Blockchain refers to a set of data managed by computers which are not owned by any entity. Each of the blocks of data are secured to the other using cryptographic principles. The information available on a blockchain network is open for anyone to see.

Transactions over a blockchain network simply comprise of information exchange between two parties through verification by million of computers around the internet. The transaction is initiated by one party, representing the âblockâ of information, which is verified by multiple computers and then added to a âchainâ for the end users.

Benefits

Considering the above framework, transacting through blockchain technology comes with a hoard of benefits:

- There is greater transparency for the data. Since blockchain comprises of shared data, every user will have the same information, hence offering transparency and consistency in the data.

- The technology offers better verification of data by multiple computers which makes the data more secure than other record-keeping systems, which is a huge advantage with respect to critical information.

- In addition, it offers increased efficiency and speed in comparison to traditional methods of data exchange, by streamlining and automating processes, at reduced costs.

Reffind Limited (ASX: RFN)

Reffind Limited is engaged in the development of cloud-based Software as a Service products, enabling subscribed companies to communicate with their employees in an innovative and effective manner.

Recent Updates

Considering its significant shareholding in Loyyal Corporation, the company recently notified that Loyyal has received the clearance from Emirates Airways PR and Legal for announcement on its successful working relationship and production integration with Emirates Skywardâs new partner infrastructure.

In another announcement, the company updated that Declan Jarett, who is currently serving as a Non-executive Director of the company, has been appointed as the Company Secretary in place of the current CS, Sonu Cheema.

Financial Highlights

During the year ended 30 June 2019, the company generated revenue amounting to $100,847, as compared to the prior corresponding period revenue of $197,431. Loss after tax amounted to $993,582, representing an improvement over prior corresponding period loss of $1,255,853.

Investment in Loyyal Corporation

The company invested a total amount of US$2.3 million in Loyyal Corporation, on 24 January 2018. US$1.5 million was invested via Series A-3 preferred shares giving the company 4,670,714 shares or an equity interest of 9.38% on Loyyal on a fully diluted basis. The remainder of US$8.0 million was invested in the form of convertible notes with interest charged at the rate of 2.5% per annum. The notes are convertible into Series A-3 preferred shares on 24 January 2020.

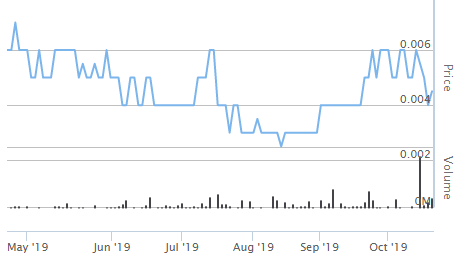

Stock Performance

The RFN stock generated returns of 12.50% over the past month. On 18 October 2019, the stock quoted $0.005, reporting no change on the previous trading price and has a market capitalisation of $2.56 million.

RFNâs Stock Performance (Source: ASX)

Fatfish Blockchain Limited (ASX: FFG)

Fatfish Blockchain Limited partners with entrepreneurs and help them build their internet ventures through co-entrepreneurship. The company supports its partner firm with funding and corporate resources required for the growth of internet businesses.

Financial Highlights

- During the half year ended 30 June 2019, the company generated revenue amounting to $1.49 million, down 10% on prior corresponding period revenue of $1.66 million.

- Loss after tax improved by 80%. In absolute terms, loss for the half-year amounted to $4.90 million, as compared to $24.26 million in prior corresponding period.

- As at 30 June 2019, net assets amounted to $28.46 million, as compared to $31.14 million as at 31 December 2018.

- The company has embarked on an internationalisation strategy to expand its presence in Europe, having an appetite for investment in the Consumer Internet sector.

- On the back of meteoric recovery of cryptocurrency prices in the first half of 2019, the company reported significant improvement in the outlook for its assets in Blockchain Technology Portfolio.

Update on Subsidiaries

- The company recently updated that iCandy Interactive Ltd, its 56% owned investee company announced its intention to seek a dual listing in Canada, to promote its brand recognition and presence in the North American market. In addition, iCandy is likely to raise fresh capital amounting to C$3 million.

- As per another update, the company reported good progress on its plan for the proposed IPO of its subsidiary, Fatfish Global Ventures AB.

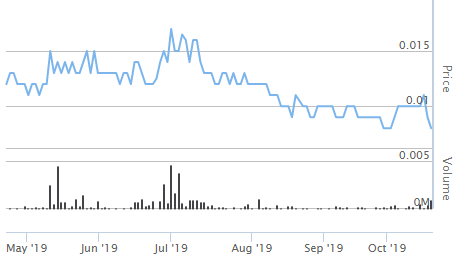

Stock Performance

FFGâs shares generated negative returns of 33.33% over a period of 3 months. After the close of the ASX trade session on 18 October 2019, the stock quoted $0.009, zoomed by 12.5% with a market cap of $5.92 million.

FFGâs Stock Performance (Source: ASX)

Security Matters Limited (ASX: SMX)

Australia-based product lifecycle, supply chain integrity and asset tracking blockchain technology company, Security Matters Limited (ASX: SMX) has started with the commercialisation of its unique, patented technology that uses a hidden chemical-based âbarcodeâ to permanently and irrevocably âmarkâ any object, be it solid, liquid or gas.

The barcode can be read through the companyâs unique âreaderâ to access the corresponding stored data, recorded and protected using blockchain technology.

Recent Updates

- On 16 October 2019, Security Matters announced that it had lodged two patent applications in the USA covering the use of its disruptive mark and trace technology under its Equilibrium Economy business model and the specific processes pertaining to its recycling offering.

- Earlier in September 2019, the company informed the market that it is aggressively targeting the Tasmanian timber and lumbar sector in collaboration with former Tasmanian Premier, Paul Lennon, AO. SMX has been working with Paul Lennon, AO for a few months now for the development of a bespoke solution for driving sustainability and transparency within the Australian and European timber and lumber industry. Parallelly, SMX is also working with few leading timber and lumber companies to test and fast track the development of its solution to be sued in the tree growing, production and chemical treatment process.

- Security Matters, on 12 September 2019, declared that it had successfully launched its blockchain product in collaboration with Quantum Crowd and R3, which is available to consumers, post completion of a three-month collaboration project that was worked upon by the technical teams at R3, SMX and Quantum Crowd to develop a tailored platform offering end-to-end solution for consumers.

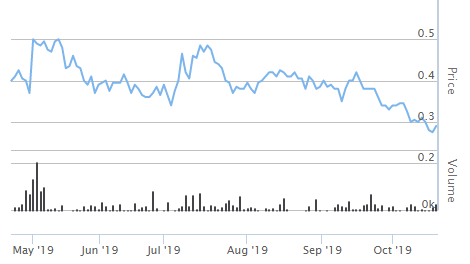

Stock Performance

The companyâs shares generated negative returns of 27.505 YTD, 28.40% in the last six months and 40.21% over the last months. On 18 October 2019, the stock quoted $0.290 with a market cap of $31.87 million.

SMXâs Stock Performance (Source: ASX)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)