With the market close on 9 July 2019, the S&P/ASX 200 Information Technology (Sector) was down by 1.78%. The index closed at A$1,348.8.

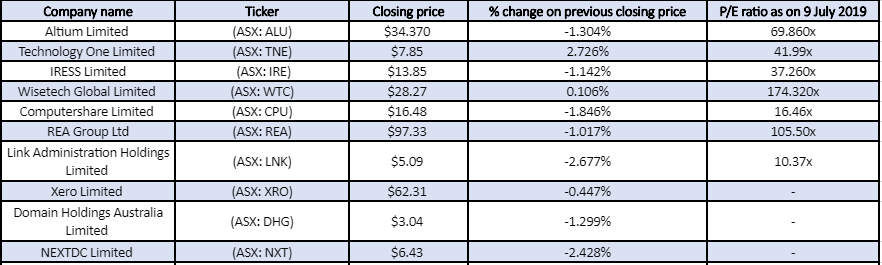

Few popular IT stocks with its closing price as on 9 July 2019 and their PE ratio.

Data as on 9 July 2019 (Source: ASX)

On 8 July 2019, David Kirk, the Chairperson of Bailador Technology Investments Limited (ASX:BTI) stated to a prominent media house that making an investment in the technology stock is quite risky, albeit technology stocks come at a premium.

Bailador Technology Investments Limited is a specialist investor in the information technology and media sectors, and its investment team has more than fifty years of collective experience in corporate, private equity as well as expansion capital investment.

About valuation:

Valuation is the analytical process which helps in understanding the worth of any particular asset or business. There are various methods and factor using which the analyst tries to do a valuation for any specific company.

There are factors such as the capital structure of the company, its future prospect, business management, which helps in the valuation of a particular company.

Valuation helps the investor to identify the fair value of any stock. An analyst or an investor does valuation of any particular stock to find if the stock in which he/she wants to invest is overvalued or undervalued.

Valuation at the early phase of investment is generally based on price per share the investor is willing to pay to invest in the company. The valuation at the end implies the per share amount which the investor receives in case of liquidation, M&A, IPOs etc.

To explain this, in case an investor initially values a company at $30 million with 10 million outstanding shares, then per share value would be $30 million/10 million, which is equivalent to $3 per share. Now, in case this company is acquired by some other company at $120 million, then the value of each share would now be $12 per share, and the investor can gain $9 per share if the investor could buy the company at $3 per share from the stock market.

The investors also prefer P/E ratio when they do the valuation of the company. P/E helps in identifying whether the stock in which the investor prefers to invest is overvalued or undervalued. A higher P/E ratio could indicate that the investor assumes that the company would give a better return in future. It also shows the amount which the investor would pay in order to earn $1 of that particular stock. However, the stock with higher P/E ratio are generally overvalued and could not be essentially considered as a better strategy for making an investment as there is a risk of losing money in case it does not meet the expectation of the investor.

On the other hand, there are many investors who buy undervalued stocks, i.e. stocks with lower P/E ratio and make a profit in case the price goes high for that particular stock.

Australia is a mineral rich country, and the statistics of Australia says that people invest more into minerals, lots of retail, lots of financial services. Now, the local interest is seen more towards the IT sectors. As compared to other sectors, the information technology sector is new, and they often provide a better return to their investors.

There is a famous quotation from Warren Buffet where he says, âBe fearful when others are greedy and greedy when others are fearfulâ. When the investors are greedy, it is a time when other needs to be careful in case they make overpayment for an asset which could lead to poor returns. On the other hand, when others are fearful about any particular stock, it is an opportunity for buying that particular stock.

It should also be noted that the value of any particular stock is in relation to the earnings which it generates over the life of the business. The value of the stock is determined by discounting all the future cash flows and calculating the present value of that stock.

In Australia, it is seen that now that people are more attracted towards the IT sector stocks. If compared to the statements of Warren Buffet, we can say that the Aussies have become greedy with respect to the IT sector stocks in anticipation of better return in the future. People generally prefer these stocks as these stocks provide better earnings. The value of these stocks is also high due to good predictions. Also, the product of the IT sector stocks is much in demand from other sectors as well, which helps the prices to move up on ASX.

Apart from that, in Australia, many stocks from NASDAQ also prefers to get listed on ASX, and few technology companies recently got listed on ASX. These also influence the Aussies towards the IT sector stocks and also indicate that the IT stocks are getting a premium valuation in Australia.

In the recent IPOâs, out of 8 IPOâs 5 stocks were from the information technology sector, and they belong to the United States. The success of the Australia Tech companies such as Wisetech Global Limited (ASX: WTC), Afterpay Touch Group Limited (ASX: APT), Altium Limited (ASX: ALU), Appen Ltd (ASX:APX) and Xero Limited (ASX: XRO) have influenced these US-based stocks to get listed on ASX.

Recently, San Francisco based company Life360, Inc (ASX: 360) also made its debut on ASX.

There have been instances in the past where the investors were impacted because of stock over valuation. The best example was the dot com bubble, which is also known as the internet bubble. Dotcom bubble was the outcome of an increase in the valuation of the US tech stock exponentially in the late 1990s, and the NASDAQ index increased from 1,000 to 5,000 in the year from 1995 to 2000. In 2001 and through 2002, these stock entered the bear market. The NASDAQ index crashed and the value which was reported 5,048.62 on 10 March 2000, tumbled and reached 1,139.90 on Oct 4, 2002. Many blue-chip companies during that period reported a significant fall in their share price, above 80%.

However, the Australian IT stocks are not in a valuation bubble as their US counterparts in the 2000s, however they are not cheap either. As seen in the above chart many of the IT stocks are trading at a high multiple, in few cases, upwards of 100x.The benchmark index ASX 200 is trading at a PE multiple of ~16-17x, at the same time S&P/ASX 200 Information Technology is trading at 26.74x (Source Thomson Reuters).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.