In the contemporary scenario, digital technologies are changing the way humans live their day to day life as well as the way businesses are performed. The Australian tech sector looks like contributing significantly with improving productivity of businesses that are adopting and adapting new technologies into their current operations.

But is the tech sector of Australia well on the road to deliver on Prime Minister’s objective to become ‘a leading digital economy by 2030’?

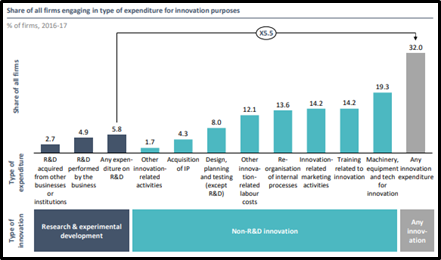

According to independent statutory board, Innovation and Science Australia (ISA), there exists an emerging trend of business investment in innovation beyond R&D; however, many businesses in Australia don’t see themselves as innovative, particularly if the businesses do not utilise R&D as a driver of their innovation.

Contemporary Australian businesses are adopting diversified approach towards innovation gliding beyond research & development (R&D), which further lands them with higher revenue and job growth and are more likeliness to survive.

Moreover, ISA proposes the Australian Government to consider re-balancing its policy mix for providing better support to business investment in non-research & development innovation, while continuing to aid business investment in research & development.

When it comes to R&D, the Australian businesses also invest in the technology, with over five times as many Australian businesses investing in innovation than in R&D alone, as mentioned by ISA.

Share of all firms engaging in the type of expenditure for innovation purposes (Source: ISA)

Investment in technology is quite prominent in the rapidly growing start-ups in Australia, especially technology start-ups, since there is a digital app adoption pattern that suggests a willingness to adopt new technology for the right reasons.

Further unveiling its findings, ISA mentioned that

- SMEs also form the largest technology purchasers in business services and service firms are also heavy app adopters;

- Five of the six high-adopting sectors were in services, both business and the consumer;

- SMEs with high technology spending growth also grew revenue 3.5 ppt per year faster, and employment 5.2 ppt per year faster than those with low technology spending growth;

Another point that validates the adoption of technology in the Australian SME sector is that smaller firms that invest more in technology or are heavier adopters of new IT tools witness faster growth than other firms.

Technology is not only shaping the revolution in product development and offering but also has transformed the business processes leading to business process innovation.

Recent developments in the Australian tech sector have indicated towards the expansion of businesses domestically as well as increasing the business’ footprints internationally.

Tech stocks like Afterpay Limited (ASX:APT) and EML Payments Limited (ASX:EML) have also been at the forefront of market disruption in the technology sector.

The APT stock has delivered 125.11% in returns to its shareholders in a year’s time till 21 February 2020 while the EML stock has landed its shareholders with pockets full of 204.35% returns within the same timeframe. Moreover, EML Payments has also shown a growth of 70% on pcp in its NPATA to $16.0 million during the half-year 2020.

Related: How Tech Stocks Can Increase Your Profit? Tech Sector in Australia by 2030

Another information technology player, Megaport Limited (ASX:MP1) has delivered 179.81% returns to its shareholders within the last one year till 21 February 2020.

By the end of the day’s trade on 21 February 2020, the S&P/ASX 200 Information Technology (Sector) settled at 1,495.0 with a decline of 0.97%. Let us discuss few tech stocks that have recently reported significant developments.

LiveTiles Limited (ASX: LVT)

As a global intelligent workplace software company, LiveTiles Limited caters to the commercial, government and education markets, and is an award-winning Microsoft Partner.

A year ago, in February 2019, LiveTiles had acquired leading intranet software business in Europe, Wizdom, which generated positive EBITDA and attained strong ARR growth of 87% from $8.0 million to $15.0 million in the 13-month period to 31 January 2020.

Other than Wizdom, LVT had also acquired CYCL in December 2019, which also boosted the Company’s clear global leadership in the precipitously emerging intranet software market, which is projected to be a $13 billion per annum market opportunity, according to the Company.

LVT believes that Wizdom would play a critical role in its strong enterprise customer and revenue growth in the financial year 2020 and in the upcoming years while also accelerating the development of its intelligent workplace platform.

The LVT stock closed at a price of $0.320 on 21 February 2020, with a market capitalisation of $274.67 million.

Related: 2019 Tech trends; what will continue in 2020?

Technology companies catering to the financial needs of the customers have been a witness to market disruption in recent times. The fusion of technology in the financial offerings from the companies has led to the development of unique and innovative solutions that are readily acceptable by the customers, thus improving earnings.

Splitit Payments Ltd (ASX:SPT)

Being a provider of credit card-based instalment solution, Splitit Payments Ltd empowers its customers to pay for purchases with a current debit or credit card by “splitting” the cost into interest and fee free monthly payments, free from extra registrations or applications.

Recently, Splitit announced a new merchant agreement with Resident Home, LLC, an online retailer of furniture, to offer the former’s solution to all its customers at NectarSleep.com (a leading brand of Resident, a direct-to-customer eCommerce company).

Resident Home, LLC was named ‘North America's fastest-growing eCommerce retailer’ in 2018 by Internet Retailer magazine, and the agreement reflects upon the Company’s continued success in attracting influential brands in North America and further progress in building high-value merchants in core categories.

The SPT stock closed the day’s trade at $0.480 on 21 February 2020 with a market cap of $152.65 million.

Sezzle Inc. (ASX:SZL)

Sezzle Inc. is amongst the rapidly growing fintech companies, with a payment platform that enhances the purchasing power for consumers by providing interest-free instalment plans at online stores, ultimately leading to increased sales for merchants.

Recently, the Company surpassed one million active customers on its platform, taking less than six months to reach the milestone. Earlier, Sezzle had secured its 500,000th customer in August 2019, which was around three years after its initial launch. The recent growth in customers can be attributed to highly successful Black Friday/Cyber Monday heading into the US and Canadian holiday shopping seasons.

The Company’s growth has been accelerating, and its pool of merchant partners had grown over 10,000 at the end of the 2019 fourth quarter.

The SZL stock settled the day’s trade on 21 February 2020 at a price of $1.830, with a market capitalisation of $318.7 million.

Quantify Technology Holdings Limited (ASX:QFY)

Quantify Technology Holdings Limited employs Internet of Things (IoT) smart home technology while engaging to make the lives better in homes, workplaces, and communities. Its qDevices replace standard power outlets and light switches and can be controlled by voice, app and touch.

The Company has the opportunity to be the first truly mass-market smart home product by capitalising on its simple, yet innovative technology and limitless platform. Its strategic priorities are to maximise domestic sales, secure distribution globally and solidify its platform.

Recently, the Company was granted patent protection for its technology in Egypt, where QFY estimates a market worth of USD 150 million that is growing at a rate of 26% per annum. Moreover, the estimated numbers only represent residential and exclude the commercial market comprising of retirement and disability living, hospitality, etc.

While Egypt constitutes as 13th country to grant patent protection to the Company, QFY looks forward to gaining significant advantage over potential competitors following the patent approval. The Company has patents pending in 52 other countries with regions including the EU.

The unique selling proposition for Quantify Technology Holdings is that the Company’s products have the ability to evolve over time without complete product replacement, resulting in the reduction of lifetime cost and ensuring future proofing of the investment.

On 21 February 2020, the QFY stock settled at a price of $0.004, with a market capitalisation of $4.66 million.

Bottomline

The Australian businesses are supported by various initiatives from the Government, including funding and road mapping the growth prospects in various technologies. The Department of Industry, Science, Energy, and Resources believes that technologies like Blockchain can be employed to varied sectors, targeted towards boosting transparency as well as data-sharing in a trusted environment.

For tech players to achieve Prime Minister’s objective, it would be necessary for individual companies as well as Government to ensure re-balancing of the additional policy support towards non-R&D innovation, among several other elements towards the goal.