Given the dynamic nature of business, companies undergo changes and variations in their performances across the year. A direct impact of this hovers over the companyâs stock performances. In this article, let us look at the recent updates of the following businesses and understand their current stock positioning and performances:

- Reliance Worldwide Corporation Limited (ASX:RWC)

- Emeco Holdings Limited (ASX:EHL)

- Coles Group Limited (ASX:COL)

- Unibail-Rodamco-Westfield (ASX:URW)

Reliance Worldwide Corporation Limited (ASX: RWC)

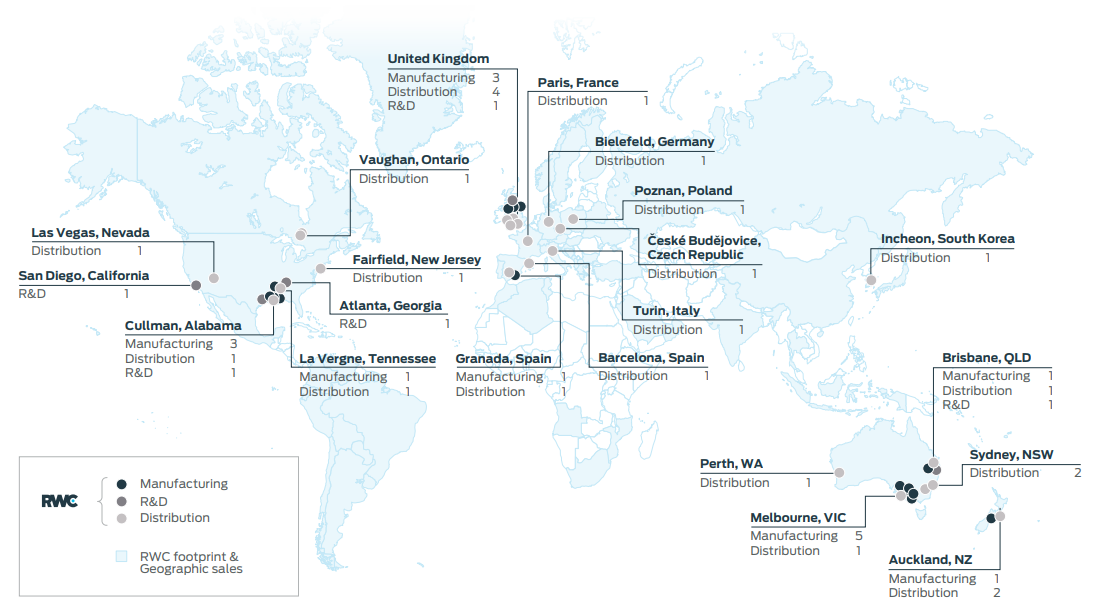

Company Profile: Regarded as a global group of powerful brands, Reliance Worldwide Corporation Limited (ASX:RWC) is an industrial player, into the business of designing, manufacturing and supplying water control systems, along with solutions primarily for the plumbing and heating industry. Besides, the company also aims to boost the performance and efficiency of smart homes and specialist industries. Established in Brisbane in 1949, the company was listed on the Australian Securities Exchange in 2016 and has its global headquarters in Atlanta. Across the globe, the companyâs business spans in 44 locations with 24 distribution hubs, 15 manufacturing plants and 5 Research and Development centres.

RWCâs locations across the globe (Source: Companyâs Website)

Stock Performance : On 1 July 2019, by the closure of the trading session, the companyâs stock was at A$3.630, up by 3.125 per cent, with approximately 790.09 million outstanding shares. The market capitalization of the company stood at A$2.78 billion and P/E ratio was 27.720x, with an annual dividend yield of 1.99 per cent, the stock has generated negative returns of 7.85 per cent, 17.18 per cent and 22.12 per cent in the last one, three and six months, respectively. Its YTD return has also been negative and stands at 20.72 per cent.

Trading Update: On 26 June 2019, the company notified the market that its substantial holder AustralianSuper Pty Ltd had changed its interest effective 21 June 2019. After the change of its interests, AustralianSuper Pty Ltd now holds 52, 392, 134 personâs votes with 6.63%.

Previously, on 13 May 2019, the company provided a trading update and notified about the revision of its FY2019 EBITDA guidance. It mentioned that across the globe, there were adverse impacts on the business which were affecting the performance and results of the company in the second half of FY2019.

In Americas, the winter storms and the decision of channel partners to reduce inventory on hand had been adversely affecting RWCâs business and operations. In the EMEA segment, the companyâs call to exit certain product lines, which were sold by the core RWC business in the UK had affected the performance. The Spain business had not delivered anticipated results and had an impact on the overall segment. In the APAC region, the forecast declined in the new housing construction in Australia has affected operations and sales.

However, on the brighter side, the John Guest business in the Americas division and core RWC businesses in the UK region are making steady progress with cost synergies being realised in line with the expectations.

The previous FY2019 EBITDA range was from $280 million to $290 million, but the company revised it and stated that the EBITDA would now range between $260 million-$270 million.

Emeco Holdings Limited (ASX: EHL)

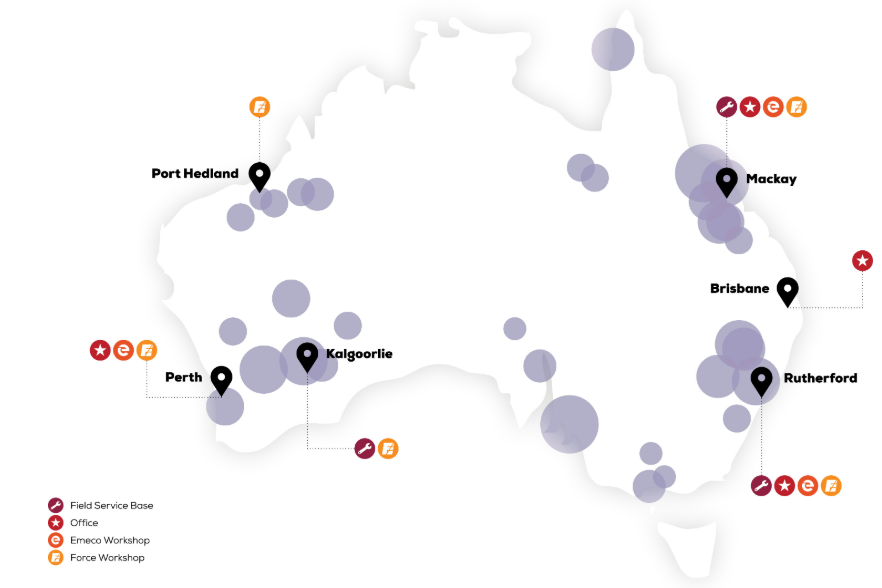

Company Profile: A player from the industrial sector, Emeco Holdings Limited (ASX:EHL) has operations in all the key mining regions of Australia. The companyâs clients are mining companies and contractors, dealing with coal, iron-ore, bauxite and copper. The company is the owner of Force Equipment, which is Australiaâs component and machine rebuild company. EHL also owns Matilda Equipment, which is a new model ancillary heavy earthmoving equipment rental company. The company was founded in 1972 and was registered on ASX in 2006. The company is headquartered in Osborne. In its rental fleet, the company has approximately 1000 machines.

EHLâs operations (Source: Companyâs Website)

Stock Performance: On 1 July 2019, by the closure of the trading session, the companyâs stock was at A$1.990, down by 3.865 per cent, with approximately 323.21 million outstanding shares. The market capitalization of the company was of A$669.05 million and P/E ratio was 22.750x. With an EPS of A$0.091, the stock has generated returns of 7.81 per cent and 8.66 per cent in the last one and three months, respectively. The YTD return stands at 2.99 per cent.

On 14 June 2019, the company notified the change of interests of the substantial holder, Paradice Investment Management Pty Ltd effective 12 June 2019. After the change of interests Paradice Investment Management Pty Ltd holds 29,242,350 personâs votes and 9.047% voting power.

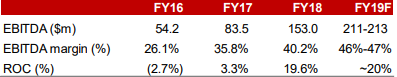

Investor Presentation: On 12th June, the company provided its operational update and FY19 guidance in its released Investor Presentation.

The company anticipates that it would achieve an EBITDA in the range of $211 million and $213 million, which would be up by approximately 40 per cent, on a YoY basis. The Net Sustaining Capex was predicted to amount to approximately $85 million and Growth Capex is on target to generate $25 million EBITDA in FY20. The leverage (measured as Net Debt/Operating EBITDA) has been forecasted to be 2.1x by the end of FY19, with a target of 1.0x by FY21. The ROC (Return On Capital) is anticipated to be ~20 per cent in FY19.

EHLâs Historical and Forecast Returns (Source: Companyâs Report)

The company notified that thermal coal division was contributing less than 25 per cent to the companyâs total revenue.

On its Fleet front, the company stated that with workshops and asset management, asset lives were extended. It resulted in the reduction of capital intensity and operating costs, while generating stronger returns.

Coles Group Limited (ASX: COL)

Company Profile: An Australian retailer, Coles Group Limited (ASX: COL) has more than 2,500 retail outlets in the country. It is regarded as Australiaâs first supermarket and has been in the market since 1914. Currently, the Group operates through stores and online platform as well. It was recently listed on the ASX, in November 2018 and has its registered office in Hawthorne. The groupâs business includes Coles supermarkets, Coles online, Coles Liquor, Coles Express, flybuys, Coles Financial Services and Spirit Hotels.

Companyâs Overview (Source: Companyâs Report)

Stock Performance: On 1 July 2019, by the end of the trading session, the companyâs stock was at A$13.230, down by 0.899 per cent, with approximately 1.33 billion outstanding shares. The market capitalization of the company was at A$17.81 billion and P/E ratio was 24.130x. With an EPS of A$0.553, the stock has generated returns of 6.21 per cent, 12.85 per cent and 11.25 per cent in the last one, three and six months, respectively. The YTD return of the stock stands at 14.01 per cent.

Coles Investor Day: On 18 June 2019, the company conducted its investors day and released a presentation, where it mentioned that it has a refreshed strategy which is based on three pillars- Inspire customers, Smarter selling and Win together. In the next four years, the company aims to generate revenue in line with its expectation and target approximately $1 billion of cumulative cost savings by FY23, driven by Smarter selling.

The company is pacing towards usage of technology to automate manual tasks and simplify above-store roles to eradicate duplication. This would positively impact reduction in costs of energy and labour. Coles would focus on the development of Coles Own Brand and target apt New store openings, while eyeing at the growth of Coles Online with the aid of Ocado partnership.

Coles Net capex for FY19 would range between $700 million and $800 million. The company would announce its full year results on 22 August 2019.

Unibail-Rodamco-Westfield (ASX: URW)

Company Profile: The company was formed recently in 2018, as Unibail-Rodamco-Westfield (ASX: URW), which is a commercial real estate industry, and a global developer and operator of flagship shopping destinations with three main business lines- development, investment and operations. It has three categories of assets- retail, offices and convention and exhibition centres. Spread across 13 countries in two continents, the company has 93 shopping centres and has one brand- Westfield. The company is listed on the French CAC 40, the Dutch AEX 25 and the Euro Stoxx indices, apart from ASX, where it got listed last year in May. The companyâs registered office is in New South Wales.

Stock Performance: On 1 July 2019 at 2:47 PM AEST, the companyâs stock was at A$10.710, up by 4.284 per cent, with approximately 2.77 billion outstanding shares. The market capitalization of the company was at A$28.42 billion and P/E ratio was 15.07x. With an EPS of A$0.682, the stock has generated negative returns of 8.71 per cent, 12.37 per cent and 6.04 per cent in the last one, three and six months, respectively. The YTD return is also negative and stands at 5.35 per cent.

Company Updates: On 1 July 2019, as per the ASX announcement, the company notified that its Group Chief Development Officer, Mr Olivier Bossard had sold 14 060 stapled shares and Class A WFD Unibail-Rodamco N.V. share at â¬126.30 per stapled share, for â¬1,775,778 and purchased 14060 stapled shares and Class A WFD UnibailRodamco N.V. share at â¬126.30 per stapled share, for â¬1,775,778, on 26 June 2019.

The company also announced that, on 27 June 2019, a member of the companyâs Supervisory Board, Mr Roderick Munsters, purchased 300 stapled shares and Class A WFD Unibail-Rodamco N.V. share at â¬126.10 per stapled share, for â¬37,830.

On 26 June 2019, the company announced that it had made a new placement of a 30-year â¬500 million bond offering, which has a 1.75 per cent fixed coupon. With this placement, the company is the first ever REIT to issue a 30-year note in the Euro bond market, with the lowest coupon ever for a Euro issue.

Read about URWâs financial update here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.