In the last one year (from 03 January 2019 to 03 January 2020), S&P/ASX 200 A-REIT (Sector) has delivered a return of 15.70%. The index, on 3 January 2020, closed at 1,587.08, up 0.69% from its previous close. On the other hand, the benchmark index S&P/ASX 200 delivered a 1-year return of 19.53%. On 03 January 2020, by the end of day’s trading, the S&P/ASX 200 closed at 6,733.49, up 0.6% from its previous close.

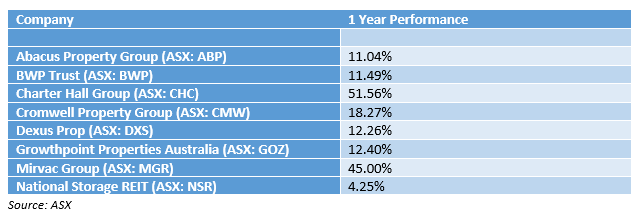

Some of the best stocks which performed well in FY2019 under S&P/ASX 200 A-REIT (Sector) were:

During the quarter ended September 2019, the price of residential property increased by 2.4%, the strongest quarterly growth recorded since December 2016. In the quarter, the property prices increased by 3.6% in both Melbourne and Sydney, by 0.7% in Brisbane, and by 1.3% in Hobart. House prices soared by 4% in Sydney, by 3.7% in Melbourne, whereas attached dwelling prices climbed 2.8% in Sydney and 3.6% in Melbourne.

The residential property prices YTD September 2019 declined by 3.7%. All capital cities, apart from Hobart, reported a fall in residential property prices.

The total value of the 10.4 million residential dwellings in Australia increased by $189.9 billion to $6,869.4 billion during the September 2019 quarter.

Now, the question that comes into mind is that will this sector outperform in 2020 or not.

Let’s first look at some ASX listed companies that delivered a positive return in 2019 and view their 2020 Outlook.

Abacus Property Group (ASX: ABP)

Abacus Property Group, from FY2019 to FY2020, increased its exposure to its key focus sectors of Office and Self-Storage via a series of acquisitions & partnerships. Also, the company had undertaken various transactions to lessen exposure to its non-core legacy investments, especially in the residential as well as retail sectors.

For the FY2019 ending 30 June 2019:

- The Group’s statutory profit declined by 17% to $202.7 million, which was $243.7 million in FY2018.

- The underlying profit tumbled from $183.3 million in FY2018 to $139.4 million in FY2019.

- Distribution per share increased by 2.8% to 18.5 cents as compared to the previous corresponding period.

- Funds from Operations declined by 24% to $129.2 million on pcp.

- Net Tangible Asset per stapled security went up by 4.7% to $3.33 on pcp.

Outlook for FY2020:

ABP remains positive on its outlook as well as market positioning in office & Self Storage Sectors. The company expects that these activities will help it in driving an attractive risk-adjusted return for its stakeholders in short to medium term.

ABP confirms that in FY2020, the distribution guidance would be in between 2% to 3%, payout ratio in FY2020 is expected to increase in between 85% to 95% of the FFO.

Developments during 1H FY2020:

- Completed the $250 million institutional placement by issuing 63.3 million new ordinary stapled securities at $3.95 per share. The fund was raised by the company to accelerate the transition to a more annuity-style, robust asset-backed business model as well as position it for future growth beyond its near-term opportunities. ABP also raised a total of $4.3 million via the share purchase plan.

- Joined a consortium managed by Charter Hall Group to acquire 32% interest in 201 Elizabeth Street, Sydney. The total consideration was for $630 million, which excludes transaction cost, where ABP’s 32% share is equivalent to $201.6 million.

- ABP signed a contract for the acquisition of five Self Storage properties for $57 million.

- It also signed an agreement to acquire 99 Walker Street, North Sydney NSW subjected to FIRB approval by CY2019 end.

Charter Hall Group (ASX: CHC)

For FY2019 ended 30 June 2019, Charter Hall Group reported operating earnings of $220.7 million. OEPS increased by 25.5% to 47.4 cps as compared to the previous corresponding period.

The revenue increased by 53.7% to $378.5 million. Statutory profit for the period was $235.3 million, a fall of 6% on pcp. Distributions increased by 6% to 33.7 cents.

FY2020 Earnings guidance:

- The company expects that in FY2020, there will be growth in post-tax operating earnings per security in the range of 18% to 20% over FY2019.

- The guidance includes CHOT (Charter Hall Office Trust) performance fee of $132 million that will be payable in April 2020, with $50 million already accrued in FY2019 earnings.

- After removing the impact of CHOT performance fees, the post-tax operating earnings growth between 11% to 13%.

- Distribution per share for FY2020 is expected to be 6% over FY2019.

Developments in 1HFY2020:

- Acquired Melbourne CBD Global Headquarters of Telstra for a total consideration of $830 million.

- Announced its investment in a new managed partnership to acquire 49% interest in the portfolio of thirty-seven Telco Exchange properties rented to Telstra Corporation limited having WALE of 21 years.

BWP Trust (ASX: BWP)

For FY2019 ended 30 June 2019, BWP Trust delivered on its financial objectives with a growth of 1.7% in full-year distribution to reach 18.11 cents per unit. The company declared a special distribution of 1.56 cents.

- Total Income in FY2019 increased from $153.4 million in FY2018 to $156.3 million.

- Total expenses increased slightly from $40.2 million to $40.3 million.

- Net profit declined from $183.1 million to $169.4 million.

Outlook:

- The demand for Bunnings Warehouse properties is anticipated to stay steady except if a severe risk incident influences valuations or liquidity in the Australian property sector.

- There would be 44 CPI/ 47 fixed rent reviews in FY2020.

- 11 Bunnings MRR’s is anticipated to complete in FY2020.

- The primary focus would be on completing the results on alternative use sites.

- Negotiating with Bunnings to improve chances to re-invest in the current portfolio.

- Look for acquisition that creates value for the trust.

What could Australia see in 2020?

With a growing Australian population and innovative new technologies, the year 2020 will be the beginning of a new decade where the upcoming generation would see a period that is going to reshape the cities. With the increase in population, Australians will see a growth in their cities, especially outer suburbs. There would be more compact housing, a decline in the ownership of personal cars along with the willingness for a healthy lifestyle.

Let’s see what might happen in 2020:

- ‘Mini Melbournes’ is expected to develop in the outer suburbs.

- Growth in the mixed-use developments.

- There might be a fall in the rate of owing a private vehicle in teens and Aussies in the 20s if they reside in a compact, connected, mixed-use, walkable neighbourhood.

- Climate, environment & health will influence the decision-making process.

- There would also be a growth in the public spaces.

- Townhouses would be a trend amongst Aussies.

- Road, bicycle path and pedestrian path would be separated from each other.

With these upcoming development in 2020, we can expect that a positive influence could also be experiencing a growth in the REIT sector.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)