According to the International Air Transport Association (IATA), the uncertainty around global economic growth prospects may have consequences on the aviation industry-wide passenger yields and financial performance amidst trade tensions, rising fuel prices and a slumping cargo market.

Worldwide, the recent uptrend in jet fuel prices is also expected to impact the global aviation industry total fuel bill and the profitability outlook.

Government Agency, Tourism Australia is continuously striving to enhance the economic benefits of tourism to the country, and works closely with airlines, Australian airports, and State and Tourism organisations (STOs) to market existing and new routes, assisting in building demand and growing sustainable aviation capacity to Australia.

Also, air access is one of the key elements in achieving the Australian tourism industryâs long-term goal of reaching the annual tourism expenditure to as much as $ 140 billion by the end of the decade in line with the Tourism 2020 strategy.

Within the Australian aviation industry, certain low-cost carriers are doing well with Qantas low-cost offshoot Jetstar at the forefront of this category. The advent of low-cost carriers chipped away at the dominance of full-service airlines and made air travel accessible to millions of people posing greater competition for the industry. Jetstar is a money-making machine for Qantas which is already doing well.

Qantas Groupâs key Frequent Flyer program generated around USD 1,144.8 million in 2018 globally, while Virgin Australiaâs Velocity program generated USD 275.46 million. In addition, Qantas and Virgin Australia also made it to the top ten airlines worldwide with high Ancillary Revenue per Passenger.

Letâs take a look at some of the prominent Australia aviation industry players.

Qantas Airways

Qantas Airways Limited (ASX: QAN), based in New South Wales, Australia, provides transportation of passengers through two airlines - Qantas (full-service carrier) and Jetstar (low cost carrier), operating international, domestic and regional services. In addition, the company also operates Qantas Frequent Flyer and Qantas Freight that offer diverse revenue streams.

The Groupâs market cap stands at ~ AUD 9.12 billion, with ~ 1.57 billion shares outstanding. On 30 July 2019, the QAN stock settled the dayâs trading at AUD 5.855, up 0.775% with ~ 6.84 million shares traded.

Trading Update Q3 FY19 - The revenue growth for the third quarter of FY19 displayed continued uptrend as it remained on track to fully balance out the effects of high fuel costs compared with 2018. Reportedly, the Groupâs total revenue increased by 2.3% to $ 4.4 billion and Group Unit Revenue was also up by 4%. Moreover, the Domestic Unit Revenue of the Group also climbed up 1.1 %, as expected given the shift in the Easter timing.

Interestingly, Qantasâ market share of the total corporate travel revenue improved by 2.5% in the period to a three-year high, despite a net reduction witnessed in capacity. The ancillary revenue per passenger for the broader Jetstar Group witnessed an 8% uptick in Q3 FY19, supplemented by Club Jetstar membership and new luggage options.

During the concerned period, Qantas and Melbourne Airport also reached an agreement for the sale of the airlineâs domestic terminal and secured future access (10-year) to Terminal 1 for $ 355 million. The proceeds for this sale would be accounted for in FY19 results.

In February 2019, the Group had commenced a share buyback of up to $ 305 million which was reportedly 54 % complete as of 6 May 2019, with 29,477,272 shares acquired. Besides, a dividend of 12 cents per share (fully franked) was also paid out on 28 March 2019.

According to Qantas Group CEO Alan Joyce, with the resources sector continuing to grow, the Group is capitalising on that with a lot of extra flying in Western Australia and Queensland along with a strong leisure demand as well.

Virgin Australia

Queensland-based Virgin Australia Holdings Limited (ASX:VAH) is A full-service airline running domestic and international operations. The Groupâs market capitalisation is circa AUD 1.35 billion, with approximately 8.45 billion shares outstanding. On 30 July 2019, the VAH stock price settled the dayâs trading at AUD 0.165, climbing up 3.12% by AUD 0.005 with ~ 426,349 shares traded.

Recently on 11 July 2019, Virgin Australia updated the stakeholders that Connectivity Pte Limited (Affinity) was considering exiting from its ~35% minority investment in Velocity Frequent Flyer Holdco Pty Limited and requested that various exit options for the sale of its stake be considered.

On 4 July 2019, Virgin Australia announced that the Australian Competition and Consumer Commission (ACCC) had granted interim authorisation for the company to cooperate with Virgin Atlantic on flights between Australia and the United Kingdom/Ireland, via Hong Kong, Los Angeles and any other future mutual connecting points.

This recent development would enable the two carriers to coordinate on a number of subjects such as jointly handling and setting prices, inventory, and managing marketing strategies, which was beyond the ambit of their existing armâs length commercial codeshare and loyalty arrangement.

Trading Update â In May 2019, VAH provided earnings guidance for the 2019 financial year based on then prevailing economic circumstances, capacity and forward booking trends. According to the Groupâs expectations, FY19 underlying earnings would be a minimum $ 100 million lower compared to the FY18 comparative result of $ 64.4 million, reflecting the ambiguity around revenue trading conditions in the local market as well as annual fuel and foreign exchange headwinds of over $ 160 million.

The Group forecasted revenue growth of 6% for the full year as it moderated throughout the second half of FY19 with a backdrop of weakening in demand from both leisure and corporate sectors, driven by lower consumer and business confidence, consumer outlay and the due to the Federal Election. Moreover, the corporate side of the business was experiencing the impact of timing of the Easter holiday period and had been slowly recovering from the Election impact.

Alliance Aviation

Queensland, Australia-based Alliance Aviation Services Limited (ASX: AQZ) provides contract, charter and allied aviation services while specializing in the transportation of its mining and energy customers' employees and contractors to and from remote locations.

Its operation bases are located in Brisbane, Townsville, Cairns, Melbourne, Adelaide, Perth, Rockhampton and Darwin.

The company has a market capitalisation of circa AUD 367.76 million with approximately 125.52 million shares outstanding. On 30 July 2019, the AQZ stock price settled the dayâs trading at AUD 2.950, up 0.683% by AUD 0.020 and ~ 58,937 shares traded.

Recently on 29 July 2019, Alliance Aviation Services announced the extension of the air charter services agreement with BHP WA Iron Ore for a further two years.

Earlier in the same month, the company informed that it had reached a binding purchase agreement with Swiss airline Helvetic Airways AG for the purchase of five Fokker 100 aircraft and the entirety of Helveticâs spare engines, parts and tooling.

Trading Update FY19 â On 20 June 2019, the company disclosed that so far, the trading performance for FY19 had been positive with a continuation of Allianceâs safe and reliable operations along with industry leading on time performance of 95%.

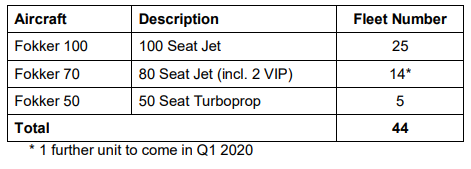

The company expects to achieve a Profit Before Tax for the year ended 30 June 2019 in excess of $ 32.5 million, which would be the best profit performance in the companyâs history of 17 years. Besides, it also mentioned that by the end of the full year 2019, the operating fleet at a minimum would be â

Source (Companyâs Report)

The company would further provide an outlook with the disclosure of full year results on 8 August 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.