The commodity markets across the globe have been a centre of attention in 2019, with ASX listed resource stocks witnessing a lot of turbulence amid rapid movement across the commodity market.

While some commodities such as gold and silver have seen continuous upside rally, commodities like iron ore and crude oil have observed a see-saw moment. The ASX mining stocks and the overall resources sector have moved correspondingly to the commodity prices in the global market.

Fortescue Metals Group Limited (ASX: FMG)

FMG is a supplier of about 170 million tonnes of iron ore per annum to China, and the relationship between the company and Chinese customers has made FMG a core supplier of seaborne iron ore to China.

The company currently holds three mine hubs, namely Chichester, Solomon, and West Pilbara Fines; and two iron ore projects, namely Eliwana Mine and Rail, and Iron Bridge.

The joint production capacity of Cloudbreak and Christmas Creek mines at the Chichester Hub is 100 million tonnes per annum, while the Solomon Hub has a joint production capacity of 70-75 million tonnes per annum from the Firetail and Kings Valley mines.

The recent increase in the iron ore prices coupled with strong operational metrics has supported the share price of the company at the Australian Securities Exchange, and a large customer base in China typically links the stock movement of the company to the iron ore prices in China, which could be easily tracked with the help of futures listed on the Dalian Commodity Exchange.

Operational Metrics

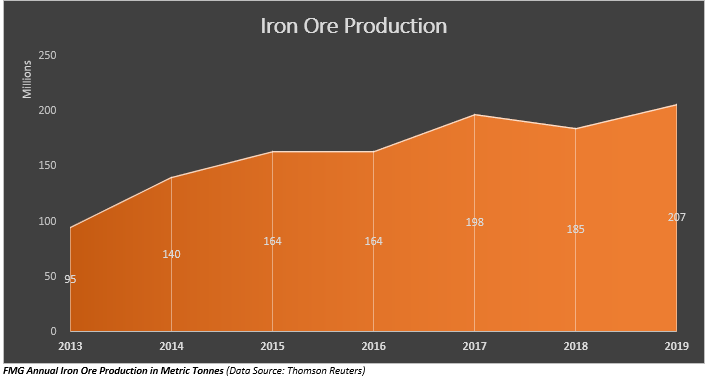

FMG ramped up iron ore production, and the production grew over 47 per cent from 2014 in 2019.

FMG ramped up iron ore production, and the production grew over 47 per cent from 2014 in 2019.

The increase in the production coupled with a higher realised price of iron ore amid an increase in iron ore prices in China supported the stock on ASX.

FMG realised USD 65 per dry metric tonne in FY2019 (as on 30 June 2019), which remained 47.7 per cent higher against the realised price of USD 44.0 per dry metric tonne in the previous corresponding period.

Iron Ore Prices and FMG

The stock of the company closely tracked the increase in iron ore prices; however, as the mining stocks incorporate equity features, the stock is currently showing divergence with the iron ore prices amid an increase in the overall equity market (as gauged by the S&P/ASX 200 Index).

To know more about the relation of the mining stocks with the commodity market and the possible reasons of divergence in a mining stock against the commodity prices, Do Read: Things to Be Familiar With Before Fishing for Mining Stocks

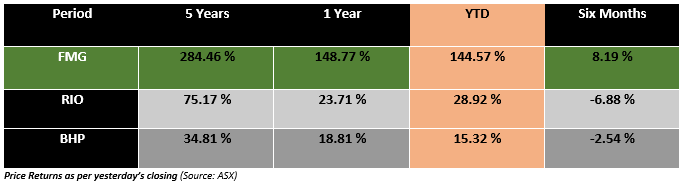

FMG has also outperformed the other ASX-listed iron ore miners such as Rio Tinto Limited (ASX: RIO) and BHP Group Limited (ASX: BHP).

Like, the iron ore miner FMG rallied over the momentum in the iron ore and equity market in Australia, gold miners on ASX rallied as well amid the bull run in the gold prices over the geopolitical cues.

To Know More, Do Read: Does Gold Investing Intimidate you? Discover the Right Parameters for Astute Judgement

Regis Resources Limited (ASX: RRL)

RRL is a Perth-based gold producer and explorer with operations at the Duketon Gold Project in Western Australia and McPhillamys Gold Project in the Central Western region of NSW.

The company ramped up the gold production, and the gold production of the company increased over 349 per cent from 2012 to 2019.

The company ramped up the gold production, and the gold production of the company increased over 349 per cent from 2012 to 2019.

The stock of the company rose significantly on the Australian Securities Exchange, backed by the rise in gold prices. RRL realised 5.1 per cent higher gold prices per troy ounce in FY2019 (as on 30 June 2019) at $1,765 per troy ounce as compared to the average realised price of $1,680 per troy ounce in the previous corresponding period.

The combination of higher production and the high market price worked for the miner, and the stock soared.

The stock reached a new 52-week high of $6.720 in July over the rise in gold prices; however, currently, the stock is showing divergence from the gold prices in the market and is tracing the movement of S&P/ ASX ALL Ordinaries Gold Index.

The recent up-run in the gold prices even took the gold mining stocks among the top-performers from the June to September 2019, and some of the gold mining stocks are still among the shining star of the year 2019.

To Know More, Do Read: A Glimpse Over ASX-Listed Top Performing Mining Stocks

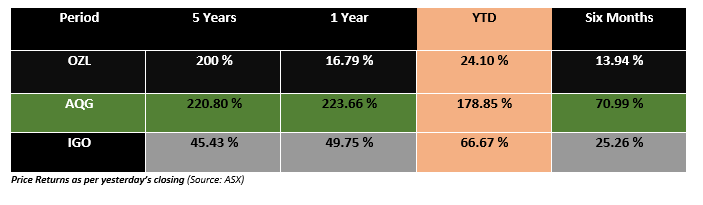

While, iron ore and gold are two specific commodities, which remained under rally, the miners with multi-commodity portfolio also rose in value with some in less proportion against the iron ore miners and gold miners amid pressure on some base metals like copper, zinc and nickel, and some in even higher proportion against gold and iron ore miners.

OZ Minerals Limited (ASX: OZL)

OZ Minerals is an ASX-listed multi-commodity player with a significant focus on copper, and the stock dropped in April 2019 from $11.040 to $8.800 in May over the drop in copper prices; however, the stock recovered significantly despite weak copper prices in the international market over its multi-commodity exposure.

Likewise, many other multi-commodity stocks such as Alacer Gold Corp (ASX: AQG) remained in the limelight and surged on ASX so far in 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.