Summary

- ASX-listed Iron ore stocks are witnessing a sentiment splash in the market over the rise in iron ore price amidst supply shortage from Brazil.

- Fortescue Metals Group Limited (ASX:FMG) is emerging as the poster boy among ASX-listed iron ore stocks and is currently shattering all records with prices continuously contouring new record highs.

- The market estimates that the Company would witness a record revenue in FY2020 amid higher side revised shipment guidance and higher average realised price on sales.

Iron ore is among top-most commodities, that has witnessed a strong rally in the middle of COVID-19 fear across the globe. The rise in prices of iron ore has seeded positive sentiments in the investing community, which in turn, has supported the stock price of many ASX-listed iron ore stocks such as Fortescue Metals Group Limited (ASX:FMG), and many others.

ASX-Listed Iron Ore Stocks

ASX-listed iron ore stocks are under a sentiment splash with many such as BHP Group Limited (ASX:BHP), Rio Tinto Limited (ASX:RIO), Champion Iron Limited (ASX:CIA) witnessing strong price move due to the disruption in the global supply chain.

Also Read: Rio Tinto Under Community Backlash After Blasting Indigenous Site

Both Brazil and Australia, two-largest iron ore suppliers to China, had seen a blow of bad weather conditions with heavy rains in Brazil hampering transportation and production side of the iron ore supply chain, while the Tropical Cyclone Damien disrupting daily activities across major iron ore production sites in the Pilbara region.

To Know More, Do Read: Iron Ore Futures At 15-Week High, FMG Hits All time High- ASX Iron Ore Stocks on Upswing

While there has been a lag in the supply chain, the fall in steel inventory across China coupled with improving steel prices in the domestic as well as in the international market is now prompting steel mills in China to procure iron ore, which is further fanning the robust demand for the commodity.

The lag in the supply chain is briefly propelling ASX-listed iron ore stocks, and Fortescue Metals Group Limited (ASX:FMG) is emerging as the poster boy among them. In the status quo, a top court dropped the Company’s bid against the Federal court decision related to the Aboriginal land on which the Solomon iron ore mine is located; however, despite that the stock seems to be climb the wall of worries and is again hitting record highs with stock prices reaching $14.600 (as on 1 June 2020, 2:02 PM AEST).

Also Read: Top Court Turns Down Fortescue’s Appeal Over Indigenous Land

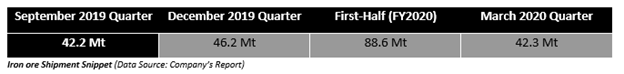

On the performance counter, FMG shipped 42.2 million tonnes of iron ore in the September 2019 quarter, which further surged to stand at 46.2 million tonnes during the December 2019 quarter, which adds to a total shipment of 88.6 million tonnes during the first half of the financial year 2020, up by 7 per cent against the previous corresponding period.

In the recent quarter, i.e., March 2020, the overall shipment took a considerable hit of 9 per cent against the previous quarter to stand at 42.3 million tonnes.

However, despite a 9 per cent decline in the product shipment, an overall increase in the realised price for iron ore supported the financials of the Company, leading to a rise in the stock price.

FMG realised an average price of USD 80.36 per dry metric tonne of iron ore for the first half of the financial year 2020, up by 73 per cent against the previous corresponding period.

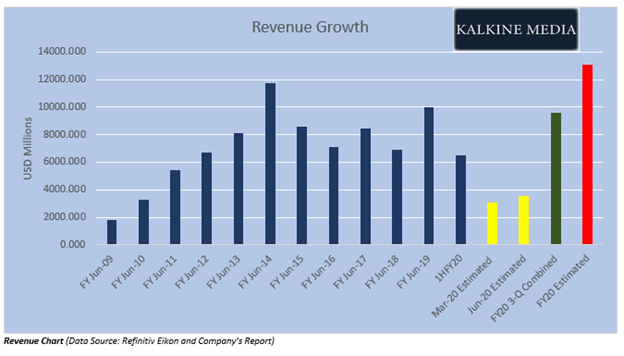

On the revenue counter, it could be seen that the Company generated a revenue of USD 9,965.0 million during FY2019 and the recent three-quarters combined revenue of USD 9,572.9 million, which represent over 86 per cent revenue of the previous financial year, and considering the rally in the iron ore price (which could provide a high realised price ahead) along with the Company’s guidance of 175 million tonnes, is supporting the revenue prospect of the miner, leading to a further gush in the stock price.

If we analyse the shipment pattern and revenue growth, it could be estimated that the Company had shipped 130.9 million tonnes of iron ore (till March 2020 quarter), and it plans to ship 175 million tonnes in FY2020, which leads to the remaining shipment of 44.1 million tonnes.

If FMG ships 44.1 million tonnes to meet its FY2020 guidance and even if we consider that the average realised price would remain the same during the second half of the year, it will lead to an estimated revenue of USD 13,116.776 million for FY2020.

Furthermore, while the market assumes that the Company would meet its previously suggested shipment guidance of 175 million tonnes along with the assumption that the average iron ore realised price would remain around USD 80.36 during the second half of the period, it is pointing towards a new high in the revenue, and in the status quo, FMG has updated its FY2020 shipment guidance to 177 million tonnes, which in turn, is further supporting the market sentiment around FMG, leading to a price gush in the stock which is shattering all of its previous records and continuously marking new record highs.

As on 31 December 2019, FMG had net debt of USD 0.7 billion and cash on books of USD 3.3 billion.

Assumptions Used in Revenue Estimation

While the Company is yet to disclose the revenue for March and June 2020 quarters, to generate the revenue growth scenario, we have considered the March shipment of 42.3 million tonnes and the previous half-year average realised price of USD 80.36 per dry metric tonnes, and likewise, for June estimate, the revenue is being estimated by considering the remaining shipment of the Company’s 175 million tonnes guidance (44.1 million tonnes) and the previous average realised price of USD 80.36 per dry metric tonnes.

Risk Factors, General Assumption, and Other Forecasts

While the market estimates that the iron ore would continue its rally amid supply shortage and robust demand in China, it should be noticed that China is currently facing the risk of a second wave of infection, which is currently being serving as in input in many independent forecasts.

In the general assumption for revenue generation above, it should be noticed that we have not considered the impact of shipment of wet metric tonnes and realised price in dry metric tonnes, which should be further discounted.

Furthermore, the Refinitiv Eikon Thomson Reuters forecast model (median-approach) estimates that the FY2020 revenue would stand at USD 12,162.385 million, which represents ~ 92.72 per cent of the general estimate of revenue above.

It should also be noticed that the revenue generation scenario above only means to reflect the overall trend in the revenue, market trend, and market sentiments, and does not guarantee any accuracy.