Summary

- Australia has had a difficult FY2020, ravaged first by the bushfires and then the ongoing COVID-19 pandemic.

- Companies that demonstrated resilience, came up with innovative solutions, and tapped the pandemic-led opportunity in H2 were the ones that evolved as the winners of FY2020.

- BNPL players like Afterpay were amongst the companies that grew their customer base in the period due to the rise in the cashless transaction.

- Biotech giant CSL signed a partnership with the University of Queensland and CEPI to develop and manufacture COVID-19 vaccine.

- Zoono picked up in CY2020 as it was able to meet the unprecedented demand of its hand and surface sanitisers.

While COVID-19 has had a severe impact on most of the businesses, few players have come out as winners. This is because of the demand for their product and services, their ability to adapt to the changing environment, and the resilience shown in times of uncertainty.

In this article, we would look at five such companies and assess them based on three parameters: emerging trends, the business stability, and disruptive nature of business.

Afterpay Limited (ASX:APT)

Emerging trends

COVID-19 has brought a radical change in the way people make payments with more people shifting to cashless transactions. People, across generations, prefer debit card over cash, and BNPL over credit.

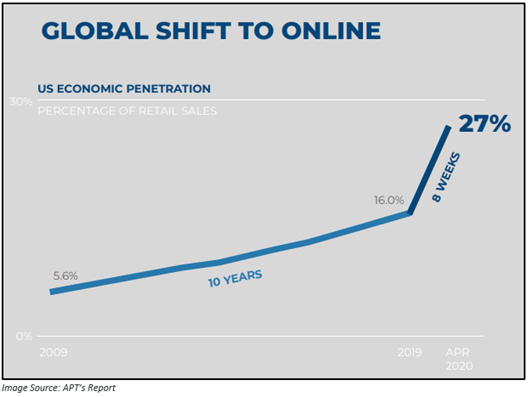

There has been an increase in online adoption. In April 2020, Australian online retail growth was 11.1%. Afterpay noted that nearly 80% of its customers were actively using its mobile app.

At present, if we look at the change in total spending, payment of transaction through BNPL payment is more, while cash and card usage have dropped significantly. The new customer segment adopting BNPL segment is older and members of higher income brackets.

Stability:

Post the crisis, experts believe there would be a drop in the traditional payment method with significant growth in debit card and decline in cash and credit card.

Many Millennials have turned away from credit cards. Afterpay confirmed that 94% of Gen Z use debit cards on its platform. One in every three dollars spent is by millennials and Gen Z. As Gen X and Millennials have grown up, their expenses for younger households surged at an increased rate than older households.

Do Read: Bonus items for BNPL Players: APT, Z1P, FXL

Disruptive business:

Afterpay offers a single integration to the ATG system platform that provides instant access to various scalable services. The platform provides:

- Perimeter Protection

- Identification and Activation

- Transaction Integrity

- Fraud Protection

- Compliance Systems

- Data Collection and Analysis

- Card Not Present Payments

- Card Present Payments

Xero Limited (ASX:XRO)

Emerging trends:

On 24 June 2020, Xero announced that it had extended its partnership with DBS Bank so that more SMEs can adopt cloud-based accounting and software services.

Offered in partnership with Enterprise Singapore and Info-communications Media Development Authority, eligible SMEs referred through DBS under the SMEs Go Digital Programme would have free access to Xero’s accounting platform to transform their digital capabilities and prepare themselves for the digital economy.

With the accounting software, these SME’s can create e-invoices with automated reminders, reducing the risk of cash flow issues arising because of the late payments from their clients.

Through the DBS Start Digital program, SMEs who are new to digital technology can choose two digital solutions from five categories like Accounting, Cybersecurity, Human Resource / Payroll, Digital Marketing and Digital Transactions.

Stability:

Small businesses that have been hit hard amid COVID-19 crisis will take longer to recover. During this time, companies must monitor their cash flow and decide on accurate and up-to-date financial information. Xero’s partnership with DBS will allow SMEs to do that when these things are back on track & create more robust businesses for the future.

Do Read: Journey of 5 Tech Shares over the last three months – XRO, 360, RHP, BTH, SKO

Disruptive businesses:

Xero provides secure online accounting software that allows working from any location, share with the employees & work together with the advisors. Its features are:

- Keep accurate records

- Keep watch on business health

- Get paid faster

CSL Limited (ASX:CSL)

Emerging trends

- On 25 June 2020, CSL stated that it had agreed to purchase from uniQure global license rights to market an adeno-associated virus gene therapy program, AMT-061 to treat patients suffering from haemophilia B. The program is presently in Phase 3 clinical trial. It could be amongst the first gene treatments to give potentially long-term benefits to haemophilia B patients.

- CSL, on 9 June, announced that it agreed to exercise its right to acquire biotech Company Vitaeris that focuses on Phase 3 development of a therapy for rejection in solid organ kidney transplant patients.

- CSL also entered into a partnership with the University of Queensland and CEPI to progress the development & manufacture of COVID-19 vaccine.

Stability:

Research is in the DNA of CSL since the Company started in 1916. The Company’s research is central to any of its action plan. CSL team comprise of more than 1,700 R&D experts engaged in developing and delivering new therapies to solve unmet medical needs and save lives. Further, the Company has created amongst the largest & most effective plasma collection networks in the world. Biotechnology is still in its early days and has enormous potential in the future for a wide range of serious and life-threatening diseases.

Do Read: How CSL is combating with the COVID-19 Pandemic?

Disruptive businesses:

CSL is famous as a biotechnology leader with a dynamic portfolio of life-saving products and a reputation for always putting patients first. The has expertise protein biotherapeutics, influenza vaccines and other biologics.

Fortescue Metals Group Ltd (ASX:FMG)

Emerging trends

Fortescue Metals Group Limited has opened Fortescue Hive, which is its newly expanded Integrated Operations Centre that uses the latest technology to bring together the Company’s wholly-owned and integrated supply chain.

The purpose-built facility comprises of Fortescue’s planning, operations, and mine control teams, along with the port, rail, shipping as well as marketing teams who would focus on delivering improved safety, dependability, effectiveness, and commercial results.

Stability:

Being amongst the largest iron ore producers in the world, FMG owns and runs integrated operations covering two iron ore mine hubs along with a fastest heavy haul railway in the world.

It has a presence not only in Australia, but it is building on its superior exploration skills, operational reputation, and potential of its people through early-stage exploration in extremely prospective regions. FMG is exploring opportunities across South America, including Ecuador, Colombia, and Argentina.

Read Here: Fortescue Metals Breaking All Records!! Here’s Why?

Disruptive businesses

FMG is involved in mining, processing, and shipping iron ore from the deposits of FMG that are within the Pilbara region of WA.

The Company was founded in 2003, and since then it has discovered and developed major iron ore deposits and constructed some of the most significant mines in the world. It has evolved itself amongst the largest global iron ore producers.

FMG has maintained consistency of shipping ~170 million tonnes of iron ore each year and is the lowest cost provider of seaborne iron ore to China.

Recent Update: On 16 June 2020, FMG declared industry-leading emissions cut goal to attain net zero operational emissions by 2040. The step taken would position the Company as a leader in addressing the global climate change challenge.

Zoono Group Limited (ASX:ZNO)

Emerging trends

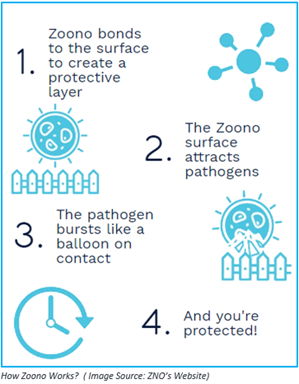

Zoono Group is the top specialist in antimicrobial safety, and it focuses on the development, production & global distribution of enduring & environmentally friendly antimicrobial solutions.

Fighting against harmful germs is the future of antimicrobial technology. The product manufactured by the Company acts as a daily germ Defence for the family.

The skin and surface sanitisers are formulated in a way that it can kill the strongest germ for longer, without tough chemicals.

Stability

Zoono continues to have a keen interest in the market at a time when most countries are under stress amidst COVID-19 pandemic. There is still uncertainty related to the duration the virus would continue.

During this period, the Company has signed multiple agreements. Some of them are:

- Distribution agreement with Eagle Health Holdings Limited: Disruptive businesses under which Eagle Health will organise for bulk import of the Company’s formulations to its wholly-owned pharmaceutical facility in Xiamen China.

- On 29 April 2020, ZNO an Exclusive Distribution/Partnership Agreement with Johns Lyng Group (ASX:JLG) as part of COVID-19 response. The agreement is for five years and can renew for next five years.

Do Read: 4 Stocks That Hit the Pot of Gold in 2020- WOA, ZNO, SGO, MMM

Disruptive businesses

Zoono’s business is built on a strong foundation of research, and it obeys to guidelines followed globally. Further, it passed PAS 2424, EN13697, EN1276 and EN1650 amongst many more antimicrobial efficacy tests.

Stock Information: