Tourism is an essential aspect of Australiaâs economy. Visitors travel to the country mostly for leisure, education and business.

Australiaâs international tourism industry has tremendously grown over the past two decades, with foreign visitor numbers increasing, and the changing composition of the sector. The travel cost, household income, and the relative tourism price are important drivers for the international tourism in the country.

Before diving further, we encourage you to READ HERE to know about the recent tourism statistics, lucrative stocks and popular destinations of the Aussie land.

Catalysts of Australian Travel & Tourism Industry

Though tourism is a beneficial source to Australiaâs GDP, there are few areas, where constant enhancements would aid the industry to reach even greater heights:

- Improve International Competitiveness- The government should take necessary steps to improve Passenger Movement Charge and Australian tourism funding.

- Develop Awareness of Australian Product- The government should prioritise on improving the business events and leisure tourism sectors, within existing resources and allocate resources for quality tourism projects in digital innovation programs.

- Investment in Skills and Labour- Career pathways in the travel and tourism industry should be constantly encouraged. Enough resources should be allocated to reduce any possible delay in the processing of visa applications.

With this backdrop, let us have a look at Flight Centre Travel Group and its recent updates:

Flight Centre Travel Group (ASX: FLT)

Flight Centre Travel Group is one of the worldâs leading travel agency groups. FLT owns operations in over 23 countries with network in over 90. The company employs more than 19,000 people globally with ~2,800 businesses. Universal Traveller, Travel managers, Travelsmart, Executive Travel and BYOjet are few major brands of the company.

Results of Annual General Meeting

On 7 November 2019, the company conducted its Annual General Meeting, highlighting the below:

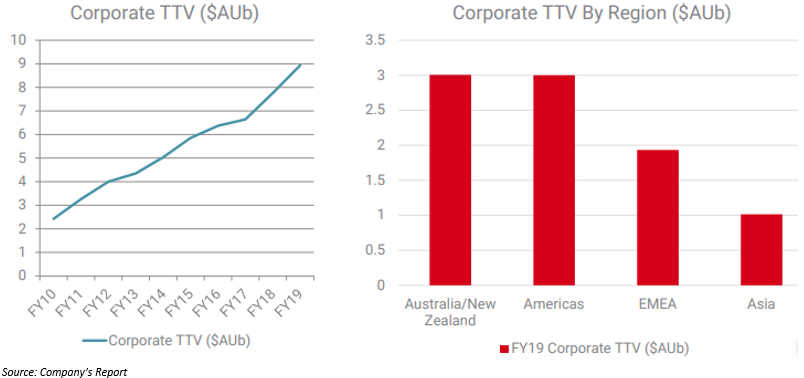

- The company recorded the Total Transaction Value (TTV) of $23.7 billion and exceeded the FY 2019 results by 8.8% or ~2 billion. The growth was achieved with fewer sales staff, and the year marked record TTV in all countries except Nordics.

- FCM won $1.3 billion worth of new business during FY19 and circa $2 billion across the corporate division.

- Profit & TTV weighted towards international businesses for the first time. FLT recorded profit across the USA, Canada, UK, Ireland, UAE, Netherlands, South Africa, New Zealand and Hong Kong/China.

- In International business, Americas topped $100 million in underlying earnings (increased almost five times since FY16).

- Scalable organic growth through corporate traveller (SME) & FCM (TMS) brands.

- FLT registered significant presence across four key regions, delivering consistent growth and strong prospects.

Financial Year 2020 Update

In Australia, FLT recorded a robust growth in the online leisure sales in the first quarter of FY 2020. Few highlights of the same are mentioned under:

- In Australia, the online leisure sales doubled over during the 3 months to September 2019 despite of the challenging trading climate. The company recorded $1.3 billion in TTV globally from leisure websites and online travel agency brands.

- FLT experienced increased costs in early FY20. It introduced the new wage model in October 2018 and paid $4.2 million in wages additionally to its leisure salespeople in Australia during the first quarter in FY20 and incurred the increased consultancy costs early in the year.

- The profits generated via the emerging in-destination businesses was soft, and lower interest earnings depicted the lower yields in the country.

100% Acquisition of Ignite Travel Group

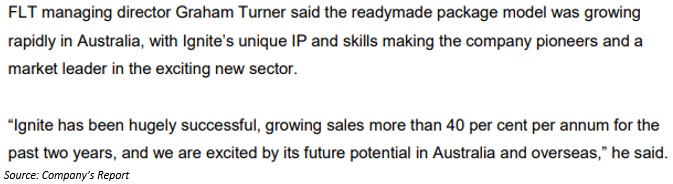

On 20 September 2019, FLT announced the 100% acquisition of Gold Coast-based Ignite Travel Group, where it previously held 49% stake in the award-winning company. The parties have decided to bring up the 100% purchase of Igniteâs NZ and Australia businesses to benefit from the successful âreadymadeâ holiday package version.

This is likely to allow implementation and integration of Igniteâs product suite via the companyâs leisure network. FLT notified that the terms of the acquisitions were confidential, and it will use the existing debts facilities to fund the deal.

FLT Managing Director, Graham Turner commented:

8% Surge in Group TTV in FY 2019

The company announced the financial results for the FY 2019 (for the period ending 30 June 2019), in August:

- FLT Group TTV increased by 8.8% to $23.7 million compared to the previous corresponding period.

- Total Revenue rose by 5% to $3,055 million.

- The companyâs Underlying profit decreased by 10.8 per cent to 343 million.

- Revenue margin declined by 55 bps, largely driven by the business mix changes and the impact of a decline in revenue margin in FCB Australia.

- Cash and cash equivalent of the company stood at $1,172 million (as at 30 June 2019).

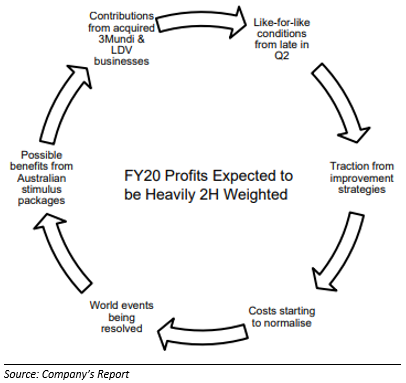

FY 2020 Guidance

The company released its guidance report for FY20 in its Annual General Meeting Presentation. The company expects year on year growth during seasonally busier second- half with 2 per cent growth on FY19. FLT is targeting an underlying Profit Before Tax (PBT) range between $310 to $350 million, upside cost to be circa $10 million and Bentours/Tempo collapse expenses to range between $5.5-$7milliion (to be excluded from the underlying results)

Stock Performance

FLT quoted $40.06 on ASX on 11 November 2019, up by 0.88%, relative to its previous close. The company has ~101.13 million outstanding shares and a market cap of $4.02 billion. FLTâs 52-weeks low and high value are $37.590 and $49.140, respectively. It has generated a positive return of 2.85% in the last six months and a negative return of 1.92% on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.