Summary

- The telecommunication industry is maturing, and telcos are progressively creating value and diversifying through M&A.

- UWL has completed the Institutional Entitlement Offer worth ~AU$152 million, moving Uniti a step closer towards the strategic acquisition of OptiComm, which would aid UWL in building a big scale national private fibre challenger.

- Spirit acquires VPD Group (expands across Australia), via its newly built wholesale business arm.

- On 26 June, NSW Supreme Court gave a nod to the Scheme related to VHA and TPM merger. Subsequent to it, shares of VHA would be renamed to TPG Telecom Limited and begin trading on 13 July this year under the ticker TPG.

As the telecommunication industry is maturing, telecom operators are going through their shares of struggle to grow their revenue streams when they sense pressure to upgrade and roll out their networks.

While penetration has reached the saturation point in most areas, lesser entities have chance to grow ahead, (which was obtainable just some years back) in terms of targeting unchartered consumer segments. Telecom operators are now identifying numerous ways in which they can create value and sustain their market position.

Did you read; Is 2020 the year for 5G amid COVID-19?

Furthermore, the pace of technological innovation has quickened, and operators are diversifying their view of mergers and acquisitions (M&A).

M&A can help create value to telcos by-

- Accelerating product roadmaps;

- Attaining access to new technologies and market;

- Helping a telco to expand beyond its core, and

- Facilitating a telecom entity to monetise its infrastructure units.

Let us now dive in to have a look at what is happening with the three telecom operators- UWL, ST1 and TPM.

Uniti Group Limited (ASX:UWL)

UWL, a diversified telecommunications service provider upgraded its earnings guidance for FY’20 on 15 June 2020, wherein the annualised EBITDA for H2 FY’20 was anticipated to be in the range of AU$37 million - AU$39 million.

Acquisition of OptiComm Limited

On 15 June 2020, UWL entered into a scheme implementation deed with OptiComm Ltd (ASX:OPC).

Under this deed, Uniti would acquire 100 per cent shares of Melbourne-based fibre-to-the-premises (FTTP) network operator, OPC for value/consideration of ~AU$532 million (including ~AU$407 million in cash and nearly 84 million UWL shares inferring AU125 million).

The 84 million Uniti shares would be issued to OptiComm stakeholders; on the other hand, the aggregate cash consideration (consisting of transaction costs) would be funded through AU$270 million Entitlement Offer and a new AU$150 million debt facility.

The OPC acquisition would aid the Company in creation of a burgeoning large-scale domestic private fibre challenger, with enlarged financial scale, expertise, and adjoining market access.

With this backdrop, let us discuss the completion of the Institutional Entitlement Offer, bringing Uniti, a step closer in accomplishing the big milestone.

On 16 June 2020, UWL notified the market on conclusion of the Institutional component of the Entitlement Offer to fund the acquisition of OptiComm, partially. The Institutional Entitlement Offer raised ~AU$152 million at an offer price of AU$1.40 per share.

Entitlement Offer invited eligible UWL stakeholders to subscribe for one new share of Uniti (new shares) for every 1.68 existing Uniti share (Entitlement), on 17 June this year.

Also, REO (Retail Entitlement Offer) fully underwritten one, would enable eligible retail stakeholders to buy Uniti shares at the similar price extended to institutional stakeholders, as per the Institutional Entitlement Offer and would additionally raise AU$118 million. REO began on 22 June this year and would end on 6 July this year.

On 26 June 2020, UWL last traded at AU$1.52, down by 0.654 per cent.UWL has a market capitalisation of AU$663.18 million, with ~443.45 million shares outstanding.

Also, read; Uniti Group to Acquire OptiComm Limited and Upgraded Earning Guidance

Spirit Telecom (ASX:ST1)

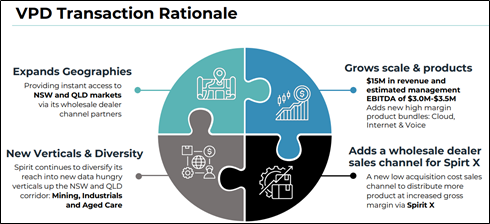

On 26 June 2020, Internet provider ST1 announced that it was acquiring Voice, Data, and cloud-services business VPD Group (Voice Print Data Group).

STI mentioned this acquisition as the largest and transformational transaction.

Spirit will establish VPD as its new wholesale business arm for cloud, internet and voice services under a new brand called Spirit Partners, and will expand its coverage further across every state in Australia.

The acquisition’s cash and share deal is spread over three tranches, wherein ST1 will fork out AU$14 million for the initial tranche. This first tranche is composed of cash and ST1 equity worth AU$7 million and ST1’s shares amounting to AU$5.8 million (equity component adjusted post net debt adjustment on conclusion).

Furthermore, the payment of the other two tranches would be made if VPD Group meets the EBITDA performance targets for FY’21 and FY’22. Thus, maximum purchase price would be equal to AU$27.5 million.

Did you read; A Glance at Six ASX-listed Stocks - GNC, VVR, D2O, SSG, ICQ, STI

Following the acquisition, ST1 would have a combined revenue run rate between AU$70 million to AU$75 million in FY’21.

The transaction is anticipated to conclude in July this year, subject to normal closing conditions.

Source: Company’s announcement

Also, read; Spirit To Acquire VPD Group; Acquisition to Provide Sales Opportunity Across Every States In Australia

On 26 June 2020, ST1 closed the day’s trade at AU$0.235, with an increase of 14.634 per cent. ST1 has a market capitalisation of AU$88.34 million, with ~430.91 million shares outstanding.

TPG Telecom Limited (ASX:TPM)

On 25 June 2020, TPG Telecom notified the market that TPG Singapore was given a green signal to run 5G with the allocation of 800 MHz of mmWave spectrum by IMDA Singapore.

VHA and TPG merger is about to take the final shape

One more good news is on the cards!

On 26 June 2020, VHA and TPG welcomed the orders from the NSW Supreme Court, approving the scheme of arrangement (Scheme) with regards to the proposal of merger of VHA and TPM.

Source: ASX announcement

Did you read; Calling the shots with 5G move: Lens on TPM and TLS

Let us now enrich ourselves with the final steps in the merger.

On 29 June 2020, TPG would lodge the orders of the Supreme court with the ASIC (Australian Securities and Investments Commission), and then the Scheme would come into effect.

The two-year-long journey of the merger under process is now coming to an end.

TPG would merge with VHA, along with the change in the name of VHA’s shares to TPG Telecom Limited.

Furthermore, TPG’s shares would be suspended from trading on ASX with the closure of trading on 29 June this year.

On 30 June 2020, the Company would witness two major affairs-

- TPG Telecom Limited would be listed on ASX under the ticker TPG;

- Tuas (parent entity) of TPG Singapore would undergo demerger, effective and listed on the ASX under ticker TUA.

Further, on 13 July 2020, the Scheme would be implemented, and the new TPG Telecom Limited would be incorporated, with numerous brands under its umbrella such as TPG, Vodafone, iiNet, Lebara, Internode and AAPT.

Moreover, 14 July 2020 would be the date of commencement of trading for the new TPG Telecom shares.

Did you watch: TPG Shareholders to receive a special dividend of 49 to 62 cents/share | ASX Market Update

On 26 June 2020, TPM shares last traded at AU$8.890, increasing by 1.023 per cent. The Company has a market cap of AU$8.16 billion, with ~927.81 million shares outstanding.