The Australian benchmark index S&P/ASX200 was trading at 6,499.1, up by 0.09 per cent (as on 4 October 2019, AEST 12:20 PM). In this article, we would discuss four diversified stocks wherein, Great Boulder Resources Limited is from the metals and mining sector, Biotron Limited operates in the health care sector, Kore Potash Plc is also a player in the metals and mining sector and KYCKR Limited operates in the information technology sector.

Great Boulder Resources Limited

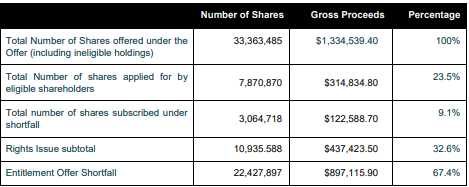

Great Boulder Resources Limited (ASX:GBR) is primarily into exploration and discovery of nickel-copper-cobalt and gold resources. Its portfolio of assets contains five exploration projects. Recently on 2 October 2019, the company updated the market with the completion of its non-renounceable entitlement offer of 1 share for every 3 shares. GBR closed the offer with eligible shareholders at an issue price of $0.04 per new fully paid ordinary share as planned on 27 September 2019.

Offer Results (Source: Companyâs Report)

Large EM Anomalies Highlighted at Mt Carlon Project

On 1 October 2019, the company announced that an aerial electromagnetic survey had highlighted two large anomalies- Eastern Zone and Western Zone at Mt Carlon Project.

Eastern Zone â This anomaly is 3.5 km long linear zone of IP. The effect of IP can be a characteristic response from dispersed sulphides bodies or clays such as montmorillonite.

Western Zone â The western anomaly is 3.7 km long coincident with a sub-cropping to outcropping BIF unit. The area has previously drill coverage with RAB drilling.

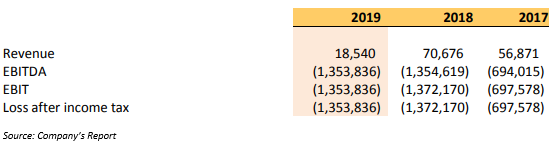

Financial Highlights for the year ended 30 June 2019

On 30 September 2019, the company declared its financial results. Below are the few highlights;

- Interest income of the company decreased to $18,540 from $70,676 compared to the previous year corresponding period;

- Loss after income tax as of 30 June 2019 was $1.3 million;

- Cash and cash equivalents of the company stood at $0.6 million;

- Earnings per share of the company stood at 1.68 cents per share.

Stock Performance

The stock of GBR was trading at $0.057 on ASX on 4 October 2019 (AEST 12:37 PM) with 111.03 million outstanding shares and a market cap of $5.88 million. The companyâs 52-week low and high value of the stock is at $0.035 and $0.242, respectively. It has generated a negative return of 57.09 per cent in the last six months and a negative return of 60.15 per cent on a year-to-date basis.

Biotron Limited

Biotron Limited (ASX:BIT) is a health care service provider and a clinical stage publicly listed Australian biotechnology company, associated with the R&D and commercialisation of a novel small molecule approach with the potential to treat several viral diseases.

Appointment of Scientific Advisory Board

On 1 October 2019, the company unveiled about the establishment of a Scientific Advisory Board (SAB) for its cote Phase 2 HIV-1 development program. The members of SAB are well-known in the academic world. Moreover, they hold experience in providing advisory services on new treatment strategies to the pharma industry. SAB would be tasked with aiding the development of BIT225, which is the lead drug of BIT.

Financial Highlights for the year ended 30 June 2019

On 29 August 2019, the company declared the statutory financial results, unveiling a loss of $1,611,799 for the period. BIT raised $6.0 million from the exercise of company options. BIT225 had shown a positive result in the clinal trial phase. Other income of the company slumped to $1,072,832 in FY2019 from $1,622,584 in FY2018.

Stock Performance

The stock of BIT was trading at $0.079 on ASX on 4 October 2019 (AEST 12:42 PM), up by 5.333 per cent from its previous closing price. The company has approx. 595.77 million outstanding shares and a market cap of $44.68 million. The 52-week low and high value of the stock is $0.044 and $0.445, respectively. It has generated a negative return of 3.85 per cent in the last six months and a negative return of 34.78 per cent on a year-to-date basis.

Kore Potash Plc

Kore Potash Plc (ASX:KP2) is an advanced stage mineral development and exploration company. It is listed on 3 Stock Exchanges- LSE, ASX and JSE.

Financial Highlights for the six months to 30 June 2019

On 6 September 2019, KP2 updated the market with its performance during the six months to end of June 2019. Below are snapshots of the results;

- The companyâs interest income decreased to US$18,992 from US$20,454 in the same period of FY2018;

- Loss after tax slumped to US$1,176,815;

- Cash and cash equivalents of the company stood at US$1,040,969;

- Total liabilities of the company increased to US$3,385,613 from US$1,246,331;

- The company had a net cash outflow in operating and investing activities of US$1.53 million and US$2.84 million, respectively.

Appointment of CFO

The company recently announced the appointment of Mr. Andrey Maruta as Chief Financial Officer, effective from 23 September 2019, after Mr John Crews stepped down.

Stock Performance

The stock of KP2 was trading at $0.022 on ASX on 4 October 2019 (AEST 12:45 PM), up by 4.762 per cent from its previous closing price. The company has approximately. 1.51 billion shares outstanding and a market cap of $31.7 million. The 52-week low and high value of the stock is at $0.014 and $0.155, respectively. The stock has generated a negative return of 46.15 per cent in the last six months and a negative return of 88.20 per cent on a year-to-date basis.

KYCKR Limited

KYCKR Limited (ASX:KYK), headquartered in New South Wales, is a provider of technology solutions to help protect against money laundering.

Ceased to be Substantial Holder

On 30 September 2019, the company announced that one of its Directors, Robert Leslie, had ceased to be a substantial holder of the company with 6,619,247 fully paid ordinary shares and 6,500,000 unlisted performance shares after change.

Financial highlights for the period ended 30 June 2019

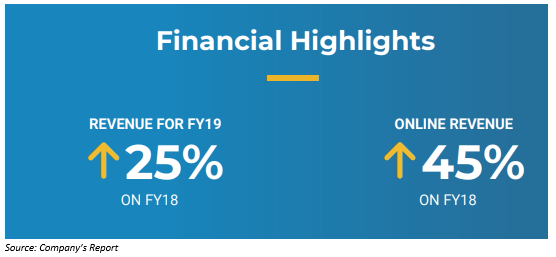

On 27 September 2019, KYK released its annual report for FY2019.

- Loss before income tax of the company increased to $6,125,773;

- The companyâs total revenue increased by 25 per cent to $2,138,671 from $1,724,409 in FY2018;

- Cash and cash equivalents of the company stood at $1,448,660;

Stock Performance

The stock of KYK was trading at $0.225 on ASX on 4 October 2019 (AEST 12:50 PM), up by 21.622 per cent from its previous closing price. The company has approximately 229.32 million shares outstanding and a market cap of $42.42 million. The 52-week low and high value of the stock is at $0.031 and $0.370, respectively. The stock has generated a positive return of 255.77 per cent in the last six months and a negative return of 164.29 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.