In May 2019, the Australian Bureau of Statistics (ABS) reported some findings from the annual Economic Activity Survey (EAS), which indicated that the growth rates for the wholesale trade and manufacturing industries have rebounded with a strong upswing in EBITDA of 24.5% ($ 4.4 billion) and 10.8% ($ 3.5 billion) in 2017-18, respectively, while the largest contributors to employment growth were service industries during the reported period.

With that backdrop, it can be noted that waste management solutions provider, Bingo Industries Limited and manufacturer of water delivery, control and optimisation systems, Reliance Worldwide Corporation are both performing extremely well and reported outstanding results for the financial year 2019. Letâs look in detail at the two industrials sector players in Australia.

Bingo Industries Limited

Business Overview- Bingo Industries Limited (ASX:BIN), incorporated in 2017 and headquartered in Auburn, Australia, together with its subsidiaries, offers waste management solutions for domestic and commercial businesses across the country. From its humble beginnings as a small family-owned skip bin business in Western Sydney, Bingo has a come a long way in establishing itself as a fully-integrated recycling and waste management company, providing solutions across the entire waste management supply chain from collection, processing, separation, recycling to disposal.

The business currently employs a staff of 800 who manage and operate a fleet of ~250 vehicles servicing more than 18,000 customers every year. Bingo Industries also has the most expansive network of resource recovery and recycling centres across New South Wales and Victoria.

The company envisions a Waste Free Australia and believes that Australia should strive towards meeting the global recycling best practice of 100% diversion of waste from landfill.

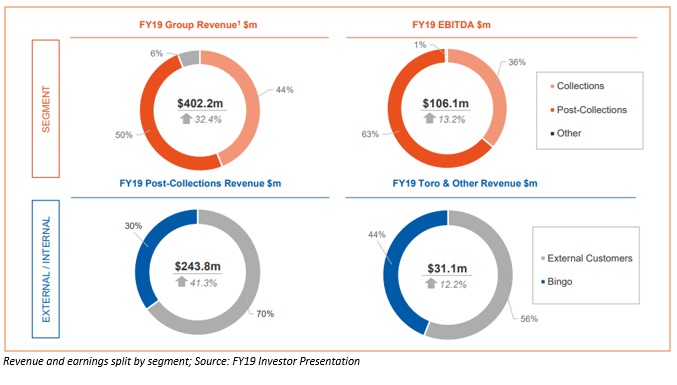

Full Year 2019 Results â On 22 August 2019, Bingo Industries announced its results for the financial year to 30 June 2019 (FY19), posting the net revenue at $ 402.2 million, up 32.4% and an underlying EBITDA of $ 106.1 million, up 13.2%, in line with the prescribed guidance, comprising $ 92.5 million in EBITDA from the BINGO business and $ 13.6 million EBITDA from Dial a Dump Industries (DADI).

During the year, Bingo Industries completed the transformational acquisition of DADI followed by expedited integration, on track to deliver annualised cost synergies of $ 15 million over two years from FY20.

The Group also successfully delivered on its development program, with West Melbourne Recycling Centre, Patons Lane Recycling Centre and Landfill online during FY19. The construction of Mortdale Recycling Centre also furthered and the development of Eastern Creek Materials Processing Centre (MPC) 2 is ongoing. Bingo also worked on the network reconfiguration plan during the period and expects a return of $ 80 million following the sale of non-core assets and Banksmeadow next year.

The rise in the New South Wales price came into effect from 1 July 2019 onward.

The Group is well placed for further growth in FY20 with a full year contribution from DADI, Patons Lane and West Melbourne. The guidance for FY20 is scheduled to be announced at the Annual General Meeting to be held on 13 November 2019.

On 22 August 2019, Bingo Industries announced a dividend of $ 0.020 (Record Date: 29 August 2019, Payment Date: 30 September 2019) with respect to the six months ended 30 June 2019.

Stock Performance - The Group has a market cap of around $ 1.48 billion with approximately 657.57 million shares outstanding. On 29 August 2019, the BIN stock closed the market trading session at $ 2.250, trading flat with around 1.47 million shares traded through the day. In addition, the BIN stock has delivered positive returns of 23.29% YTD and 34.73% in the last six months.

Recently, Bingo Industriesâ Directors Barry Buffier and Michael Coleman acquired 20,000 ordinary shares (indirect interest) and 15,000 ordinary shares (indirect interest) at a value consideration of $ 46,811.66 and $ 33,949.50, respectively, on market trade.

Yarra Funds Management Limited also became a substantial holder with the Group on purchase of around 34,168,696 ordinary shares, translating into a voting power of 5.196%.

Reliance Worldwide Corporation Limited

Business Overview - Reliance Worldwide Corporation Limited (ASX:RWC), established as a small private tooling and manufacturing store in 1949 in Brisbane, Australia, is now one of the global market leader and manufacturer of water delivery, control and optimisation systems for the modern built environment.

Reliance Worldwide Corporation offers high?quality products such as PEX pipes, valves, manifolds, brass and plastic Push?to?Connect (PTC) fittings, underfloor heating components and other accessories to the plumbing and heating, ventilation and air conditioning industries worldwide. The company markets its products under brands such as SharkBite, RMC Water Valves, Cash Acme, Reliance Water Controls, StreamLabs, Holdrite, JG Speedfit, and others. Historically, Reliance Worldwide has achieved sales growth on top of broader market growth.

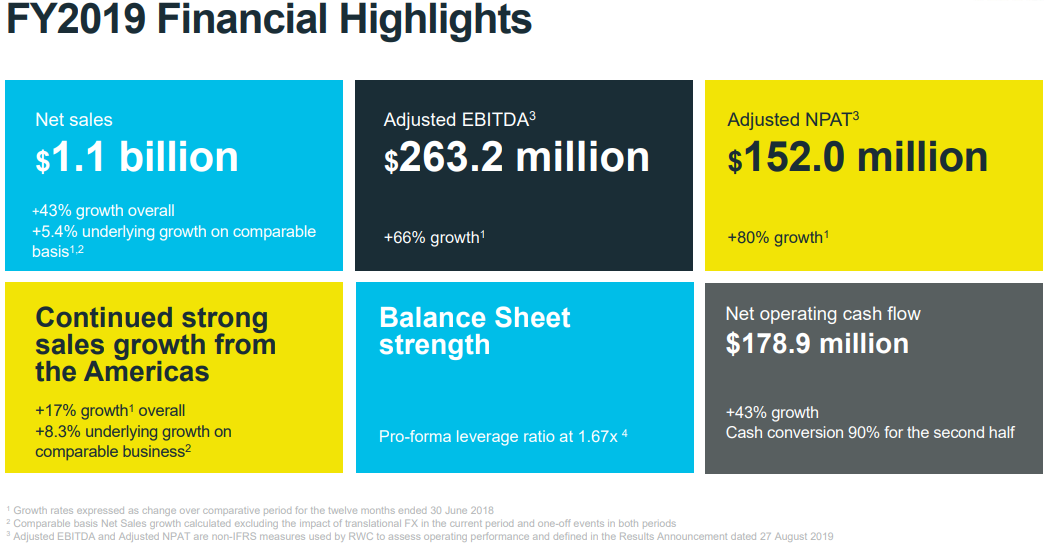

FY19 Result Highlights - On 27 August 2019, Reliance Worldwide released its consolidated results for the financial year ended 30 June 2019 (FY19), posting a Net Profit after Tax (NPAT) of $ 133 million, a staggering increase of 102% on FY18.

The net sales amounted to $ 1,104.0 million, up 43% on the prior year and the second half trading performance was in line with guidance provided in May 2019. RWCâs core net sales (excluding John Guest) generated $ 782.9 million, 5.1% higher than FY18, and the net sales of John Guest products were at $ 321.1 million, up 8.2% on the prior year. The EBITDA for the year was $ 242.5 million, reflecting a 79.1% increase on the prior yearâs figure mainly due to the first full year contribution from John Guest.

The record performance was primarily due to the inclusion of John Guest for a full year and the strong underlying growth of 8% achieved in the Americas, where reported net sales for the year were at $ 653.9 million, an increase of 16.8% on FY18.

Amidst other supporting factors, FY19 results were also impacted by favourable foreign exchange movements for translation purposes, primarily a weaker Australian dollar versus the US dollar.

Source: FY19 Results Presentation

The capital expenditure payments on property, plant, equipment, intellectual property and other intangibles acquired during the year totalled $ 69.6 million and the reported net cash inflow from operating activities for the year was $ 136.0 million (FY18: $ 80.1 million).

RWC continues to maintain a sound balance sheet and conservative financial position and the net debt at 30 June 2019 was $ 426.6 million.

RWC has also announced a fully-franked dividend of 5 cents per share (Record Date: 11 September 2019, Payment Date: 11 October 2019) with respect to the period of six months to 30 June 2019. The total dividends for FY2019 stand at $ 71.1 million, being 9.0 cents per share (FY2018: $ 42.1 million, being 6.5 cents per share).

Stock Performance - Reliance Worldwide Corporationâs market capitalisation is around $ 2.95 billion with around 790.09 million shares outstanding. On 29 August 2019, the RWC stock price settled the market trading at $ 3.720, down 0.268% by $ 0.010 with ~ 3.65 million shares traded.

The stock has an annual dividend yield of 2.41% to date.

Recently, Bennelong Australian Equity Partners Ltd and Paradice Investment Management Pty Ltd increased their shareholding in RWC to 13.79% and 7.078%, respectively.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.