Investors achieve the dual benefit of owning shares and earning profit through investment in dividend stocks. The investment in dividend stocks carries the advantage of providing returns while keeping the ownership of the stocks for capital gains.

Moreover, the dividend gained from these stocks can be reinvested back, to increase the number of stocks held, through Dividend Reinvestment Plans rolled out by companies.

A stock that provides regular dividends helps the investor to get regular income on a periodic basis during the tepid economic scenarios when most of the stock prices are down and selling of stocks would lead to huge losses to the investorâs pocket. During a bear market, investors can buy high dividend yield stocks at a low price and use the dividends to reinvest in the stocks and when the stock prices rise, they can book profits.

Let us have a look at the ASX Dream Dividends Stocks-

Super Retail Group Limited (ASX: SUL)

Super Retail Group Limited is an Australia-based company with speciality retail stores in the automotive, tools, leisure and sports category. SUL is the owner of four iconic brands: Supercheap Auto, Rebel, BCF and Macpac. The market cap of SUL was $1.84 billion on 14 October 2019.

Appointment of group General Counsel and Company Secretary: Super Retail Group Limited appointed Mr Justin Coss as the interim Group General Counsel and Company Secretary after the resignation of Mr Peter Lim from the role. Mr Coss has experience as general counsel and company secretary for many ASX-listed companies and recently was the Group Legal Counsel and Company Secretary for AUB Group limited.

Total Sales Up by 5.4% on pcp basis:

- The company reported total sales of $2.71 billion up by 5.4% on the previous comparative period (pcp);

- It registered like for like sales growth of 2.9% with all divisions delivering positive growth;

- SUL reported an EBITDA of $314.7 million, an increase of 7% on pcp;

- Segment depreciation and amortisation increased by 16.2% to $86.6 million reflecting investment in omni- retail model;

- Group segment earnings before interest and tax (EBIT) of $228.1 million, an increase of 3.9% on pcp;

- Normalised net profit after tax (NPAT) of $152.5 million, an increase of 5.0% on pcp;

- Strong operating cashflows resulted in reduction of $36.2 million net debt;

- The company declared a final fully franked dividend of 28.5 cents per share contributing to full year dividends of 50 cents per share.

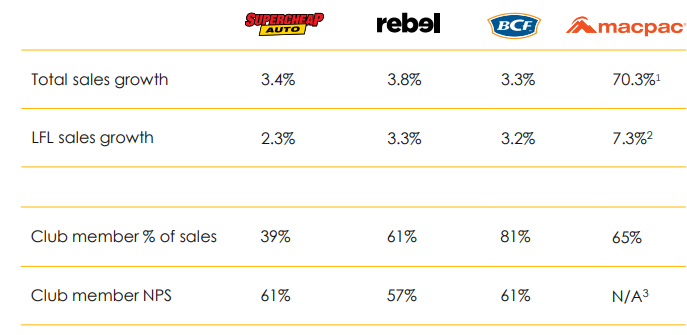

Segment Performance:

- Supercheap Auto: Sales increased by 3.4% to $1,040.6 million, with like for like growth of 2.3% which was driven by higher average transaction value and reflected an increase in average item value and higher average units per transaction;

- Rebel: Sales increased by 3.8% to $1,016.4 million, with like for like growth of 3.3%, driven by both transaction growth and higher average transaction value;

- BCF: Sales increased by 3.3% to $514.6 million with like for like growth of 3.2% which was driven by higher average transaction value resulting from higher units per sale;

- Macpac: Macpac stores (including Adventure Hubs) delivered an EBITDA of $17.4 million compared to acquisition case of NZD 16 million (equivalent to $14.7 million), in line with managementâs business plan.

Groupâs Highlights (Source: Companyâs Presentation)

Stock Performance: The SUL stock has generated a total return of 14.60% in last six months. At 1:47 PM AEST on 14 October 2019, the stock is trading at $9.360 per share, up by 0.21%.

Macquarie Group Limited (ASX: MQG)

Macquarie Group Limited acts primarily as an investment intermediary for institutional, corporate, government and retail clients and counterparties around the world, generating income by providing a diversified range of products and services to its clients. As on 14 October 2019, the market capitalisation of the company stood at $45.85 billion.

Macquarie Issues ordinary Capital and Convertible Securities: Macquarie Group Limited issued new fully paid ordinary shares in September 2019:

- 8,333,333 shares issued on 3 September 2019;

- 5,660,150 shares issued on 30 September 2019.

As on, 30 September 2019, the number of Macquarie ordinary shares on issue was 354,376,467.

Macquarie Completed Successful Institutional Placement of $1.0 billion: Macquarie Group announced the successful completion of $1.0 billion Institutional Placement which will result in the issue of approximately 8.3 million new fully paid ordinary shares at a price of $120 per New Share, representing:

- 8% discount to the last closing price of $123.51 on 27 August 2019;

- 8% discount to the 5-day VWAP of $123.46.

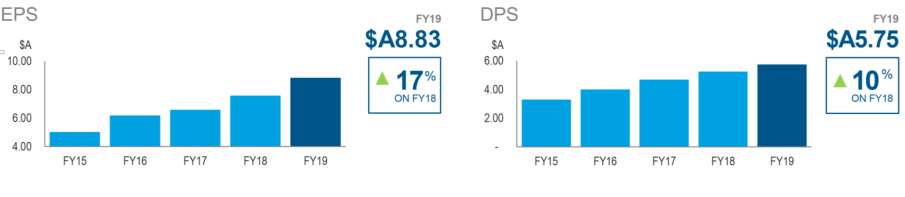

Historical DPS (Source: Companyâs Presentation)

Stock Performance: The stock has generated a total return of 1.87% in the last three months. Macquarie declared a final dividend of $5.75 per share (45% franked at a dividend payout ratio of 66%). The stock has an annual dividend yield of 4.44%. At 2:03 PM AEST on 14 October 2019, the stock was trading at $131.460 per share, up by 1.6%.

IRESS Limited (ASX: IRE)

IRESS Limited is a leading technology company, founded in 1993 in Melbourne, and provides software to the financial services industry. Its revenue is primarily subscription based and recurring. The market cap of IRE was $1.98 billion on 14 October 2019.

Revenue Rose by 5% on CC basis: For 1H19 (the six months ending 30 June 2019) and on a constant currency basis, IREâs operating revenue rose by 5% and Segment Profit was up by 10% on pcp.

- The company reported a revenue of $241.8 million, up by 5% on 1H18 and +3% on 2H18;

- Segment profit increased by 10% to $74.1 million on 1H18 and 5% on 2H18;

- NPAT amounted to $30.4 million, down by 5% on both 1H18 and 2H18;

- Cash conversion of 100% in the half; recurring revenue ~90%; net debt balance $193.3 million representing a conservative leverage ratio of 1.3x Segment Profit.

Stock Performance: The stock has generated negative returns of -20.01% and -16.05% in the last three months and six months, respectively. The company announced an interim dividend worth 16 cents per share (10% franked). The IRESS stock has an annual dividend yield of 4.05%. At 2:18 PM AEST on 14 October 2019, the stock was trading at $11.350 per share.

Scentre Group (ASX: SCG)

Scentre Group possesses and runs the living centre portfolio in ANZ, with retail real estate AUM. The market cap of SCG was $21.09 billion on 14 October 2019.

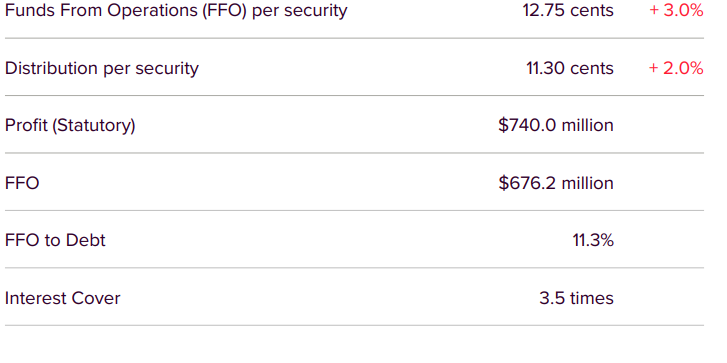

Highlights for the First Half of 2019: As the company focused on delivering what customers want, the first six months of 2019 were an active period. Annual customer visitation was more than 535 million and growing, with customers staying for longer and visiting more frequently; the total annual sales increased to $24.4 billion and companyâs platform accounts for more than 7% of all retail sales in Australia.

An average specialty store in the companyâs portfolio generated annual in-store sales of more than $1.5 million and is growing. After the divestment of the Sydney Office Towers and the Westfield Burwood JV, the company released $2.1 billion of capital.

Half Year Results Source: Companyâs Presentation

Half Year Results Source: Companyâs Presentation

Stock Performance: The stock has generated a total return of 1.02% in the last six months. SCG announced an interim dividend of 11.30 cents per share. The IRESS stock has an annual dividend yield of 5.64%. As at 2:24 PM AEST, the stock was trading at $3.965 per share, down by 0.12%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.