ASX gold stocks are currently tumbling on the exchange despite steady gold prices in the domestic market. The gold spot in the Australian dollar is presently hovering around $2,150 (as on 11 December 2019 03:03 PM AEST), down by 7.40 per cent from its recent peak price of $2,322.18 (high on 26 August 2019).

While gold prices have fallen by just 7.40 per cent, the all ordinaries gold index eroded by over 26.50 per cent from its recent top of 8,730.20 (high on 8 August 2019).

Bullion equity investors in the Australian market have achieved decent results over their keen forecasts concerning to the bullion market, which could be inferred from the early discounting of the ASX gold stocks by the investors prior to the correction in gold prices.

To Know More, Do Read: Is the Emergence of Volatile Patterns in RSG and SAR a Warning Sign for Gold Bulls OR Does Gold Still Stand Strong?

Presently, the ASX gold stocks are either trading at the lower end of their 52-week high, and low range or are trading in the middle of the range, depending upon their respective reserves quantity and market valuation.

While the efficiency of the bullion investors in the domestic market could be asserted with some degree of confidence, let us take a look at few of the ASX gold mining companies, and try to analyse how efficient their current market price is, as compared to the gold prices.

Relations to Reckon the Market Efficiency

St Barbara Limited (ASX: SBM)

SBM is an ASX-listed gold mining company with key gold operations such as Leonora, Simberi, and Atlantic gold in the operational portfolio.

The Leonora operation of the company is in Western Australia and contains Gwalia underground mine, which is the cornerstone asset of the company with an average ore grade of 6.4g/t Au.

The Simberi operation of the company is in Paua New Guinea. The open-pit operation of the company produced 142,000 ounces of gold in FY19 (as on 30 June 2019).

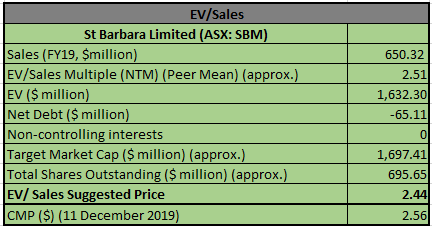

The EV/Sales multiple valuation-approach at the stock price by using the EV/Sales multiple of the industry (industry mean) suggests that the stock is currently overvalued against the peer group.

(Value Inputs from Thomson Reuters and Companyâs Report)

The EV/Sales is not the only valuation criteria to ascertain that the stock is currently overvalued, and investors should dig for more valuation measures post jumping into any decision regarding the stock, but the valuation suggests that currently SBM is overvalued as compared to the prevailing gold prices in the domestic market.

XAUAUD and SBM PE/ XAUAUD Daily Chart (Source: Thomson Reuters)

The price-to-earnings ratio of the stock is currently falling over the decline in market prices; however, the PE/ XAUAUD (pink line) suggests an astute alignment of current market prices of the company with the domestic gold prices, which further suggest higher efficiency of the investors on aligning the prices of gold stocks with the current prices of gold spot.

SBM, AU10YT, and SBM PE/AU10YT Daily Chart (Source: Thomson Reuters)

On further analysing the PE of the stock against the Australian 10-year bond yields, it could be inferred that the fall in the domestic bond yield is currently supporting the share prices of the company as the investors move to compensate for the decline in bond markets from the equity market (a likely reason for the surge in S&P/ ASX 200 Index), and started taking risks as the geopolitical issues in the global market eases slightly.

The behaviour of the domestic investors could be further inferred by observing a U-turn in bond yields or the market discount rate, which suggests that the market is currently favouring the risky assets such as equity as compared to gold.

The potential shift by the domestic investors toward the equity market is currently providing support to the S&P/ ASX 200 index, and the same shift is making the gold stocks fall on ASX. However, the equity feature of the gold stocks is providing some support to the prices, which could also explain the higher current market price as compared to the price suggested by the EV/Sales multiple valuation-approach applied on SBM.

The same correlation and methods could be further used by the investors to reckon the market efficiency related to the ASX gold stocks to take advantage of any discrepancies if spotted by the investors.

However, investors should first try to find out the reason for the difference between the determined value and the observed value before acting on any discrepancies.

To know how gold stocks link to the feature of both commodity (gold) and equity, and to also know how to interpret P/E in case of a resource stock, Please Refer: Is P/E Ratio A Good Valuation Metric To Value A Resource Stock?

What Gold Has To Say to the Investors Moving Towards Risker Assets?

XAUAUD Weekly Chart (Source: Thomson Reuters)

On a weekly chart, gold prices are retracing with a formation of a potential bullish flag, which is yet to give confirmation. The retracement in gold prices could go till the bottom line of the range, where gold could find immediate support.

The prices are currently above both the 200- and 50-days exponential moving average, which could act the final support for the gold prices. The current value of 14-Day Relative Strength Index coupled with the volume trend suggests that the prices could take a U-turn from the current levels as the primary trend remains an uptrend.

If the prices take a U-turn, the upper line of the flag range could act as the barrier to provide some resistance, and a break and close above the same could prompt bullish actions in gold.

To explore more about the domestic gold market, and which mines are currently ramping up the production, Please Refer: ASX Gold Stocks At The Brim Of The Rejuvenating Gold Industry In Australia

The chances of a U-turn in gold prices could provide benefits of including the gold stocks in the portfolio for healthy profits, and also, the current market prices of gold stocks are just slightly overvalued as compared to the gold prices amid increase in equity indices, which could be well compensated if gold continues the halted rally.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.