As the outlook for real estate is improving, the major banks of Australia are cutting down their fixed rates to earn back the lost market shares. While CBA has decreased its interest rates on a range of its residential and investment fixed rate loans for the new customers, ANZ has also reduced a number of its fixed interest rates, demonstrating the current favourable conditions for the long-term funding.

Following the recent fixed rate cuts by ANZ and CBA, Westpac Banking Corporation (ASX: WBC) is also cutting its fixed rates. A subsidiary of the Westpac Group, Bank of Melbourne now has 2-year standard fixed rate at 3.29% per annum. Likewise, other subsidiaries of Westpac are also reducing their fixed interest rates.

Recently, Westpac forecasted that Reserve Bank of Australia might further reduce it cash rate to 0.75% in October this year and to 0.50% in February next year to bolster the economy.

Earlier in July 2019, when RBA reduced its official cash rate to reduce the unemployment and achieve progress towards the inflation target it prompted many banks to cut down their interest rates. Australia And New Zealand Banking Group Limited (ASX: ANZ), one of the Australiaâs leading banks in term of market capitalisation, decreased the variable interest home loan rates for Australian home and residential investment loans by 0.25% per annum and for Standard Variable Rate Owner Occupiers who are paying principal and interest, it reduced the Index Rate to 4.93% per annum, passing the reduction in cash rate to its customers.

Similarly, CBA had lessened the Owner Occupied Principal and Interest Standard Variable Rate home loan to a new record low rate of 4.93 percent per year, while the Investor Principal and Interest Standard Variable Rate home loans were cut by 0.19 percent per year to 5.51% per year. Likewise, CBA had reduced the Owner Occupied Interest Only Standard Variable Rate home loans reduced to 5.42% per annum and for savers, it offered a special 5-month term deposit rate at 2.20% per annum with an additional 0.10% per annum bonus for existing CBA pensioner customers.

National Australia Bank Limited (ASX: NAB) also reduced its variable home loan interest rates by 0.19% per annum and informed if the official cash rate are further reduced, it has no plans to decrease the rates by more than 19 basis point.

NAB Apologises for Data Breach

One of the Australiaâs leading business banks, National Australia Bank recently started contacting around 13,000 of its customers to inform that some of their personal information has been mistakenly uploaded, without authorisation, to the servers of two data service companies.

The breached data comprised of basic information like customer name, date of birth, contact details but in some cases, sensitive information like government-issued identification number, such as a driverâs licence number have also been leaked.

The bank has assured to its customers, that it takes privacy and protection of customer information extremely seriously and has provided an explanation that it was due to a human error behind the data breach. The bank has further assured that it was not a cyber-security issue and it will cover the cost of independent, enhanced fraud detection identification services for the customers who got affected by the information breach.

The impacted customers need not to take any action with their account.

The bank has sincerely apologised for this mistake and is taking precautionary measures to ensure that this does not happen again.

The bank recently roped in the CEO of Royal Bank of Scotland, Mr. Ross McEwan for the position of CEO and MD of NAB. Mr. Ross McEwan is a highly experienced global financial services executive who recently resigned from RBS in the month of April 2019.

Stock Performance

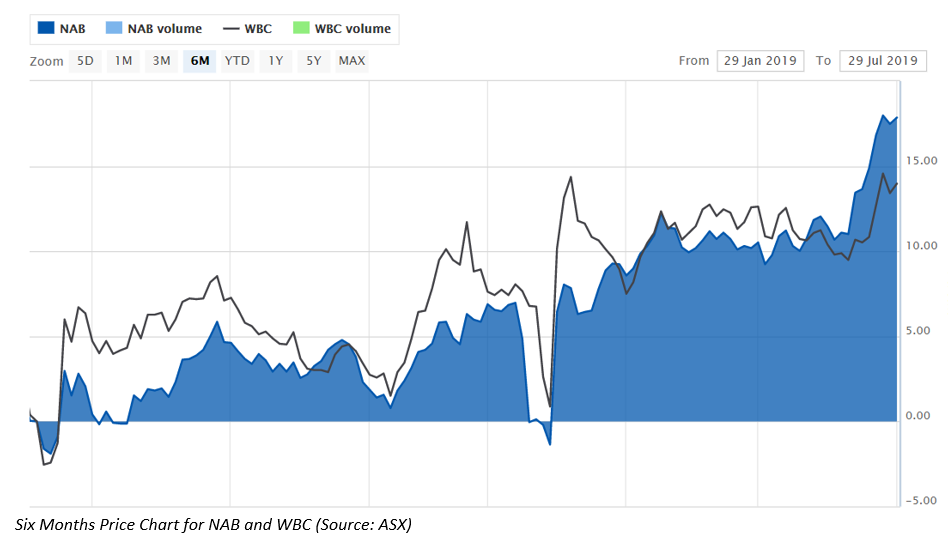

On the stock performance front, on 30 July 2019, the shares of NAB last traded at A$28.650, up by 0.245 percent from its previous close. It has a market capitalisation of around A$82.4 billion, with ~2.88 billion shares outstanding. Also, the stock price of NAB has generated a return of 17.81% during the past six months period. NAB has a PE multiple of 13.930x and an annual dividend yield of 6.37%. The stockâs 52 weeks high price stands at A$29.000 and 52 weeks low price at A$22.520 with a yearly average volume of ~7,298,742.

Share performance of other major banks

The shares of CBA were up 0.18% during 30 Jul 2019âs intraday trade. On the stock performance front, the share price of CBA has generated a return of 16.68% during the past six months. CBAâs stock has a PE multiple of 16.220x and an annual dividend yield of 5.18%. After the closure of trading session on 30 July 2019, CBAâs stock was at a price of A$83.4 with a market capitalisation of circa A$147.37 billion. The stockâs 52 weeks high price stands at A$83.990 and 52 weeks low price of A$65.230 with a yearly average volume of ~3,087,162.

Further, the shares of ANZ were up by 0.539% during 30 July 2019âs intraday trade. On the stock performance front, the share price of ANZ has provided a return of 8.87% during the past six months. ANZâs stock has a PE multiple of 12.710x and an annual dividend yield of 5.75%. At the end of the trading session, on 30 July 2019, ANZâs stock was at a price of A$28.000 with a market capitalisation of circa A$78.94 billion. The stockâs 52 weeks high price stands at A$30.390 and 52 weeks low price of A$22.980 with a yearly average volume of ~5,708,275.

Besides, the shares of WBC were up by 1.01% during 30 July 2019âs intraday trade. On the stock performance front, the share price of WBC given a return of 13.52% during the past six months. WBCâs stock has a PE multiple of 13.930x and an annual dividend yield of 6.55%. After the marketâs close on 30 July 2019, ANZâs stock was at a price of A$29.000 with a market capitalisation of circa $100.02 billion. The stockâs 52 weeks high price stands at A$30.440- and 52-weeks low price of A$23.300 with a yearly average volume of ~7,134,923.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.