Commodity markets are highly sought after by the investors and speculators for diversification and return enhancement as they usually move in opposition to stocks. While investors keep a keen eye over the commodities, investing in mining stocks emerge as a decent alternative to park investment in the commodities.

To Know More, Do Read: Smart Ways To Invest In A Commodity Stock

Why invest in Mining Stocks?

The global mining industry is vast with Russell 1000 Index, which includes the largest 1,000 U.S. stocks by market capitalization, consisting of about 12 per cent of stocks that cater to energy, metals and mining. In 2018, the 40 largest publicly traded mining companies hauled over $680 billion of revenue from their operations, which in turn, makes mining stocks an eye-catcher.

While we previously discussed the oil and energy stocks, let us now take a look over the mining sector, and their ability to provide with superior risk-adjusted returns.

Direct Exposure and Introduction to Convenience Yields

Mining Companies dig for metals such as copper, nickel, gold, silver, lithium, etc., vital for the economic development of a country.

The metals mined by these companies, usually get stored in a warehouse or storage facility and marked up as inventory on the balance sheet, which gives the companies and its investors an additional advantage in terms of convenience yield.

Convenience yield is defined as the benefit of having the physical inventory in hand of a commodity rather than deferred consumption right provided by forward and future contracts of commodities.

When the prices of the underlying commodity surges it is better to have a physical inventory to take advantage of the prices by delivering the inventory or via considering the moneyness of the exchange option- a commodity in exchange for cash/benefit.

Investors might ask, why to immediately cash out the inventory in case of a price surge? The answer to the question is that it is not always better to have immediate cash as the prices of the underlying commodity may further rise; however, it depends upon the slope and other metrics of the future curve.

The future curve represents the market expectation of supply and demand dynamics ahead in time, and the equation to calculate the future curve involves calculating the storage cost and the convenience yields, which varies from place to place and from investor to investor.

Thus, if investors or miners can calculate these two metrics, they can find price discrepancies (between estimated and observed) to take advantage; however, obtaining these values is an onerous and expensive task, which in turn, provide an advantage for holding physical inventory.

Higher convenience yield offered by the mining stocks at the initial stage of the price rush of the underlying commodity is one of the substantial advantages of investing in the mining stock.

Mining Stocks Share Positive Correlation with Underlying Commodity

XAU and NCM Daily Chart (Source: Thomson Reuters)

The mining companies stock price trend follows the price trend of the underlying commodity or they establish a positive correlation with each other, which, in turn, gives investors indirect exposure to the commodity market.

To Know More, Do Read: Gold-Backed ETFs Vs Gold; A look At Direct And Indirect Investment Approach

However, at times, one can witness the divergence of price trend between a mining stock and the underlying commodity it mines amid certain factors such as below:

Hedging

Mining companies frequently enter and ignore hedging based upon their view over the future prospect of the underlying commodity, which, in turn, leads to the price trend divergence.

For mining companies, hedging is considered as an effective way of securing the future sales; however, if the company hedge the complete production or a large sum of it at the current price and the underlying commodities rises beyond the hedge price, the investors and speculators quickly discount the opportunity cost and create divergence in price trends.

Business or Operational Discrepancies

Despite the fact that the share price actions of a mining company mimic the price actions of the underlying commodity, the business or operational problem of the company leads to price trend divergence several times in the real scenario; however, arbitrageurs quickly cease such scenarios, but still emergence of such divergence cannot be neglected.

Return Enhancement

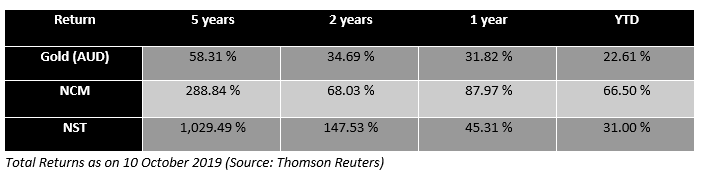

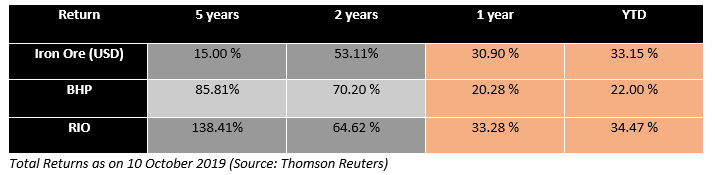

It is well evident that many times an investment in the mining stock perform better as compared to an investment in a commodity.

However, it entirely varies from company to company and on the investment time horizon as well. A mining stock can underperform the underlying commodity as well, and apart from that, high risk offered by the mining stock as compared to the underlying commodity could also justify higher return provided by these stocks.

The operating performance and financial leverage may also vary and could affect the return profile of the mining stock.

Risk of Investing in Mining Stocks

Investing in mining stocks generally exposes investors to an additional Beta (systematic risk) of the equity market apart from the Beta (systematic risk) of the commodity market.

A major problem with the approach of investing in the mining stock is that most firms have revenue related to variety of commodities (a firm can mine copper, nickel, gold, etc.) or have operations extend outside of activities directly related to the ownership and extraction of commodities, which in turn, brings the correlation of a mining stock down against a single commodity.

Another key problem with the mining stocks is, albeit, the earning per share (EPS) of a mining firm may be somewhat highly correlated to the price of the underlying commodity, the price-to-earnings ratio (or P/E ratio) may not be.

If the stock market declines quickly, P/E ratio falls, and when the commodity prices and inflation increases (as they have positive correlation), the decline in the overall market P/E ratios could arguably lead to a decline in the P/E ratio of the mining stock, however, because of the cyclical nature of their earnings, it is a difficult task to consider PE ratio alone to value a mining stock.

Due to aforementioned reasons mining stocks tend to underperform the underlying commodity at times.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.