S&P/ASX 200 Information Technology (Sector) was trading at 1,449.3, up 5.9 points or 0.41% from its previous close, while the benchmark index was trading at 6,651.9, up 4.6 points or 0.07% (on 9 September 2019, AEST 02:04 PM). In terms of the points, the S&P/ASX 200 Information Technology (Sector) index is outperforming the benchmark index. Also, the sector has broken its important resistance level at 1,449.3, which indicates that there is a high probability that the index may move upward in the near future.

Let us have a look at how some of the IT sector players are performing on the ASX. The stock of Nearmap Ltd (ASX:NEA) was trading at $2.740, down 0.364% from its previous close (on 9 September 2019, AEST 02:05 PM). The company has a market cap of $1.24 billion and approximately 449.96 million outstanding shares.

The stock of Afterpay Touch Group Limited (ASX:APT) was trading at a price of $34.090, up 0.62% from its previous close (on 9 September 2019, AEST 02:05 PM). Its market cap stands at $8.56 billion, while the company has ~ 252.64 million outstanding shares.

The stock of Altium Limited (ASX:ALU) was trading at $37.975, up 2.524% from its last closing price (on 9 September 2019, AEST 02:05 PM). ALUâs market cap is $4.85 billion with ~ 130.97 million outstanding shares.

The stock of Xero Limited (ASX:XRO) was trading at $67.000, up by 0.752% from its last closing price (on 9 September 2019, AEST 02:05 PM). XRO has a market cap of $9.4 billion and ~ 141.37 million outstanding shares.

The stock of Appen Limited (ASX:APX) was trading at $25.880, down 0.919% from its last closing price (on 9 September 2019, AEST 02:05 PM). APXâs market cap is $3.16 billion with approximately 120.98 million outstanding shares.

Source: ASX, as on 9 September 2019, AEST 02:05 PM

Letâs have a look at the recent updates of these companies.

Nearmap Ltd

Nearmap Ltd (ASX:NEA), a provider of geospatial map technology for businesses, enterprises as well as government clients, recently announced the appointment of Ms Tracey Horton AO as an Independent Non-Executive Director, effective from 1 September 2019. Ms Horton holds significant experience in global strategy.

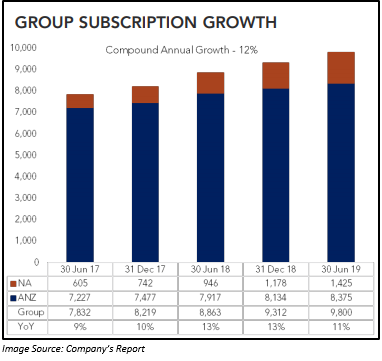

On 21 August 2019, Nearmap announced its FY2019 results for the period ended 30 June 2019. NEA reported a 36% increase in group annualised contract value to $90.2 million. The statutory revenue of the company increased by 45% to $77.6 million as compared to the prior corresponding period (pcp). Global subscriptions during the period were 9,800, representing a year-on-year increase of 11%, while the Groupâs average revenue per subscription was $9,208, a rise of 23%. The group customer churn rate, decreased from 7.5% in FY2018 to 5.3% in FY2019.

Afterpay Touch Group Limited

Afterpay Touch Group Limited (ASX: APT), a technology-driven payment company that aims to offer its customers with an amazing purchasing experience, recently released its FY2019 results.

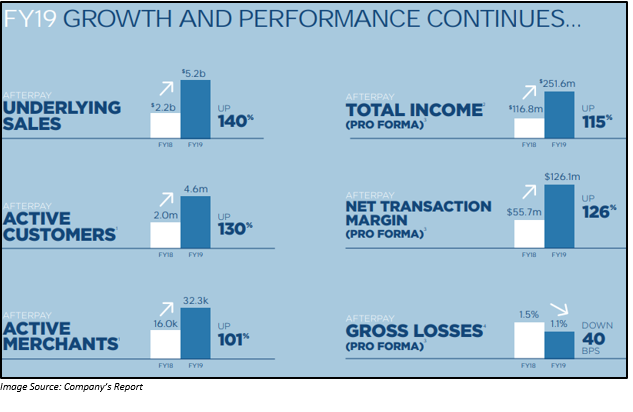

The global underlying sales of the company in FY2019 increased by 140% to $5.2 billion. The number of active customers increased by 130% to 4.6 million and above 5.2 million as at 23 August 2019. At present, over 12,500 new customers join the global platform in a single day. The number of active merchants during the period increased by 101% by the end of FY2019 and reached 35,300 as on 23 August 2019. Growth reported by the company in the regions of the US and the UK exceeded APTâs expectations.

More than 200k UK clients signed up in the 1st 15 weeks, which was above the US in the same time frame post-launch. The company also entered into a strategic partnership with VISA during the period with an aim to support its future expansion and platform innovation. Australia and New Zealand continue to grow strong with more than $1 billion of underlying sales since inception.

There was an increase in the total Afterpay pro forma income by 115% to $251.6 million. The gross loss declined from 1.5% in FY2018 to 1.1% in FY2019. The balance sheet of the company remained strong to scale and compete on a global scale.

Altium Limited

Altium Limited (ASX: ALU), a leading provider of PCB design software, on 6 September 2019 announced that director Wendy Stops had transferred some of ALUâs stock from one personal holding to a new one with no change in his total beneficial shareholding.

ALU on 3 September 2019 released an announcement providing a notice of initial substantial holding, unveiling that Mitsubishi UFJ Financial Group, Inc. has become a substantial holder in the company with 7,157,117 fully paid ordinary shares of the company, translating into a 5.46% voting power.

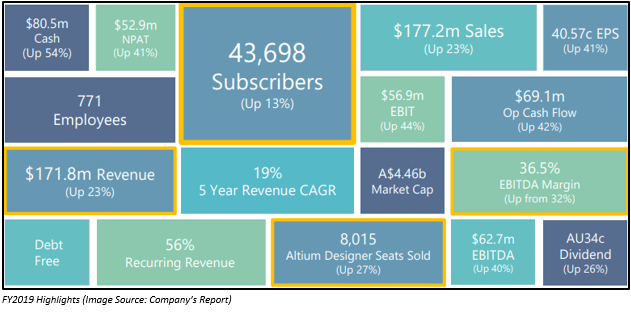

On 19 August 2019, ALU released its outstanding financial results for the period ended 30 June 2019. ALU was able to achieve excellent revenue growth of 23% to US$171.8 million across all its business segments as well as key regions during the period. The net profit of ALU increased by 41% to US$52.9 million and EPS grew by 41%. The number of subscribers exceeded 43,600 subscribers. The company reported a strong performance from the US and the EMEA region. Revenue from the US region increased by 14%, while from the EMEA region grew by 20%. There was a 17% growth in the Board and Systems revenue to US$126.8 million. The Octopart® product of the company contributed 49% towards revenue and TASKING® delivered an increase of 37%. The EBITDA margin increased from 32% in FY2018 to 36.5% in FY2019. EPS increased by 41% to 40.57 cents and operating cash flow went up by 42% to US$69.1 million. ALU declared a final dividend of A$ 18 cents per share.

Xero Limited

Xero Limited (ASX: XRO), an IT sector player that offers small businesses with online accounting software, recently conducted its AGM and released a presentation on 15 August 2019.

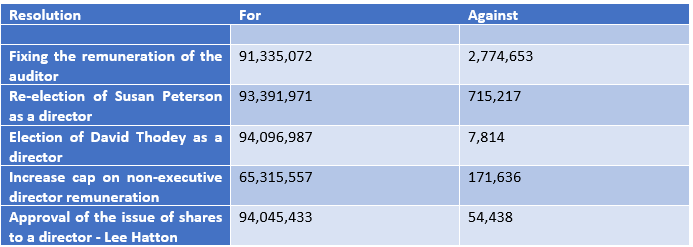

The presentation included the resolution for fixing the remuneration of the auditor, the re-election of Susan Peterson as a director, election of David Thodey as a director, increasing the upper remuneration band of non-executive director remuneration and approval of the issue of shares to a director - Lee Hatton.

Source: Companyâs Report

The company also highlighted its FY2019 performance for the year ended 31 March 2019. XRO has a strong business model with annualised monthly recurring revenue (AMRR) of $154 million. AMRR represents a more than 32% growth in a y-o-y term. The free cash flow increased by 35% y-o-y to $6.5 million. The operating revenue of the company increased by 36% to $552.8 million.

Appen Limited

Appen Limited (ASX:APX), a provider of high-quality training data to enhance machine learning at scale, recently released its half yearly results for the period ended 30 June 2019.

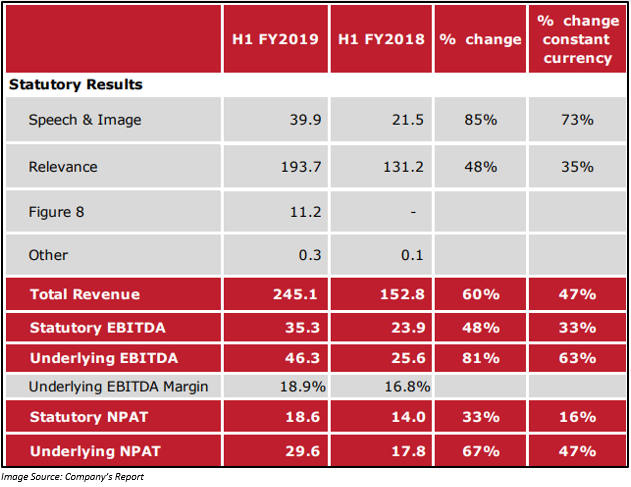

APX reported an increase of 60% in its revenue to $245.1 million. Underlying EBITDA went up by 81% to $46.3 million, while statutory EBITDA grew by 48%. Underlying NPAT increased by 67% to $29.6 million, and statutory NPAT increased by 33% to $18.6 million. There was an increase of 48% in relevance revenue to $193.7 million. Leapforce got fully integrated, while Figure Eight is speeding up the technology roadmap, helping the company in diversifying its revenue and expanding markets.

The company also delivered a strong core performance in speech and image data.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.