Iron ore prices have shown promising recovery in the international market and Australian iron ore miners such as BHP Group Limited (ASX: BHP) and Rio Tinto (ASX:RIO) are gaining attraction over their increase stance to slash the value chain emission.

Iron Ore Price Actions

The iron ore prices in China (DCIOF0) rose from RMB 619.0 (Dayâs low on 25 September 2019) to the present level of RMB 659.90 (as on 30 September 2019 1:05 PM AEST), which in turn, underpins an increase of over 6.60 per cent.

Likewise, the prices recovered on the CME (October Series TIOV9) from the level of USD 87.75 (Dayâs low on 24 September 2019) to the level of USD 89.72, while the current Bid is at USD 91.35 (as on 30 September 2019 1:24 PM AEST).

Factors Fanning Iron Ore

The iron ore prices are currently being supported by the re-stocking from the Chinese mills ahead of the golden week of the National holidays starting from 01 October 2019. However, recently, the local authorities and government have implemented stricter environmental regulation, which marked slower iron ore deliveries from the ports in China. The tighter regulation in China also exerted pressure on crude steel production.

Also Read: Iron Ore Prices Subdued Ahead of National Holidays in China

Iron Ore Ports Delivery and Crude Steel Production

The iron ore deliveries from significant Chinese ports fell for the week ended 27 September 2019 amid restrictions imposed by the local authorities on-road transportation and steel production. As per the data, the iron ore deliveries plunged by 375,000 metric tonnes for the week ended 27 September 2019 to average at 2.46 million metric tonnes from the major Chinese ports.

Crude Steel Output

The daily output of crude steel across the key mills of China Iron and Steel Association (or CISA) averaged at 2 million metric tonnes during the first ten days of September 2019, down by 14,000 metric tonnes against the previous corresponding period.

Also Read: CISA Crack Down on Iron Ore Prices kept RIO and BHP Under Duress

While the environmental regulations are getting stringent across the globe, the Australian iron ore miners are engaging into the activities to curb down their value chain emission, which could support the miners in their task of long-term sustainability.

Australian Miners Value China Emission

The Australian iron ore behemoth-BHP Group is taking strong actions to curb down its operational and value chain emissions. The company is focused on both upstream and downstream scope 3 emissions (or value chain emissions) for the long-term substantiality.

While BHP disclosed the actions taken and considered by the company to tackle the value chain emission, its rival Rio Tinto (ASX: RIO) is also considering of decreasing its scope 3 emission to survive in the tighter environmental regulations.

To Know More, Do Read: BHP Climate Focus- A Ticket to Long-Term Sustainability?

Rio Tintoâs Environmental Responsibility

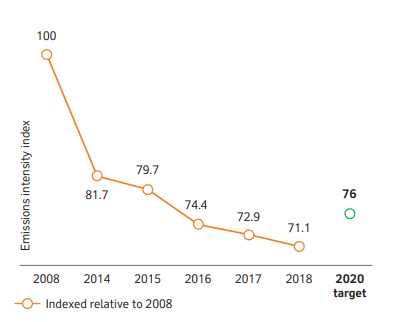

Rio Tinto published its Environmental Report in 2018, in which the company targeted a 10 per cent reduction in its operational emission. The target of the company would end in 2020 by which Rio plans to reduce the emission intensity by 24 per cent against the 2008 baseline.

Emission Intensity (Source: Companyâs Climate Report)

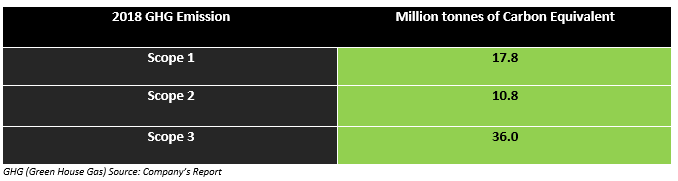

The 2018 emission profile of the company stood as below:

Rio is now focused on its Scope 3 value chain emission, which remains an imminent threat to the companyâs Pilbara iron ore operations.

Rio Eyeing at Scope 3 Emission Cut

Rio Tinto recently signed a Memorandum of Understanding (MoU) with Chinaâs largest steel producer and one of Chinaâs most prestigious and influential universities to develop and implement new methods to slash out the GHC and improve the environmental performance of the steel making value chain.

CISA invited Rio and other parties including the giant steel producer- China Baowu Steel Group and Tsinghua University to sign the MoU at the 19th Chinaâs International Steel and Raw material Conference held in Qingdao.

The Memorandum would aid in the creation of the joint working group aimed at curbing the carbon emissions.

The scope 3 emission of the iron ore industry accounts between 7 to 9 per cent of the worldâs carbon emissions, and the working group would establish a joint action plan to utilise the best of the engaged partiesâ complementary strength in research and development, technologies, processes, logistics, etc., to address the climate change.

Rio produces the raw material for many primary metal markets, and the company had achieved significant results on curbing down the value chain (Scope 3) emission in the past.

Rioâs Elysis Joint Venture

In 2018, the company in partnership with Alcoa, Apple and the government of Canada and Quebec announced the worldâs first carbon-free smelting process

The Elysis Joint Venture of the company, that develop and commercialise inert anode technology is among the most innovative process in the aluminium industry for over a century. The process eliminates all greenhouse gas emissions from smelting and also produce oxygen as a by-product.

The innovative process of the Joint Venture, which reduces the operating cost and increase productivity is planned to be installed at new smelting facilities or retrofitted to existing smelters.

To wrap up, climate change presents a substantial challenge to the global markets and for producers of raw materials such as Rio and BHP. The inclusion of climate policy into the strategic planning process marks a significant move from Rio to contribute its amount of share into the global stance to curb the greenhouse emissions.

Rio reduced 43 per cent of its emission footprints since 2008 to 2018 and the company is actively pursuing new technological solutions that would support the company over the long-term to reduce its carbon footprints across the operational and value chain.

Rio and BHP both have shifted the majority of their operational energy demand to renewable resources; however, the value chain emission of the raw material suppliers are surmounting. Nevertheless, both the giant miners are taking significant steps to curb their value chain emission, which could provide these miners with long-term sustainability.

Rio prices last traded at $92.670 (Dayâs close on 30 September 2019), while BHP last traded at $36.720 (Dayâs close on 30 September 2019).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.