Gold prices are narrowing down and are in and under consolidation; however, the prices are hovering around its new base of USD 1,500 per ounce, which is sufficient for the gold miners to take their exchange option into consideration.

While the ASX gold stocks have shown bearish signs previously, the ending of the September 2019 quarter with strong operational and financial performance is now providing the ASX gold stocks with an upside thrust.

Saracen Mineral Holdings Limited (ASX: SAR)

The company declared a record gold production, for the September 2019 quarter, of 96,324 ounces with a drop of $62 in all-in sustain cost (or AISC), which stood at $964 per ounce for the September 2019 against the previous quarter.

The production at the Carosue Dam stood at 50,590 ounces while the production at Thunderbox stood at 45,735 ounces.

Operational Metrics

Carosue Dam production, which stood at 50,590 ounces with an AISC of $1,234 remained stronger against the previous quarter production of 45,800 ounces of gold with an AISC of $1,183 per ounce.

The operating cash flow of the mine stood at $30.6 million, while net mine cash flow stood at $20.0 million post a growth capital of $10.5 million.

The Karari- Dervish underground mine production stood at 56,100 ounces @3.0 gram per tonne during the September 2019 quarter as compared to the production of 44,500 ounces @2.8 gram per tonne.

The stoping at the mine would continue to ramp up the production, and SAR would consider Karari- Dervish as one mine.

The mill at the Carosue Dam processed 591,000 tonnes of ore with an average grade of 2.9 gram per tonne with the metallurgical recovery of 93.7 per cent. In June 2019 quarter, the mill processed 604,000 tonnes of ore with an average grade of 2.5 gram per tonne.

The quantity of processed ore witnessed a decline; however, higher grade supported the production.

SAR aims to extend the mill in order to increase the throughput to 3.2 million tonnes per annum, and the preferred tender is imminent to undertake the mill expansion. The mill expansion would witness the addition of a second ball mill along with upgrades to the gravity gold recovery circuit and elution column.

Thunderbox production stood at a record level of 45,735 ounces with an AISC of $682 per ounce for the September 2019 quarter, as compared to the previous quarter production of 42,300 ounces with an AISC of $897 per ounce.

The operating cash flow of the mine stood at $51.9 million, while the net mine cash flow stood $34.2 million post adjusting with the growth capital of $17.7 million, expended on Thunderbox underground development and Kailis Stage 2 mine development.

The strip ratio remined below 1:1 for the September 2019 quarter and mined grades increased at the Thunderbox C Zone pit. The closing ore stockpile stood at 102,300 ounces, which marked a 50 per cent increase from the previous quarter.

Kailis Stage 2 would continue to supply high-grade oxide feed for the Thunderbox processing plant over the coming year.

The FY20 production guidance of the company remained unchanged at 350 - 370,000 ounces of gold at an AISC of $1,025-$1,075.

Financial Metrics

The total cash, bullion and investments at the end of the September 2019 quarter stood at $196.1 million, up by almost 27 per cent from the previous quarter.

The gold sales for the quarter stood at 97,307 ounces at an average realised price of 1,916 per ounce for sales receipts of $186.4 million.

The company offsets the capital development cost of Thunderbox Underground ($2.6 million) and Kailis Stage 2 ($7.3 million) via the sales receipt of $9.9 million and would not recognise it under the sales revenue in the financial account as the sales were made from gold recovered via development activities at the Thunderbox Underground and Kailis Stage 2.

The NPAT (unaudited) generated during the quarter stood between $42-$45.

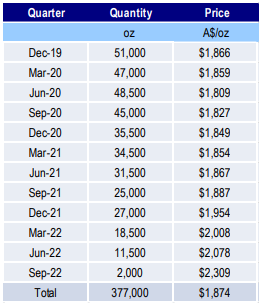

Saracen hedged 38,000 ounces of gold at $2,225 per ounce and delivered 80,000 ounces at $1,863 per ounce. At the end of the quarter, the hedge book stood at 377,000 ounces at an average delivery price of $1,874 per ounce.

The delivery of the gold and hedge stood as below:

(Source: Companyâs Report)

The stock last traded at $3.710 (as on 23 October 2019), up by 5.099 per cent from its previous close.

(Source: Companyâs Report)

The stock last traded at $3.710 (as on 23 October 2019), up by 5.099 per cent from its previous close.

Gold Road Resources Limited (ASX: GOR)

The Perth based gold exploration company recently announced its quarterly report.

The Gruyere JV of the company produced 29,107 ounces on a 100 per cent basis during the September 2019 quarter, and notified that the FY19 production would remain at the upper range of the production guidance of 75,000 to 100,000 ounces (100 per cent basis).

The AISC guidance for December 2019 quarter remained unchanged at $1,050 to $1,150 per ounce.

Operational Metrics

Gruyere and the Gold Fields (50:50) delivered another quarter of milestones. The development at the project was completed within budget while attaining the commercial production at the end of the quarter.

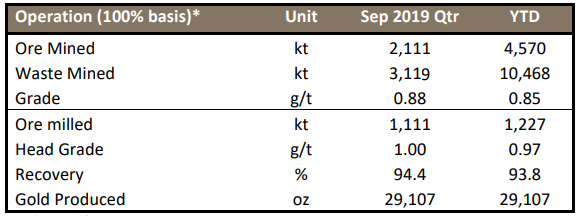

The company mined a total of 2.1 million tonnes of ore (50 per cent basis) with an average grade of 0.88 gram per tonne for 59,662 contained ounces of gold. The LOM average production of the JV is anticipated by the company to be around 300,000 ounces per annum over the 12?year life with an average AISC of $1,025 per ounce.

The ore stockpiles at the end of the quarter stood at 3.2 million tonnes including 0.9 million tonnes @ 1.18 gram per tonne ROM scheduled for December 2019 quarter.

The processing plant at the JV continued operations post pouring the first gold in June 2019, and after the commissioning of the ball mill in August 2019, the project is ramping up, and GOR estimates the that the project would take six to seven months to reach full potential.

The processing the mining activities at the project stood as below:

(Source: Thomson Reuters)

On a 50 per cent basis, GOR sold 12,461 ounces of gold at an average realised price of $2,052.

Financial Metrics

The company held $65.3 million and bullion of $5.8 million at the end of the September 2019 quarter, with an $80.4 million debt drawn from $150 million Finance Facilities, which in turn, led to net debt of $9.3 million.

The net debt of $9.3 million remained below the GORâs anticipation amid less expenditure and higher revenue from the Gruyere JV.

The company delivered 4,700 ounces into the hedge book at an average price of $1,812 per ounce. The hedge delivery and average price of the company at the end of the September 2019 quarter stood as below:

(Source: Companyâs Report)

The stock last traded at $1.165 (as on 23 October 2019), up by 13.659 per cent from its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.