The big four banks of Australia region are compelled to maintain billions of dollars of money more in New Zealand, following the nationâs central bank expanded bank capital needs. As per the bank, they need extra NZD13 billion to meet the new requirements, which is very less than NZD20 billion, earlier forecasted.

Increasing the total capital ratio to 16% for the smaller banks and 18% to the big four banks is vital to enable the country to withstand economic turbulence, as per the Reserve Bank of New Zealand (RBNZ). This will bring more skin in the game and help protect against a future banking crisis.

In such a volatile environment for the banking industry in Australia, letâs have a look at one of the famous materials stocks- Boral Limited.

Boral Limited (ASX: BLD)

Boral Limited is engaged in the manufacture and supply of buildings and construction materials in Australia, Asia and the USA. The company is an international construction material and building products group with three strong divisions:

- A fast-growing plasterboard joint venture in Asia, Australia and the Middle East;

- the high-performing, well-positioned construction materials business of Boral Australia, USG Boral;

- Boral North America, a scaled and growing building products and fly ash business.

The company employees more than 26,000 contractors and employees. Its operations span across 826 building and construction materials operating and distribution sites globally.

Financial Irregularities Found in Boralâs North American Windows Business

Recently, the company announced that it recognised some financial irregularities in its business of North American Windows, which involves misreporting in relation to inventory levels and raw material and labour costs at its windows plants.

A restricted and confidential investigation is being done by lawyers retained by Boral, who were also involved in forensic accountants to help with the investigation. It is expected that the irregularities with regards to the duration from September last year and October this year will cause a one-off effect on EBITDA or earnings before interest, tax, depreciation and amortisation in the order of USD20 million - USD30 million.

Financial Year 2019 More Challenging than Expected

The company had a challenging environment in FY19 than expected. In the country, housing starts were down 15% and the value of work done in roads, highways, bridges and subdivisions was down by an estimated 6%. US housing starts were 2% softer and in South Korea, which is the key country market outside of Australia in USG Boral joint venture. The residential construction is in a cyclical downturn. To fight this downturn, the company resized activities, educed costs and seek out new opportunities to grow revenues.

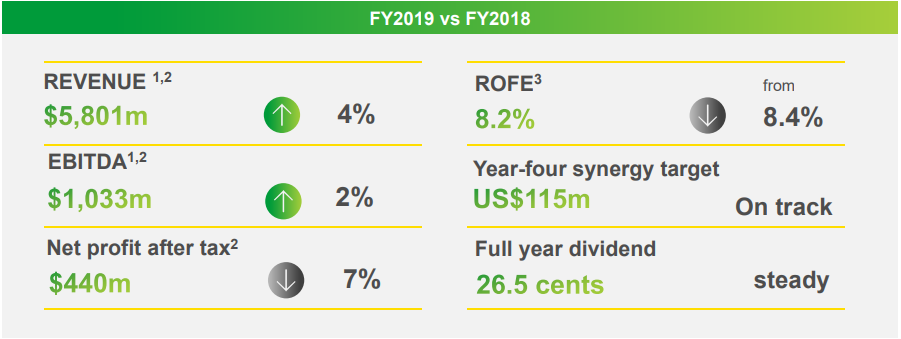

Even in this tough environment, the company reported an increase of 4% in revenues to $5.8 billion and 2% increase in earnings before tax, depreciation and amortisation (EBITDA) to $1.03 billion for continuing operations. Companyâs NPAT before significant items stood at $440 million, down 7% from the previous year. The companyâs return on funds employed, also referred to as ROFE, was 8.2%, and if compared with Boralâs cost of capital of around 9.0% on a ROFE equivalent basis.

After selling Denver Construction Materials and the US Block businesses in July and November 2018 respectively, companyâs net debt was down to $2.19 billion, which compares with $2.45 billion in the prior year. The company delivered synergies of US$32 million after acquiring Headwaters and now the company is on track to achieve four-year synergy target of US$115 million in FY2021.

The company paid 13.5 cent final dividend, taking the full year dividend to 26.5 cents per share, in line with the prior year.

FY19 Financial Results (Source: Companyâs Report)

Segmental Performance in FY19

In FY2019, the housing-related demand soothed in Australia, the USA and South Korea and the company suffered some delays in huge infrastructure projects in Australia as well as bad weather in North America. Due to these headwinds, the company focused on the things such as cost reduction initiatives and resizing its operations.

On a continuing operations basis, the company reported revenue of $5.8 billion, which was up 4% on the prior year, and Group EBITDA of $1.033 billion was up 2%. EBITDA margins on reported revenue of 17.7% were same as 18.0% margins in the prior year.

Boral Australia delivered an EBITDA of $593 million, a 6% decrease on FY2018 and by excluding Property earnings of $33 million, EBITDA was down 2% year-on-year. In FY19, the company made joint effort to align its operations with demand, cut overhead costs and enhance margins.

Boral North America reported EBITDA of US$297 million, from continuing operations after excluding earnings from the US Block businesses and Denver Construction Materials, which were separated in November 2018 and July 2018, respectively.

- Boral North Americaâs EBITDA stood at $415 million, a 19% increase, reflecting synergy delivery and favoured by a positive currency translation;

- While the US business delivered solid earnings growth with attractive EBITDA margins of 18.6%, volumes and earnings were impacted by extreme rainfall and a 2% decline in housing starts;

- ROFE remain low at 5.6% but have improved as compared to previous year.

USG Boral, companyâs 50% owned gypsum joint venture, registered underlying EBITDA of $252 million in FY2019, down 6%. USG Boral reported post-tax earnings of was $57 million, down by 10% from the previous year.

Outlook for FY20

The company reconfirmed its guidance which was provided earlier to the market. The company expects NPAT to be around 5 to 15% lower in FY2020 relative to FY2019 and it reflects lower earnings and higher depreciation charges. For FY20, Boral expects property earnings in between $55 to $65 million, with a stronger view of the second half expected in February.

Following the first quarter, the company expects EBITDA in the 1HFY20 to be around 5% lower than the previous year. Input from property of around $30 million to only moderately offset the impact of higher costs and lower volumes, which includes one-off costs linked with disturbances at Peppertree and Berrima.

Stock Performance

The stock of BLD was trading at $4.585 per share on 9th December 2019, down by 0.542% (at AEST 1:05 PM). The company has a market capitalisation of $5.4 billion, as on 9th December 2019, with an annual dividend yield of 5.75%. The total outstanding shares of the company stood at 1.17 billion, and its 52-week low and high is $3.930 and $5.735, respectively. The stock has given a total return of 4.30% and -11.35% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.