History proves that the stock markets have delivered generous returns to investors over time. The risk-and-return game has been a reliable source of income for many and continues to attract people to jump into the dynamic investing world.

Stock investing offers a hoard of benefits:

- Takes advantage of a growing economy with growing corporate earnings;

- It is one of the best ways of stay ahead ofinflation (buy and hold strategy);

- The stock market makes it easy to buy shares of companies;

- There are two options- where most investors intend to buy low and then sell high and others who prefer a regular stream of income (in the form of dividends);

- Liquidity is a huge bonus of investing, where the stock market allows one to sell a stock at any time.

In todayâs article, we would understand the concept of value stocks and break down ways in which investing in value stocks would fill in oneâs pockets. We would also browse through the performance of few value stocks which are listed and traded on the ASX.

Let us begin by understanding value stocks-

Value Stocks

Trading at lower price relative to its fundamentals like earnings, sales or dividends compared to the peer group, value stock is best described as a security which trades at a lower price compared to that of other companies in the same industry. Since the price of the underlying equity does not ideally match the companyâs revenues and earnings performance, investors tapping value stocks attempt to capitalize on the inefficiencies of the market.

Features

- high dividend yield;

- low price-to-book ratio (P/B ratio);

- a low price-to-earnings ratio (P/E ratio);

- usually available at a bargain price because market participants tend to ignore and place the stock in the group with low investor attention;

- the price of the stock is relatively lower than the stock prices of companies in the same industry.

In a stock market, the market price of the stock is based on the prices bid and offered by the investors. It should be noted that a value investor considers several fundamentals of the business to ascertain the value of the company. If the market price is below the value of the company as perceived by the investor, the stock is deemed to be undervalued, or a value stock.

How Do You Find A Value Stock?

Have you wondered as to why would you consider valuing a stock, in the first place? The answer is feasibly simple- determining the intrinsic value of a stock sets a rough benchmark in pricing that the investor can use to ascertain if the stock is an attractive purchase or if it is expensive and should be sold.

Over time, the âbuy low, sell highâ concept is a strategy every investor follows, and without determining the reference value, this strategy cannot be applied.

The most commonly used method to find value stocks is through financial ratios/ ratio analysis method, which include:

- Price to Earnings ratio (P/E Ratio);

- Price to Book Ratio (P/B Ratio);

- Price to Sales multiple (P/S Ratio) and

- Earnings Yield (Earnings/Price expressed as a % yield).

Another way of finding a value stock is the Discounted Cash Flow analysis, through which one can determine the current value of the cash that the company is likely to generate in the future for its shareholders.

Value Stocks Shining Bright Lately?

Some market experts have an opinion that value stocks could outperform the growth stocks, which seem to dominate the S&P 500 index. Ever since the Great Financial Crisis of 2008-2009, value stocks have lagged behind growth stocks and have failed to regain their footing since.

Lately, investment markets have been exposed to a lot of micro and macro-economic challenges and adversities, like the continuing trade war, instability in the Middle East, governing regulation amendments with rate cuts, a looming fear of an emerging slowdown, soft economic data across the globe- all these have resulted in sharp market oscillations.

A silver lining has noticeably appeared, primarily due to the fears of slowdown or recession with investors realising that revenues, earnings, dividends, and fair value are the basic criteria for investing and cannot be ignored. This is welcoming for the good-old value stocks which seem to be particularly worthy and discernible in the current times.

How to Make Money Through Value Stocks?

Quite a few investing experts advocate that if an investor wishes to make money in the market, he should consider owning value companies instead of just high-growth stocks, as they believe that value potentially outperforms growth. Cheap, beaten-down stocks bear potential to work well over time. Let us browse through a few considerations that would aid an investor to make money through value stocks:

- Search for value- one should ideally tap a company that has sustained no losses over the past few years, has less total debt against its total tangible equity, the share price is less than the book value per share, and the yield is at least twice the yield on long-term AAA bonds.

- One should stay patient and not get pulled to sell stocks in times when the value stocks tend to underperform. This is because falling markets are often an opportunity and a market rebound always takes place, given the dynamic nature of the stock market. Thus, an investor should be aware of the fact that a normal cyclical pattern would always come and go.

- Emerging markets should be considered- Accounting for almost half of the global GDP, the emerging market sectorâs vast potential should never be overlooked by the investor. Despite big risks and the fact that emerging market investments have endured a prolonged bear market, economic woes have made the stocks cheap.

- Buy beaten down stocks- There are stocks that would have underperformed but are constituents of sectors that tend to perform well over the long term.

- Managing short-term and long-term debt smartly is the key to value creation as value investing is based on the principle of low leverage. Therefore, an investor should hunt for companies where the current assets in liquid form can comfortably service the current liabilities (low debt with steady growth in revenues and profits).

Value Stocks on ASX

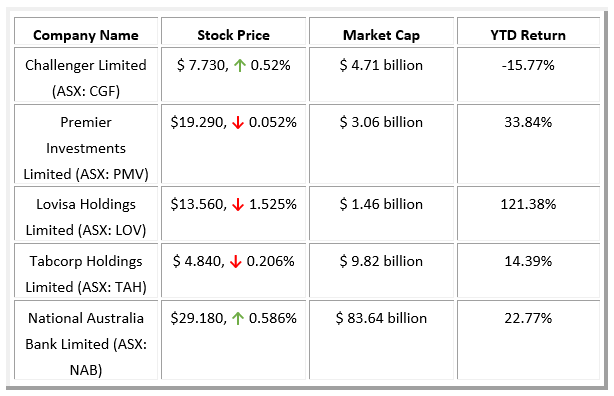

Now that we understand the concept of value stocks and ways to tap this lucrative investing opportunity, let us look at the performance of few value stocks on ASX, after the close of the trading session on 25 October 2019: They are Challenger Limited (ASX: CGF), Premier Investments Limited (ASX: PMV), Lovisa Holdings Limited (ASX: LOV), Tabcorp Holdings Limited (ASX: TAH) and National Australia Bank Limited (ASX: NAB).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.