The companies under discussion in this article have disclosed their intention to become a publicly-traded company. These companies have released the prospectus for an initial public offering on ASX.

Letâs discuss these businesses that are due to debut on ASX possibly.

13 Seeds Limited

Based in Tasmania, 13 Seeds plies trade in the Australian hemp food and nutraceuticals space. Its product line-up includes fifteen products in gourmet food range and ten products in skin care range.

The companyâs distribution capabilities include a network of health food stores, independent grocers and non-major supermarkets in Australia. In addition, it markets products through online retailers and its own website.

13 Seeds was founded in the year 2016, and its initial range was cosmetic products like facial serum, body wash, day cream renewal, night creams and toners. Following the legalisation of hemp for human consumption in 2017, the company seized the opportunity and launched a gourmet food range.

Business Model

13 Seeds has no intentions in the primary production of hemp and acquisition of manufacturing facilities. The company intends to develop the brand presence and reach across several products with an initial focus on food.

It intends to source hemp seed from Tasmania in priority, contingent on availability, harvest, quality and price. The company would seek a relatively less capital-intensive model with reliance on 3rd party providers including contract manufacturers, primary producers, wholesale distributors, logistics providers and retailers.

Initially, the company intends to focus on food, nutraceuticals, and skin care markets. Moreover, it would continue to develop new hemp-based products based on the consumer expectations, demand, etc.

Offer

The company is offering 30 million shares at an issue price of $0.20 each to raise up to $6 million before costs. The minimum size of the issue is 25 million shares, meaning a minimum capital raise of $5 million before costs.

In addition, there is a secondary offer wherein the company would issue 3.75 million shares upon the conversion of convertible notes and an issue of up to 7 million options to the lead manager or its nominees. The offer is scheduled to close on 3 December 2019 at 5 PM AEDT.

Financial Information

In the year ended 30 June 2019, the company reported a sales income of $165.34k and other income of $68.3k. Loss after tax for the period was around $446.27k against $190.8k in the previous year.

During the period, the marketing and promotional expenses increased to $142.4k compared to 11.08k in the previous year. The occupancy expenses increased to $36.9k compared to $6.2k in the previous year.

MoneyMe Limited

Founded in 2013, MoneyMe is a digital consumer credit business leveraging its technology platform and big data analytics to provide an innovative loan offering to tech-savvy customers. Since inception to 30 September 2019, the company has originated over $340 million in loans via its risk-based lending platform.

It is operating in the online consumer credit sector in Australia, providing finance solutions to consumers to meet varied personal funding needs. The services are targeted to customers seeking fast, convenient and simple access to credit from their mobile devices.

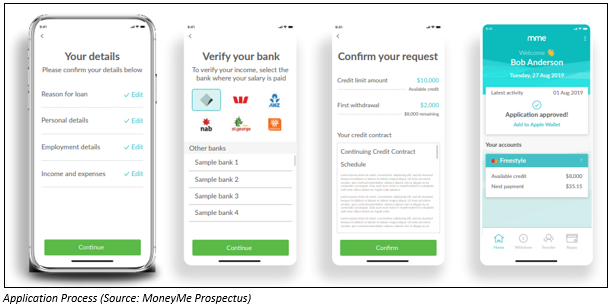

MoneyMeâs Horizon Technology Platform completes the applications process in approx. five minutes, and funds are released shortly after the approval. It leverages algorithms to provide personalised, risk-based pricing that allows to balance the risk and return in the loan book.

Products

MoneyMe has two products in its line-up â Personal Loan and Freestyle Virtual Credit Account. The company utilises its primary brand â MoneyMe and secondary brand â MyOzMoney.

Its loan revenue comprises of a combination of interest rate charges and fees. Moreover, the companyâs loan processing and risk-assessment is automated through in-house developed algorithms.

MoneyMe personal loan product allows a customer to receive credit funds in between 2.1k to 25k with a tenure ranging from three months to three years. Its payments are based on fixed amortisation with automated direct-debit instalments on a weekly, fortnightly or monthly basis.

Its Freestyle Virtual Credit Account has a credit offering in the range of 1k to 10k with revolving term. The product payments are based on fixed amortisation with automated direct-debit instalments on a fortnightly or monthly basis.

Offer

The company is offering 36 million shares at an issue price of $1.25 per share, resulting in an expected raise of approx. $45 million. The shares offered under the IPO would represent approximately 22.7% of the shares on issue at completion, and total number of shares on issue at completion would be approximately 169.4 million. In addition, the offer is closing on 6 December 2019.

Statutory Financials

In the year ended 30 June 2019, the company posted total revenue of $31.9 million compared to $24.1 million in the previous year. The total operating expenses for the period were $31.4 million against $23.1 million. It posted a net profit after tax of $0.3 million in FY 2019 compared to $0.7 million in the previous year.

Openpay Group Ltd

Founded in 2013, Openpay Group was originally formed as an in-store digital solution for lay-by targeting retailers and their consumers. The company provides a payment platform to improve the experience of merchants and consumers.

Presently, the company caters to merchants from retail, automotive, health care and home improvement. It works in partnership with merchants to develop a wide variety of plans ranging from two months to twenty-four months in tenure with values ranging from $50 to $20k.

The companyâs plans are presently available in Australia, augmented by additional merchants and customers in New Zealand. In the UK, the company is progressing with its services, offering two to three month plans for up to £1,200 in the retail segment.

Offer

The company is offering approx. 31.25 million shares at an issue price of $1.60 per share to raise approx. $50 million before costs and expenses. The shares offered under the IPO would represent approximately 33.3% of the shares on issue on completion of the offer. The total number of shares on issue at completion of the Offer would be 93.75 million.

Statutory Financials

In the year ended 30 June 2019, the company reported BNPS income of $11 million compared to $6.8 million in the previous year. Gross profit for the period was $7.2 million against $5.6 million in the previous year.

Loss for the year was $14.7 million compared to $4.4 million in the previous year with significant increases in employee benefits and other operating expenses.

Also Read:

How to Make Money by Investing in IPO Stocks on the ASX?

Whatâs Latest In The IPO Space?

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.