Thereâs plenty going on in the world right now to make investors, businesses and stock exchange markets nervous. The much-discussed interest rates in Australia and beyond are at record lows, the US-China trade war does not seem to subside anytime soon, a hard Brexit is probably fast-approaching, and the probability of a commodity war with Iran could sink the global oil supply. Furthermore, Italy is surviving the risk of defaulting whereas the UK and Germany are facing an economic turmoil.

What are the implications? Is the world sailing towards a recession? Is an economic storm awaiting to sweep us off our feet? These precarious questions are an everyday topic of discussion amid researchers, market enthusiasts and industry experts. Let us discuss the reasons which are for and against a situation of recession in Australia, but before we go there, letâs strengthen our knowledge regarding the concept of recession:

Breaking Down Recession

Recessions come along when an economy is unstable and vulnerable after a period of rapid growth in spending, debt or inflation. It causes a loss of confidence and delay in spending. The interesting part about recession, apart from the low predictability of its occurrence, is the fact that economies can combat it through population growth and new innovations, counter cyclical economic policies, increasing economic diversity and upliftment of the services sector. The last recession phase in Australia took place 28 years ago, indicating that the country is firm and stable, and capable of sailing through the economic bubbles.

The Prevailing Risk of Recession

The world is still recovering from the massive repercussions spilled by the international financial crisis of 2008, but Australia was perhaps one of the few economies which surpassed the difficult phase with considerably low blows. Experts credit the countryâs good governance and an accidental support from China, a then emerging economy, for supporting the Australian economy during the crisis phase.

However, with global interest rates nearing zero, the monetary stimulus is likely to get restricted, toppled with the on-going and un-settling trade war between two of the worldâs biggest economies is making the global economy gradually sink, as government budgets are not as stable as before. RBA Governor, Mr Philip Lowe has reportedly urged the current Morrison government to spend on infrastructure and other economy requisites, which would boost the productivity growth and avoid the dangling recession hovering over the Australian economy.

There is an ongoing debate in the market that recession is unlikely to occur in Australia, though there have been whispers that with the economic risk trajectory depicting a upward and uncertain trend, recession could tap the Aussie land, shaking the consumer confidence and hampering the economic growth.

Let us now consider both sides of the discussion:

Recession- unlikely in Australia?

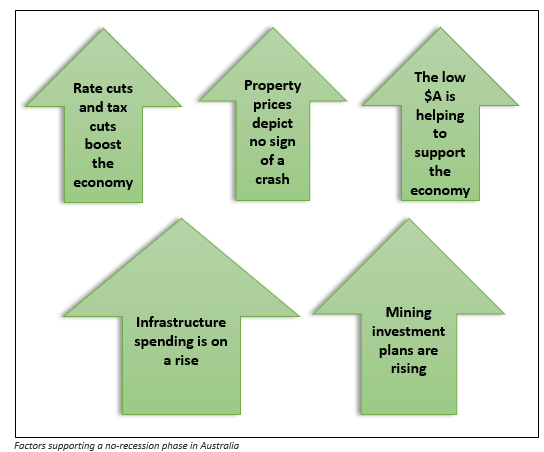

Even though the Australian growth is likely to remain weak over the next year, with the tax cuts, receding threat from the property landscape, rampant infrastructure in work, low AUD valuation and bettering of the Australian mining sector, a recession is highly unlikely to raise concerns in Australia. These factors would be deeply rooted by the strong population growth, low cyclical spending and surplus of the current accounts which would in turn, boost the fiscal surplus.

Experts suggest that economic reforms have been robust in Australia and the floating of the $A has been supportive in times of economic crisis. Moreover, the population growth and desynchronised cycles across industry sectors are a shock absorber for Australia. However, the economy has depicted a soft profit results in 1H19, the downside being soft profit results, with only 58% of the companies reporting profits on the prior corresponding period, while the earnings growth slowed to 1.3% and excluding the resources, stocks was approximately -2.4%.

Even with these downtrends, and high combined levels of unemployment and underemployment, toppled with the prediction that wages growth and inflation would remain low, a recession is unlikely to hit the tech-savvy country. This is because the business investment outlook is slowly improving and the low $A, at 39% down since 2011, is helping to support the economy.

Moreover, the recent state budgets have optimistically agreed on infrastructure spending, which is supported by ultra-low long-term borrowing costs. The much-discussed rate cuts and tax cuts by RBA were always aimed to boost growth, which seems likely.

Last, but not the least, the property plummet is gradually relaxing in the economy, with buyer interest returning in capital cities, negating any negative wealth effect on consumer spending.

Recession- likely in Australia?

A set of experts are both fearing and expecting an upcoming financial Armageddon next year. As previously emphasised, a recession is an unpredictable and unstable economic affair, and only time and the financial indicators can do justice to its likely prevalence in Australia.

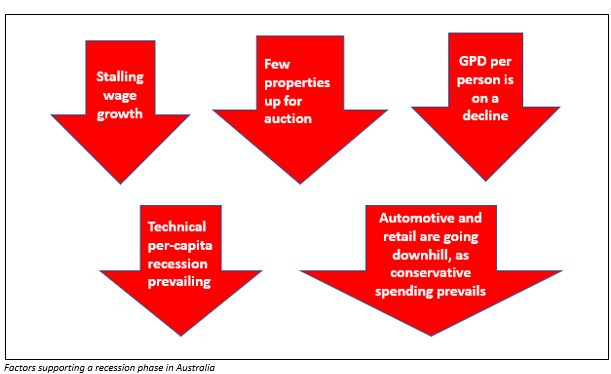

It should be noted that there are factors, which support this fact- as a reasonable 3% Australian wage growth for 2020-21 seems unlikely, given the recent stalling of the real wages in the country. Moreover, the Automotive Industry has been downhill, with sales dropping, driven by the low wage growth and less spending capability.

Adding on, even though the property market has improved over the year, they are heavily influenced by the low volume of housing stock on offer, indicating that homeowners are still rather reluctant to sell properties, which puts a pressure on the price.

The retail sector has undergone a phase of pessimism, with the retail sales currently at its weakest since 1991. According to industry experts, the economyâs GDP per person has decreased since last two consecutive quarters in 2019, indicating that Australia is already in a technical per-capita recession phase.

Where is the recession grid headed?

Given the above-mentioned facts, it is safe to believe that Australiaâs economy isnât looking too hot right now. There is less hiring, wage growth is currently sluggish, mortgage arrears are at dangerous level and the RBA has been slashing interest levels historically and consecutively. The flailing housing condition, soared gold prices and unstable retail sales have toppled the concerns chart of Australia.

However, it should be noted that the share market is at an 11-year high and the countryâs current account deficit has collapsed. Moreover, the A$ has been stabilising the economy and mining investments are back in swing. With betterment in the property and infrastructure space, backed with the robust governance prevailing dominantly in the country, Australia is truly depicting some positives around.

It would be interesting to watch the unfolding of macro and micro economic factors and analyse the economic stance that Australia showcases in the times to come.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.