Fatfish Blockchain Limited (ASX:FFG) is an international venture investment and development firm that establishes partnerships with experienced executives and entrepreneurs to build and grow primarily technology businesses through a co-entrepreneurship model. Over the recent years, Fatfishâs key focus has been on emerging global technology trends, and its investment portfolio covers sectors of blockchain, fintech and consumer internet technologies.

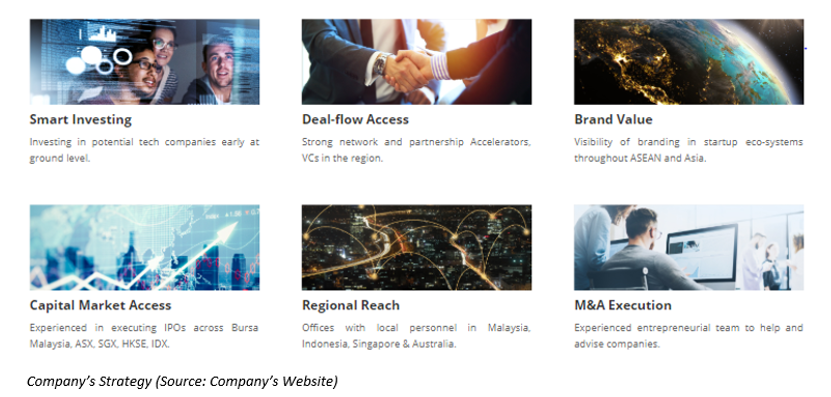

Besides, the company has operations across Singapore, Kuala Lumpur and Stockholm. Here is the snapshot of its business strategy.

On 14th May 2019, Fatfish Blockchain informed the market that there has been a significant change in the operating environment of its 51% owned blockchain mining investee company, Minerium Technology Ltd.

On 14th May 2019, Fatfish Blockchain informed the market that there has been a significant change in the operating environment of its 51% owned blockchain mining investee company, Minerium Technology Ltd.

At the backdrop of a sharp rise in the global market prices of cryptocurrencies, the bitcoin market price, in particular, has recovered from its lowest point of USD 3,400 per bitcoin this year to the current market price of circa USD 8,000 per bitcoin. This recovery of bitcoin price has brought a positive impact to the operating environment for Minerium as it primarily operates computing facilities for blockchain and crypto mining with many of its computing facilities especially engaged in bitcoin mining operations.

Moreover, with the recovery of bitcoin price, Minerium currently generates around USD 1,200 (~AUD 1,730) worth of bitcoin per day via its bitcoin mining operations. Meanwhile, Minerium also operates mining facilities for other blockchain networks such as the Mimblewimble Protocol related blockchain networks, which primarily are privacy focussed blockchain technologies.

As announced in FFGâs Market Updates on 12th March 2019, Minerium had stalled its expansion to Mongolia and its IPO plan earlier this year due to unfavourable market conditions and sentiment. With the transpiring conducive environment, the Minerium management is cautiously optimistic that if the current uptrend of cryptocurrency sustains for long, the company may reconsider its expansion and fundraising plans.

Recently, on 30th April 2019, Fatfish Blockchain announced that its Malaysian subsidiary, Fatfish Ventures Sdn Bhd (FVSB) had disposed of its entire holdings in Malaysia-listed Peterlabs Holdings Berhad (PLabs) via on market transactions. The move is part of FFGâs ongoing strategy to dispose of noncore assets that would allow the Company to focus more on the core areas of the technology and consumer internet business.

The net disposal proceeds of RM 4,755,266 (~ AUD 1,631,828) would be utilised to repay the non-recourse debt raised for the funding of PLabs acquisition, which amounted to ~ RM 5,455,266 (~ AUD 1,872,042). An outstanding amount of RM 700,000 (~ AUD 0.24million) would be repayable and shall be repaid by FVSB with its working capital.

In its recent disclosure of the quarterly activities update for the three months to 31st March 2019, Fatfish Blockchain reported that the acquisition of Snaefell AB, by FFGâs Swedish subsidiary, Fatfish Global Ventures AB had been successfully completed in February 2019. During the concerned period, the operating activities generated ~ AUD 646K of net cash outflows. Meanwhile, the investing and financing activities contributed ~ AUD 408K and AUD 1.2 million of net cash inflows. The net cash balance amounted to AUD 1.30 million at the end of the period.

With around 620.75 million outstanding shares, the FFG stock closed the dayâs trading at AUD 0.015, zooming up 25% with ~ 16 million shares traded.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.