A managed fund is an investment fund, which is managed by a professional fund manager who is an expert in investing in a variety of instruments. The portfolio of managed funds is dependent on a fund manager and it is his/her call on what will be the constituents of the fund.

In a managed fund, money from people is pooled together and then the fund manager or investment manager buys or sell shares on peopleâs behalf. The value of the fund would depend on the price of the shares and will move accordingly.

A Managed Fund:

- Is managed by an investment professional;

- Invests as per the fundâs investment objective;

- Might contain an investment objective varying from conservative to aggressive-conservative funds generally earn smaller returns with less risk, while aggressive funds generally offer potentially higher returns with greater risks.

Types of Managed Funds Someone Should Invest In:

A financial advisor can help determine the types of funds that are most appropriate based on the investment goals time horizon, current financial position and attitude towards risk.

Reasons to Own Managed Funds:

Growth Potential: Managed Funds can earn money in the three ways as follows:

- a) Appreciation- Fund shares rise in value or appreciate, in the scenario where securities the fund owns grow in total value;

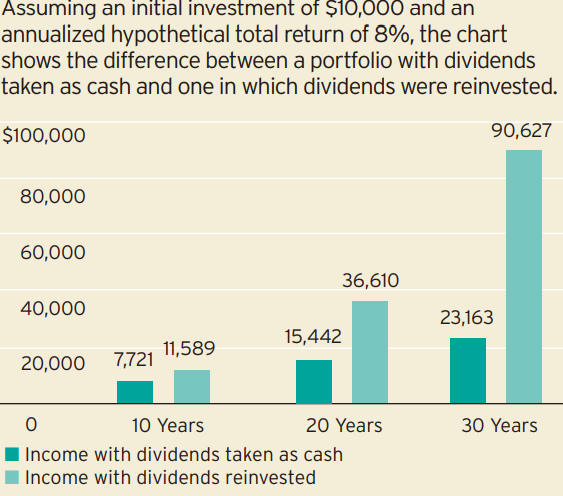

- b) Capital Gains Distribution- Capital gains result when fund managers sell securities owned by the fund at a profit. As a shareholder, one can choose to re-invest the distribution in additional fund shares or receive cash;

- c) Dividends- Shareholders may receive dividends generally on a quarterly basis, when the companies in which the fund is invested distribute a portion of their profits. As a shareholder, one can choose to receive dividends or reinvest the dividends in the funds.

Source: Invesco Aim Management Group Inc.

Diversification: Diversification may protect an investor from market highs and lows because one is not too heavily invested in one company or industry. It simply means all the eggs are not in one basket. Managed funds allow one to diversify assets among a variety of investments so one can take benefit of strong areas of market and reduce the risk when other areas of the market perform badly.

Professional Money Management: Managed funds are generally controlled by a portfolio manager who is supported by a team of knowledgeable investment specialists. This team bases its buying decision on extensive, ongoing research and analysis which means one does not have to spend thousand of hours performing its own research.

Convenience and Flexibility: Managed funds offer many suitable features, which includes exchange privileges, liquidity and automatic investment plans. Buying and selling managed fund shares is very easy and the money is readily accessible because mutual funds are liquid assets.

Within a fund company, one can generally move portions of investment into other funds with different objectives, as the financial situation changes with no additional sales charge. Investing the same amount of money on a regular basis, such as weekly or monthly, is a convenient way to benefit from changing market price because as the market price goes up and down, the investorâs regular investment can buy some shares at a lower price and some at higher price and in the long period, the price per share will average out.

Basic Types of Managed Funds

- Stock or Equity Funds: These types of funds invest primarily in shares of overseas company stocks and some even focus on companies with a specific industry or sector. Companies range from small to mid-size to large, well established ones with strong financial structure and balance sheet. There are many types of stock funds that offer varying degrees of risk and return potential.

- Bond Funds: The bond funds invest mainly in municipal, corporate or government bonds and can be either taxable or non-taxable which are typically designed to protect principal and provide income through regular dividend payments;

- Balanced Funds: These types of funds make an investment in stocks and bonds both to balance the growth potential of stocks with relative stability of bonds;

- Money Market Funds: These types of funds invest in securities like treasury bills (U.S.) and convertible debentures that mature in one year or less, and these are considered to have minimal risk and their returns are typically just a bit higher than those of savings accounts.

Asset Allocation: A Key Component of Portfolio Performance

Distributing the mutual funds investments across different class assets like bonds, money market and stocks is called asset allocation, and this strategy is an important part of investing because it helps balance the risk and return of the portfolio to meet the financial goals.

- Conservative Portfolio

The conservative investor has a low risk tolerance and is particularly sensitive to short term volatility and therefore he or she is typically interested in preservation of capital, receiving steady investment income and beating inflation over the long term.

- Moderate Portfolio

The moderate investor is interested in receiving steady investment income and preserving capital. He or she is less sensitive to short term volatility than the conservative investor.

- Growth Portfolio

The growth investor is expecting for higher return from the portfolio, because he or she usually has a relatively high-risk tolerance and long-time horizon and they are generally not concerned about short term volatility.

Letâs have a look at some of the top managed funds on ASX and their returns.

Performance of mFunds, Source: ASX

- SGH Emerging Companies Fund: The fund has given a total return of 23.20% in the last five years period, which has been issued by Equity Trustees Limited. It is designed to provide medium to long term capital growth potential and seek to outperform the S&P/ASX Emerging Companies Accumulation Index. The fund size is $124.2 million.

- Hyperion Global Growth Companies B: The fund has given a total return of 20.92% in the last five-year timeframe, which has been issued by Pinnacle Fund Services Limited. It is designed to provide medium to long duration capital increase and income by making an investment in elevated calibre entities mainly listed on a well-known international exchange during the time of making an investment. The fund size is $192.7 million.

- Evans and Partners International: The fund has given a total return of 17.03% in the last five years period, which has been issued by Equities Trustees Limited. It is designed to provide investors with an attractive risk-adjusted return over a full market cycle. The fund size is $54.0 million.

- Bennelong Concentrated Australian Equities: The fund has given a total return of 16.45% in the last five years period, which has been issued by Bennelong Funds Management Limited. It is designed to outperform the S&P/ASX Accumulation Index by 4% pa after fees. The fund size is $841.3 million.

- Fidelity Asia: The fund has given a total return of 16.35% in the past five years timeframe, which has been issued by FIL Responsible Entity Limited. It is designed to achieve returns in excess of the MSCI AC Asia Index over the suggested minimum investment period of five to seven years. The fund size is $401.3 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.