Dividends provide the investors with a stream of income that is distributed by companies to their shareholders. Dividends form a major part of a companyâs capital allocation decision. Companies declare dividends annually, semi-annually, quarterly, depending upon its dividend policies.

Companies with diversified revenues are likely to provide dividends that are consistent and growing. Growing dividends also depend upon the earning capability of the company and more importantly, earnings growth.

Markets often provide investors to act opportunistically at times when high-quality dividend stocks are discounted by the market amid a widespread sell-off. It should be noted that these opportunities provide investors with opportunities to increase yield-to-cost.

Suppose a high-quality dividend stock is extremely shorted by the market, leading to a sharp fall in the price of the stock. If the investors are buying that stock at that price, it will increase the expected dividend-yield of stocks bought at that price.

As the dividend-yield would be high, when the price of the stock is low. Subsequently, when the company declares a dividend, it might result in an increase in the price of the stock. The increase in the price of the stock could have other reasons as well.

However, the yield offered by the stock at higher prices would be lower compared to the yield when the stock was heavily shorted. Therefore, the investors who had bought the stock when it was heavily shorted would have a better yield-to-cost.

In this article, we discuss four high-quality dividend stocks in the ASX-listed universe. These entities are from a diversified set of sectors, including Consumer Discretionary, Healthcare, Real Estate & Consumer Staples.

Letâs discuss these stocks:

Super Retail Group Limited (ASX: SUL)

In September 2019, the company reported that it had appointed Mr Justin Cross as interim Group General Counsel and Company Secretary, following the resignation of Peter Lim.

During September 2019, the company has also reported that it would be organising its Investor Day on 8 November 2019 in Sydney. It was also reported that 2019 Annual General Meeting is scheduled on 22 October 2019 in Queensland.

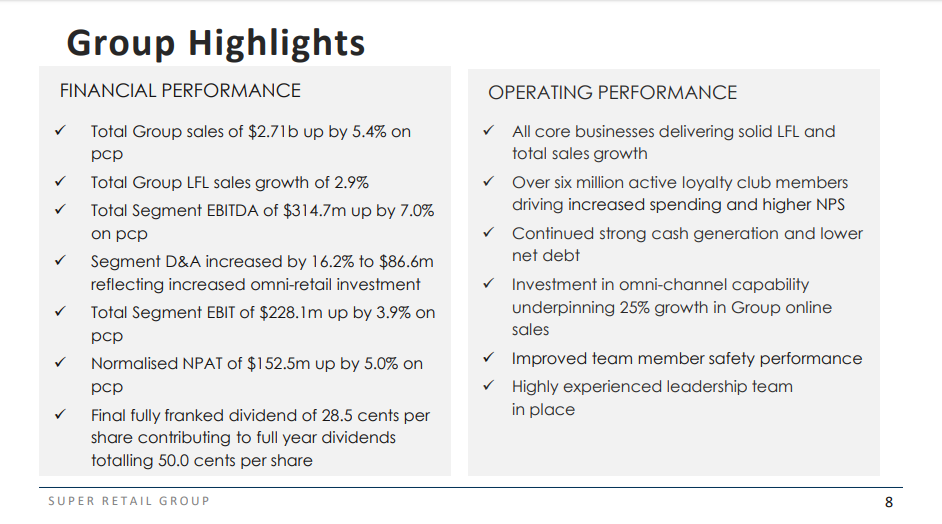

In the full-year ended 29 June 2019, the company had reported a revenue from ordinary activities of $2.71 billion, up by 5.4% from $2.57 billion in the previous year. In FY 2019, the company declared total fully franked dividends of 50.0 cents per share.

FY 2019 Highlights (Source: SULâs 2019 Full Year Investor Presentation)

During the year, the company was able to attain sales growth, reflecting sale & like-for like sales growth across all four divisions. The company has been focusing on working capital management, and investing in inventory levels to increase in-store availability of products.

On 18 October 2019, SUL last traded at $9.4, up by 1.732% relative to the last close. In the past three-month, SUL has delivered a return of -2.74%. On a YTD basis, the return of SUL has been +35.29% and +1.32% over the past one year. Besides, the market capitalisation of the company was ~$1.82 billion, with ~197.38 million shares outstanding.

Ramsay Health Care Limited (ASX: RHC)

Ramsay Health Care is a leading healthcare company, having diversified strategic portfolio, deep & experienced leadership, industry leading quality & scale. It has a market leading position in Australia, Scandinavia & France.

The company has recently released its 2019 Annual Report for the period ended 30 June 2019. In FY 2019, the company declared total fully franked dividend of 151.5 cents per share. During the year, the company recorded $11.59 billion in total revenue & other income compared to $9.18 billion in the previous year.

RHC Overview (Source: RHCâs Presentation FY2019 Results Briefing)

Further, on segmental basis, the company recorded total segment revenue of $5.18 billion from Asia Pacific, $942 million from the UK, $4.28 billion from France, and $1.14 billion from Nordics.

RHCâs net profit for the year was $572.4 million for the period compared to $411.21 million in the previous year. After CARES dividend, the diluted earnings per share was 263.3 cents per share compared to 185.6 cents per share in the previous year.

On 18 October 2019, RHC last traded at $68.98, up by 0.16% relative to the last close. In the past three-month, RHC has delivered a return of -4.13%. On a YTD basis, the return of RHC has been +19.23% and +27.11% over the past one year. Besides, the market capitalisation of the company was ~$13.92 billion, with ~202.08 million shares outstanding.

Aventus Group (ASX: AVN)

Aventus Group includes the Aventus Retail Property Fund & Aventus Holdings Limited. It provides investment and management of large format retail property assets.

Recently, the group announced the distribution for the quarter ended 30 September 2018. It has declared an unfranked distribution of 4.22 cents per unit to the securityholders on record as of 30 September 2019 and the distribution would be paid on 31 October 2019.

Further, the group has disclosed the DRP issue price of the distribution â $2.66 per stapled security. The group appointed Macquarie Capital (Australia) Limited to act as the sole underwriter for the DRP.

On 18 October 2019, AVN last traded at $2.76, up by 0.364% relative to the last close. In the past three-month, AVN has delivered a return of +15.55%. On a YTD basis, the return of AVN has been +28.5% and +30.95% over the past one year. Besides, the market capitalisation of the company was ~$1.5 billion, with ~547.13 million shares outstanding

Coles Group Limited (ASX: COL)

In September 2019, the company has reported that its 2019 Annual General Meeting would be convening on 13 November 2019.

During September, the company also notified that it would implement a Dividend Reinvestment Plan (DRP) for its shareholders. The DRP would be operated for the dividends payable after 26 September 2019.

The DRP would allow the shareholders to have their dividends reinvested in part or full in exchange for the additional shares of the company. Shareholders who wish to participate must elect for the DRP.

The shareholders who are registered in the records of the company, following the demerger from Wesfarmers Limited (ASX: WES) need to make new DRP election to take part in DRP.

2019 Highlights (Source: Source: COLâs 2019 Annual Report)

In the year ended 30 June 2019, the company recorded sales revenue from continuing operation of $38.18 billion down by 1.9% over the previous corresponding period. Profit after tax of the company increased 5.4% to $1.07 billion due to lower income tax expense partially offset by higher financing costs after demerger.

On 18 October 2019, COL last traded at $15, down by 1.64% relative to the last close. In the past three-month, COL has delivered a return of +9.78%. On a YTD basis, the return of COL has been +31.34%. Besides, the market capitalisation of the company was ~$20.34 billion, with ~1.33 billion shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)