Silver is skyrocketing in the international market amid demand push and strong fundamentals, which is further propelling the ASX-listed silver stocks. The prices of Australian dollar-denominated silver spot climbed to the level of A$2.953 (Dayâs high on 04 September 2019) and are currently holding the upper levels to trade at A$28.583 (04:50 PM AEST).

The silver spot has rallied over the past three months, and the precious metal started the present month with a bull rush. The prices of Australian dollar-denominated silver spot climbed from the level of A$27.672 (Dayâs low on 02 September) to the level of A$28.953.

Silver on Charts:

XAGAUD Daily Chart (Source: Thomson Reuters)

On the daily chart, the Australian dollar-denominated silver prices recently witnessed a breakout of a symmetrical triangle and the prices of the commodity rallied post that.

On connecting the Fibonacci series from the coordinates marked as 0,1,2 on the chart, we can observe that silver spot is presently taking a hurdle around the 100.0 per cent projected level, which is at A$28.9085. Investors should keep an eye around A$28.9085 as a break above the same could again support the bull rally.

On the other hand, failure to breach above A$28.9085 could generate the bearsâ interest; thus, it could cause a short-term price correction.

The Australian dollar-denominated silver spot is presently trading above 21- and 200-days exponential moving averages, which are at A$26.4280 and A$22.544, respectively. The pair of moving averages could act as immediate support if the silver spot fails to cross A$28.9085 and falls.

Also Read: Central Banks and Gold-backed ETFs led Gold Shine; Whatâs next for the Safe-Haven?

XAU/XAG Ratio:

The gold-to-silver ratio plunged in the international market from the level of 93.34 (Dayâs high on 12 July 2019) post forming a double top pattern on the daily chart. The fall in the XAUXAG ratio further suggested the potential of silver to outperform gold in the middle of the rush for safe havens.

Also Read: Silver to Outperform Gold Ahead?

ASX-Listed Silver Miners

Silver Mines Limited (ASX: SVL)

SVL is an Australian Securities Exchange-listed silver explorer and developer with significant tenements in New South Wales (NSW). The silver project portfolio of the company includes Bowdens, Barabolar, Conrad and Webbs.

Project Portfolio:

Bowdens Silver Project:

The silver prospect of the company is an undeveloped silver deposit in Australia with substantial resources. The Feasibility Study completed by the company in June 2018 consisting of a single open-cut mine based on a maiden Proven and Probable Ore Reserve of 29.9 million tonnes with an average grade of 69.0g/t of silver, suggested an average production of 3.4 million ounces of silver per annum.

The Feasibility also suggested that due to the high grades of ore at the prospect the initial first three years would produce about 5.4 million ounces of silver per annum. The JORC classified Measured, Indicated, and Inferred Resources of the prospect stands at 128 million tonnes with an average grade of 40g/t of silver, which is equivalent to 275 million ounces of silver.

The initial capital cost for the prospect is anticipated to be A$246.0 million including, power supply, mine development, processing plant and the Tailings Storage Facility. The capital costs also mark an additional A$53.9 million expenditure over the 16 years life of mine in sustaining capital.

Barabolar Project:

Barabolar project is a multi-commodity prospect, with over 300 parts per billion of silver soil anomalism, as compared to, up to 100 parts per billion of copper, lead, zinc, etc.

SVL completed a 30-line kilometre DDIP (or dipole-dipole induced polarisation), which returned with both chargeability and resistivity data. As per the company, the high chargeability area is anticipated to be sulphide mineralisation; while the high resistivity is indications toward quartz veining and silicification.

The induced polarised survey assisted the company in generating ten targets proximal to surface anomalism.

Silver Mines is aiming for a comprehensive initial drilling program amid a number of high-order target zones. The drilling program would be up to 7,500 metres of RC and DD drilling.

Stock Movement:

The share price of the company is on a bull from the level of A$0.035 (Dayâs low on 29 May 2019) to the present level of A$0.150 (Dayâs high on 5 September 2019), which in turn, underpinned the growth or price appreciation of over 328 per cent.

South32 Limited (ASX: S32)

South32 operates one of the worldâs largest silver mine-Cannington in the North West Queensland, Australia.

Silver Production at Cannington:

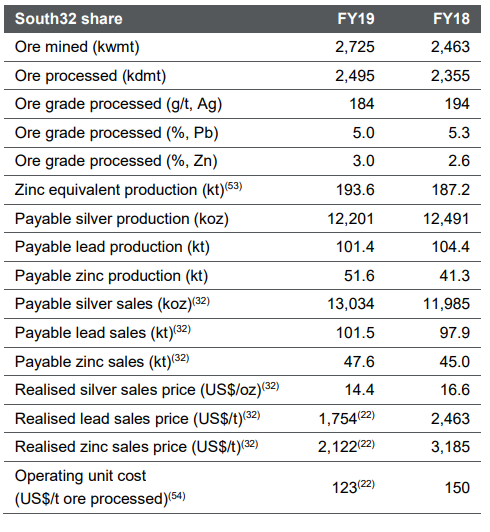

S32 mined 2,725k wet metric tonnes of ores in FY2019 (ended 30 June) at the Cannington underground mine, and processed 2,495k dry metric tonnes of ore. Both higher as compared to the previous year mined and process ore volumes.

The company processed lower grade quality of 184g/t in at the Cannington mine in FY2019, as compared to the processed grade of 194g/t in FY2018. Which in turn, slashed the silver production to 12,201k ounces of silver in FY2019, down by 2.32 per cent as compared to the FY2019 production of 12,491k ounces.

Despite the lower production, the sales volume for silver went up by 8.75 per cent to stand at 13,034k ounces in FY2019 as compared to the sales volume of 11,985k ounces for FY2018.

However, the company realised a lower price for silver sales, and the realised selling price for silver stood at US$14.4 an ounce in FY2019 as compared to the average realised price of US$16.6 per ounce in FY2018.

The operating cost of the Cannington underground mine decreased by 18 per cent to stand at US$123 a tonne of ore processed in FY2019 against the operating cost of US$150 a tonne of ore processed in FY2018.

The summery of Cannington production is as below:

(Source: Companyâs Report)

Stock Movement:

The share price of the company is in a decent up run. It rallied from the level of A$2.360 (Dayâs low on 26 August 2019) to the present high of A$2.750 (Dayâs high on 5 September 2019), which in turn, underpinned the growth or price appreciation of over 16.52 per cent in just few trading sessions.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.