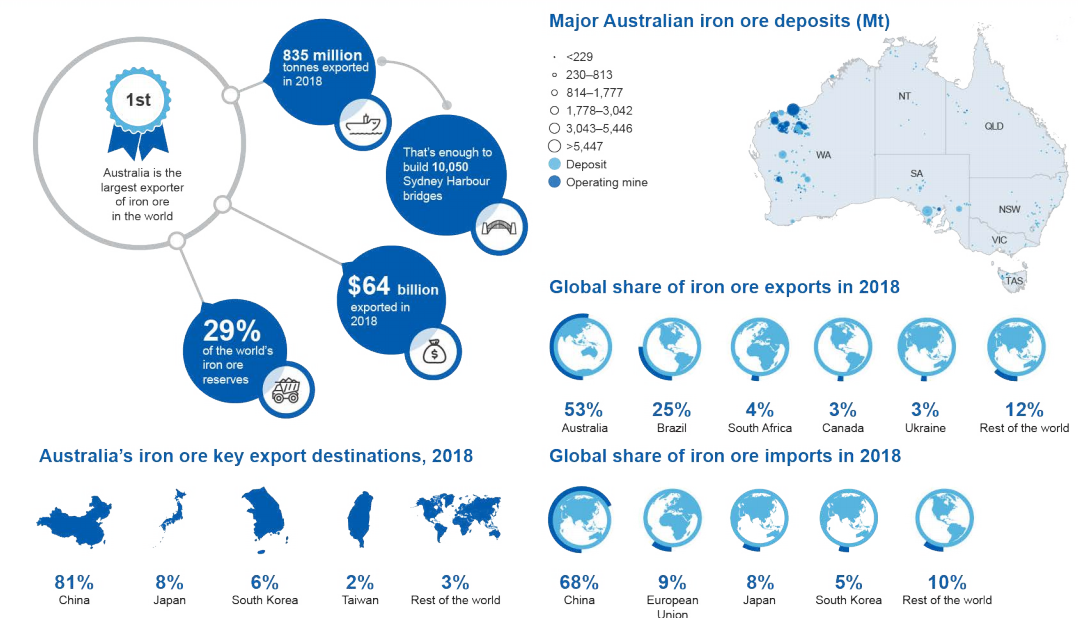

In 2018, Australia exported around 835 million tonnes of iron ore, accounting for 53% of the global supply chain. However, in the wake of Tropical Cyclone Veronica and Wallace in the first half of 2019, the environmental conditions were hampered in Western Australiaâs Pilbara region which impacted the port operations, caused supply disruption in the operations of significant Australian iron ore miners such as Rio Tinto and BHP Billiton, and therefore inhibited overall exports.

Yet, according to the Department of Industry, Innovation and Science (DIIS) in Australia, Australia is the largest exporter of Iron Ore in the world (see figure below).

Source: DIIS

Source: DIIS

BHP Group Limited

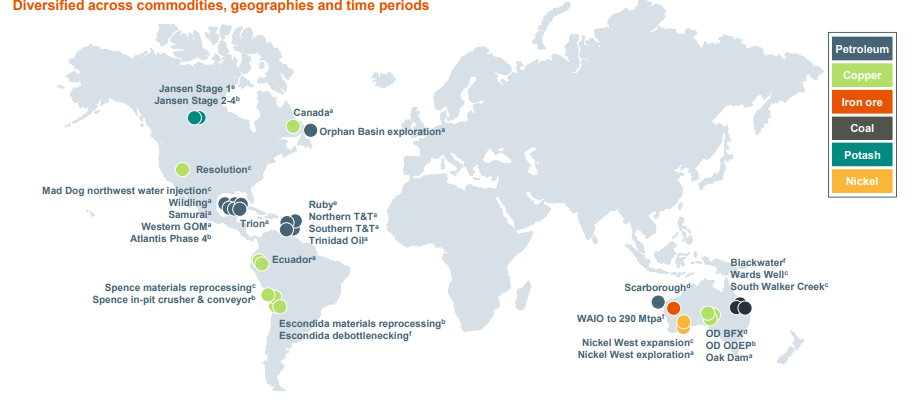

BHP Group Ltd (ASX:BHP), based in Melbourne, Australia, is a global resources company primarily engaged in the mineral exploration and production of Iron Ore, Coal, Petroleum, Copper, Lead, Zinc, Gold, Silver, Uranium, Molybdenum, and other concentrates.

Source: 2019 Global Metals, Mining and Steel Conference

Source: 2019 Global Metals, Mining and Steel Conference

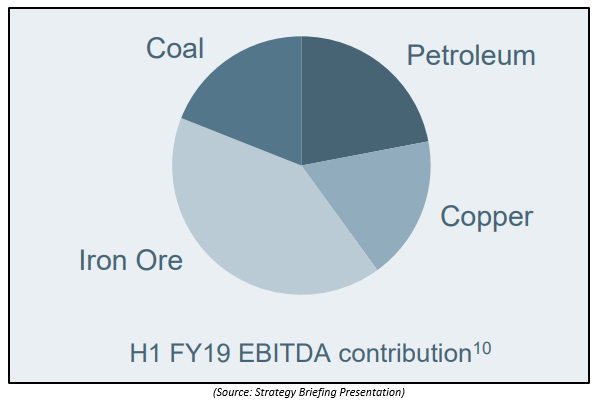

Recently on 17 July 2019, the Group released its Quarterly Activities Report for the three months to 30 June 2019. Reportedly, BHP Groupâs Iron ore exports have experienced a drop for the first time in around two decades, constituting a weak year of exports from the overall Australian iron ore Industry. It is to be noted that, iron ore is the largest contributor to the groups EBITDA.

Iron Ore- BHP Groupâs total iron-ore production remained broadly unchanged year-on-year in FY19 at 238 Mt, while there was an increased June 2019 quarterly production at Western Australia Iron Ore reaching 63 Mt (up 12%), reflecting the return to full capacity following Tropical Cyclone Veronica in March 2019.

For the half year ended 30 June 2019, the average realised price for iron ore stood at USD 77.74 /wmt, FOB, up 40% on USD 55.62 /wmt, FOB released in the December 2018 half. For the financial year 2019, the average realised iron ore price amounted to USD 66.68 /wmt, FOB, up 18% on FY18.

The Group estimates the production to range between 242 and 253 Mt (273 and 286 Mt on a 100 % basis) in FY2020 as a significant maintenance program is currently under plan for Port Hedland. This program is being planned in such a way so as to improve productivity and offer a stable base for the Groupâs tightly knit supply chain while also sustainably scale up production towards 290 Mtpa (100 % basis).

A major car dumper maintenance campaign is also being developed under the same program and due for execution in the September 2019 quarter, with a corresponding impact expected on production.

BHP Group also posted that volumes were flat at Western Australia Iron Ore in the Pilbara region, depicting record production at Jimblebar and inventory disruptions from the Mt Whaleback fire in the previous quarter. Also, in the recent quarter, WAIO delivered an annualised run rate of over 290 Mt, not including the damage caused by the cyclone.

At the end of FY19, BHP Group had five major projects under development in copper, iron ore, petroleum and potash, with a total budget of ~USD 11.1 billion for the life of the projects.

Overall, the Group exceeded full year production guidance for petroleum and met revised guidance for copper and iron ore.

Underlying improvements in productivity were largely offset by the impact of unplanned production outages of USD 835 million during the first half of 2019, in addition to grade decline in copper and higher unit costs in coal. Thus, a negative movement of ~USD 1 billion is expected to be included in the full year results of FY19.

Stock Performance - The Groupâs market capitalisation stands at around AUD 121.13 billion with approximately 2.95 billion shares outstanding. On 19 July 2019, the BHP stock was trading at AUD 41.190, down 0.109% by AUD 0.045, with ~ 1.12 million shares traded (as at AEST: 12:55 PM). The stock has delivered positive return yields of 24.19% for the last six months and 27.33% YTD.

On 13 June 2019, BHPâs Director Mr Ian Cockerill acquired an indirect interest in the company upon purchase of 3,500 ordinary shares in BHP Group Plc (LON:BHP), at GBP 19.25 per share.

Rio Tinto Limited

Rio Tinto Limited (ASX: RIO), established in 1959 and headquartered in Melbourne, Australia, is another leading global resource company engaged in acquiring, mining, and processing mineral deposits worldwide. The Group has a strong portfolio comprising of eight commodities spread across 18 countries. Rio Tinto Limited is a subsidiary of Rio Tinto Group.

Oyu Tolgoi Underground Project Cost Overshoot - Recently, on 16 July 2019, Rio Tinto provided an update on the schedule and cost of the Oyu Tolgoi underground project in Mongolia, which is underway to become one of the largest copper mines in the world.

So far since February 2019, the Group has finished the development of important underground infrastructure including the control room facility and the jaw crusher system, while the development of shafts 3 and 4 is on schedule. In addition, the shaft 2 commissioning is expected to be done in October 2019.

However, advanced geotechnical information and data modelling has indicated that there is a possibility of certain risks associated with the currently approved mine design, which has caused the Group to consider a number of other mine designs options. The evaluation and finalisation are anticipated to go on until early 2020. As a result, further technical work would be required to complete the final assessment.

The Group added that depending on the selection of the mine design option, first sustainable production could be achieved between May 2022 and June 2023, a delay of 16 to 30 months (includes contingency of up to eight months) compared to the original feasibility study guidance in 2016.

The preliminary estimates for development capital spend for the Oyu Tolgoi underground Project, depending on the outcome of the work described above, has now been updated to between $ 6.5 billion to $ 7.2 billion, reflecting an increase of $ 1.2 billion to $ 1.9 billion from the previously disclosed $ 5.3 billion.

This preliminary range is subject to change prior to completion of the Definitive Estimate.

Stephen McIntosh, Group executive, Growth & Innovation added that the ground conditions are more challenging than expected and delays are quite common for such a large and complex project.

The current lenders to the project include local commercial banks such as Australia And New Zealand Banking Group Limited (ASX: ANZ) and National Australia Bank Limited (ASX: NAB) as part of the lending consortium, which comprised of over 20 global financial institutions and agreed to over USD 4 billion finance package subject to total debt limit of USD6 billion.

Rio Tinto and its mining partners are considering financing the extra costs from elsewhere than the current lenders.

Rio Tinto is the operator of Oyu Tolgoi project but does not directly own an interest in the mine. The Group rather holds a 50.79 % stake in Canada-based Turquoise Hill Resources , which directly owns 66 % of Oyu Tolgoi LLC, the Mongolian company that owns the mine. The remainder 34 % interest in Oyu Tolgoi LLC is held by the Mongolian Government.

Q2 Production Results â On 16 July 2019, Rio Tinto reported that the Group witnessed a difficult operational performance across its portfolio in 1HCY2019, and also investing in future growth at Richards Bay Minerals and Resolution.

Especially for the Iron ore operations in Australia, there were operational and weather issues amidst a continued robustness in the pricing and market demand.

A snapshot of the quarterly production is as follows-

Source: Second Quarter Operations Review

Stock Performance: Rio Tintoâs market capitalisation stands at around AUD 38.31 billion with approximately 371.22 million shares outstanding. On 19 July 2019, the RIO stock was trading at AUD 102.705, up 0.337% by AUD 0.345 with approximately 614,782 shares traded (as at AEST: 1:29 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.